23 Sep

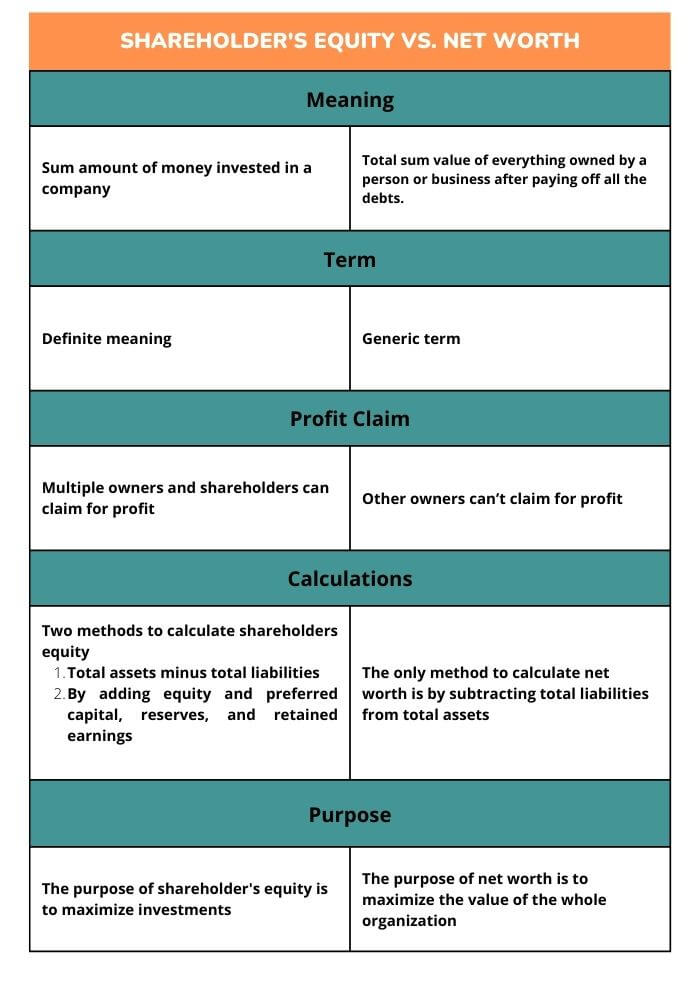

Shareholders’ equity and net worth are distinct terms usually used interchangeably, but there is a slight difference between both terminologies. The difference between a company’s shareholders’ equity vs. net worth is important to understand because they are two very different measures of identifying the financial health of two different organizations.

Although the two items have similar names and look similar on paper, they are different in most other respects. The difference between shareholder’s equity and net worth can be confusing. In this article, we will clarify things by explaining what the terms mean, how they differ, and how they help your business to operate effectively.

Definition

Let’s first understand their definitions to understand the difference between the two important terms.

Shareholders’ equity is the sum amount of money invested in a company. In simple terms, shareholders’ equity is the sum of the value of all outstanding shares of stock minus any debt owed to lenders.

Net worth is the total sum value of everything owned by a person or business after paying off all the debts. It indicates the remaining revenue that remains after all liabilities have been paid.

Term

The term shareholder’s equity has a definite meaning.

The term net worth is a generic term.

Related

Shareholder’s equity is used when the company has multiple owners or shareholders. Many people other than owners, such as shareholders, can claim the money after paying for the liabilities of a company.

Net worth only considers individuals’ or companies’ value without interfering with any shareholder. No partners other than the owner can claim the profit.

Equation

There are two ways or methods to find the shareholder’s equity.

- Shareholder’s equity = Assets – Liabilities

- Shareholder’s equity = equity and preferred capital + reserves + retained earnings

In both concepts, there is only one similar method i.e., subtracting total liabilities from total assets that are shown on the financial statements. Net worth is money an individual can keep or invest in a business. So even though these two account numbers show the same amount of money, they’re very different in terms of how they’re calculated and interpreted.

Purpose

The purpose of shareholder’s equity is to maximize investments. In contrast, the purpose of net worth is to maximize the value of the whole organization. This calculation helps investors determine how much they could lose if their investments fail.

In shareholder’s equity, the shareholders’ investments play the main role, while for the net worth, assets and liabilities play a major role.

Shareholders' Equity Vs. Net Worth

Conclusion

Shareholders’ Equity is a financial term used for the value of all of the stockholder’s investments in a company. Net Worth takes this valuation one step further and relates it to the individual’s total assets after subtracting liabilities. Both are powerful tools that can be used in effective proprietary analysis but are best when used together for a more accurate depiction of the situation at hand.

Related Post

Copyright © 2024 – Powered by uConnect