30 Dec

Are you tired of losing money on your investments despite following the latest market trends and expert advice? If so, it might be time to consider focusing on absolute returns. Absolute return is a powerful concept in the world of investing, that measures the actual return of an investment over a given period of time, without considering any external benchmarks or indices. By focusing on absolute returns, you can take control of your investment strategy and aim for positive returns regardless of market fluctuations. In this blog, we’ll explore the concept of absolute return in more detail. Keep reading!

Table of Contents

What is Absolute Return?

Absolute return is the profits or losses incurred over time on an asset or investment. It is an important concept in the investment world, as it represents the actual return that an investment has generated over a certain period of time, without taking into account any external benchmarks or indices. They are typically used by hedge fund managers who aim to maximize returns for their investors using various strategies, regardless of market trends.

Calculating Absolute Return

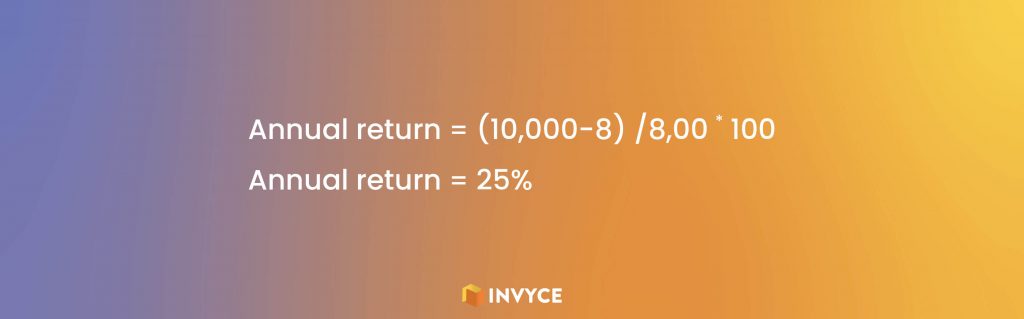

To calculate absolute returns, investors simply need to subtract the initial investment value from the current value of the investment and divide that result by the initial investment/asset value.

For example, if an investment is worth $10,000 and the initial investment value was $8,000, the absolute return would be calculated as;

Interpretation

The interpretation of the final value in the absolute return calculation depends on whether the result is positive or negative. If the result is positive, it means that the investment has generated a return that is greater than the initial investment value. For example, in the calculation provided above, the value is 25%, which means that the investment has generated a return that is 25% greater than the initial investment value.

Benefits

- One of the main advantages of absolute returns is that they are not as impacted by market volatility as other types of returns, making them attractive to investors looking to manage risk.

- It can be used by investors with a short-term time horizon who are seeking to earn fast returns, or by those with a long-term perspective who are looking to build a diversified portfolio that can generate positive returns over the long run.

- Calculating absolute returns is relatively simple and straightforward. It only requires subtracting the initial investment value from the current value of the investment and dividing the result by the initial investment value. This makes it an accessible tool for investors of all levels of experience.

- Moreover, the goal of any investment is to generate positive returns. It can help investors evaluate whether an investment is meeting this goal.

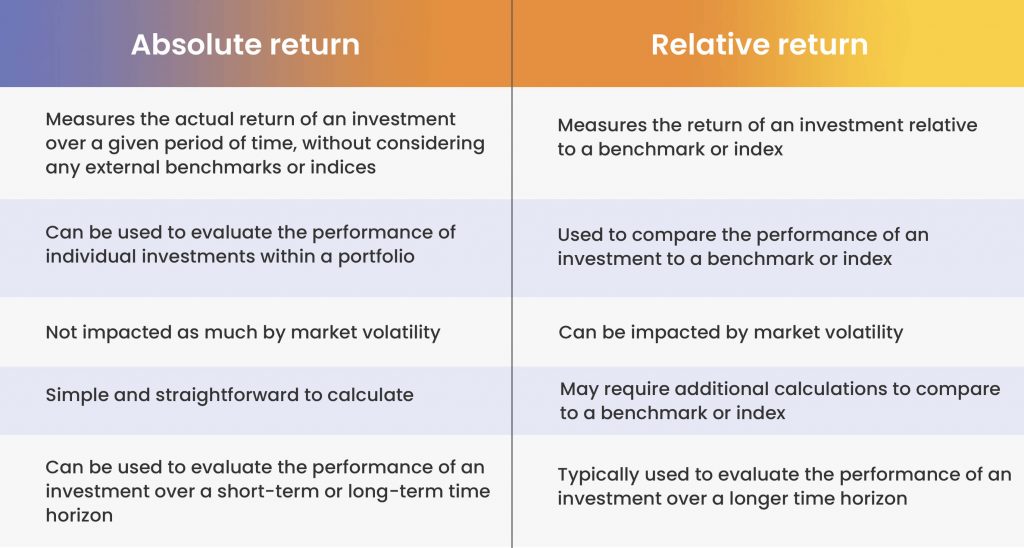

Difference Between Absolute Return and Relative Return

Conclusion

In conclusion, absolute return is an important concept in the world of investing that measures the actual return of an investment over a given period of time. By focusing on total returns, investors can take a dynamic approach to risk management and aim for positive returns regardless of market trends. Whether you’re an experienced investor looking to maximize your returns or a beginner looking to build a solid foundation for your investment portfolio, understanding and utilizing them can be a powerful tool in achieving your investment goals

Content writer at Invyce.com

Related Post

Copyright © 2024 – Powered by uConnect

Meena Khan