08 Jun

The Break-even point in accounting is a crucial element in many businesses’ financial planning and budgeting activities. Although it is also known as the point of zero profit or zero revenue, it refers to the output level at which costs incurred equal the revenue generated. In other words, this is the volume level where total costs are equal to revenues. BEP analysis takes into consideration both fixed and variable costs. This article goes over the BEP, and how you can calculate it with examples and factors that increase or decrease BEP.

Table of Contents

Break-even point in accounting

A BEP is when the total cost and revenue are equal in a specific accounting period. As a result, there is no net loss or gain-even broke.

Let’s understand through an example.

Suppose a company, John Traders Ltd, spent $200,000 on manufacturing products/items and acquired revenue of $200,000. In this case, the company achieves its BEP. It means the company didn’t lose anything or earn anything either.

Importance of break-even point

The importance of the BEP is to determine the point at which a business will neither make nor lose money. This is important because it helps businesses plan their expenses and revenue. In addition, the BEP shows what level of sales must be achieved for a company to cover its fixed costs and make a profit.

How to calculate the break-even point?

The BEP calculates in two different ways:

- Break-even point in a unit

Break-even point in a sales dollar

BEP in a unit

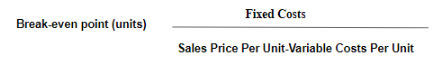

The BEP in the unit is the number of goods you need to sell to reach BEP.The below formula will help you find the BEP in units

Example

Suppose you have a furniture trading company and want to find a BEP. Your fixed cost total is $7000, and your variable costs per unit are $30 sales price per unit is $60.

Let’s put these values in the above formula to find unit BEP.

$7000/($60-$30) =233 units

You need to sell 233 units to reach a break-even point

BEP in a sales dollar

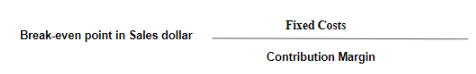

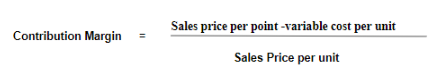

The break-even point in a sales dollar is an amount of income you need to bring to reach your BEP. The below formula will help you find the BEP in a sales dollar:

Example

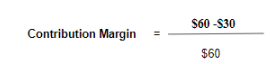

Let’s use above same values from the above example

Fixed costs: $7000

Variables costs per unit: $30

Sales per unit: $60

Contribution Margin = $59.5

Let’s put value in the above formula

Break-even point = $117.64

The above figure shows that the company needs to sell furniture of value of $117.64 in order to reach the BEP.

Factors that increase and decrease the break-even-point

The increase and decrease of the BEP depend on certain factors.

Factors that increase the BEP

1.Increase in customers sales

One of the main factors in increasing the BEP is increased customer sales. When there is an increase in customer sales, there is higher demand. Then, the company produces more products to meet the demands.

2.Equipment failure/repair

Repair or failure of equipment increases the BEP. It increases when the target number of units is not produced within the fixed time period.

3.Increase in production costs

When customers’ sales point and demand remain the same while the price of variable costs increases in the case of additional expenses, the BEP increases.

Factors that decrease the BEP

The strategy owned by a company to generate higher profits, then the BEP must be lowered.

1. Raise product price

A raise in product price increase the profit and reduce the BEP.

2.Outsourcing

Profit can be increased when businesses opt for outsourcing, which can reduce manufacturing costs and increase production volume.

Conclusion

The BEP is one of the essential tools for determining whether or not a business is likely to be profitable. But actual calculating break-even can be tricky. With this in mind, this article will try to settle all your concerns about breaking even and hopefully enable you to make informed business decisions with greater ease. It will also allow you to understand better the importance of BEP and why it’s such a crucial tool for businesses to employ.

Shabana has been a committed content writer and strategist for over a 5 years. With a focus on SaaS products, she excels in crafting compelling and informative content.

Related Post

Copyright © 2024 – Powered by uConnect

Shabana