08 Sep

Capital assets such as investments, bonds, estate, etc., are usually sold at a higher price than their original price. But sometimes, businesses have to sell these assets lower than the actual price. At this point, enterprises face capital loss. The loss in value of investments happens because sometimes the value of capital assets drops with time. This blog is going to explain the concept of capital loss with examples.

What is a Capital Loss?

Capital loss happens when the value of capital assets decreases over time. The capital assets include investments, stocks, bonds, mutual funds, real estate, etc. The investor usually realizes the loss on capital assets when an asset is sold at a lower price. A capital loss is a difference between the higher original price of the capital asset and the lower price at which the asset is sold. It is considered a loss for an investor. Any taxable capital gains generated by a corporation during the same accounting period may be offset by capital losses.

For example, an investor buys a house worth $200,000 in 2021. After one year, he decided to sell the house. After market research, he found that his house’s worth after one year decreased to $150,000. Therefore he sold his house for $150,000. The investor’s capital loss is the difference between the purchase and selling prices i.e., $50,000.

Reporting of Capital Loss

Both the capital gain and the capital loss are reported in form 8949. Form 8949 is an internal revenue service (IRS) form used to report capital gains and losses. It is used by individuals, corporations, estates, or trustees. To determine whether the total sales result in a gain, loss, or wash, Form 8949 details the description of the assets sold, their cost basis, and the gross profits from sales.

How to Calculate The Capital Loss

Capital loss can be calculated by using the formula given below;

Capital loss = Purchase Price – Sale Price

Calculation

Let’s assume ABC company invested $500,000 in real estate in 2020. In 2022, the company needs to buy equipment; therefore, it decided to sell the real estate. After market research, the company’s legal lawyer told them that the value of a real estate property had decreased to $300,000. If the company sells an asset, it will face capital loss. As a company needs cash in hand, therefore, sells the assets anyway. By using the given values, let’s find the capital loss.

Capital loss = $500,000 – $300,000

Capital loss= $200,000.

The company lost $200,000 on its investment in real estate.

Holding Period

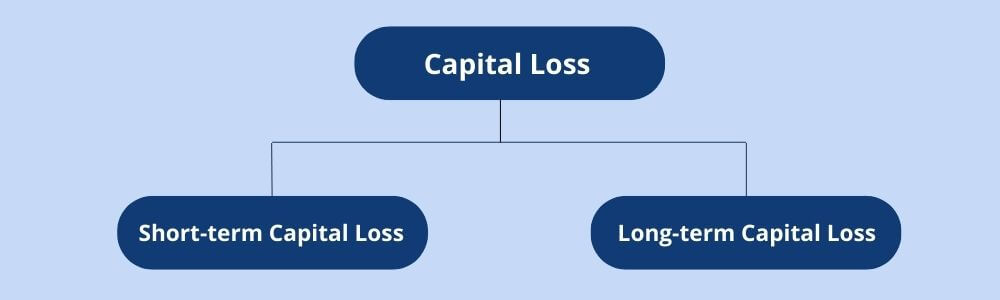

The holding period is the time between purchasing and selling the capital asset. It is the time when the investor holds an asset. The capital loss is divided into two categories based on the holding period..

Short-term capital loss: Short-term loss occurs when you buy and sell securities within a short period of time. If an investor owns an asset for less than one year, he will face short-term capital loss. Let’s say you bought a hundred shares of ABC Company at $100 per share and then sold them at $80 per share after six months; you would have a short-term loss of 20%.

Long-term capital loss: Long-term loss occurs if you have held your investments for a long period of time or more than one year. If your ABC Company was trading at $100 per share before you bought it, and it is now trading at $80, you would have a long-term loss of 20%.

Key takeaways

- Capital losses occur when you sell an asset at a lower price than what you paid.

- Capital loss can be calculated by subtracting the sale price from the purchase price.

- The time between the purchase and sale dates is called the holding period.

- On the basis of the holding period, a capital loss is divided into short-term capital loss and long-term capital loss.

Content writer at Invyce.com

Related Post

Copyright © 2024 – Powered by uConnect

Meena Khan