01 Jul

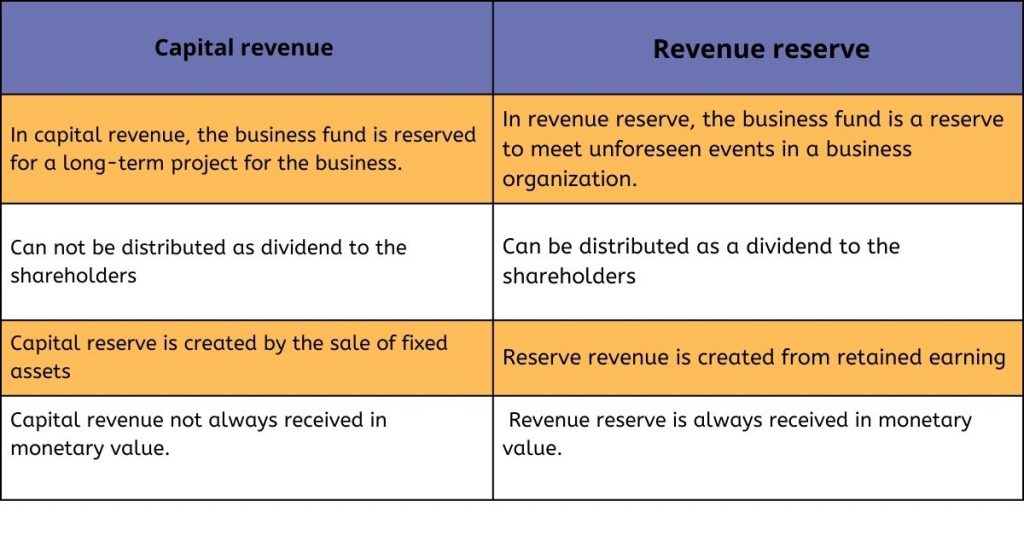

Capital reserve and revenue reserve are two types of reserves that companies create. A capital reserve is the funds designated for investment, while a revenue reserve is the funds used for business purposes. Both depend on terms like net assets, basic profit, perpetual/temporary nature, etc. This article highlights the definitions and differences between revenue and capital reserve

Table of Contents

Definition Capital reserve

The capital reserve is a part of the profit that is not distributed to the shareholders. Still, that profit is kept in a business to meet sudden events like future expenses or losses, inflation, and to invest in business expansion. A capital reserve is a type of reserve created from capital profits, such as profit on the sales of shares. The capital reserve also can be used to repurchase company shares.

Profit/gain on Capital Reserve

- Profit or gain on sale of fixed capital or investment.

- Pre-incorporation Profit

- Premium on issue of securities

- Profit/gain on redemption of debentures.

- Profit or gain on the reissue of forfeited shares

- Profit/gain on revaluation of assets and liabilities.

Definition of Revenue reserve

The revenue is a type of reserve that is created from net profit. The revenue reserve is also not distributed to the shareholders but is kept for meeting future requirements or long-term projects of the business.

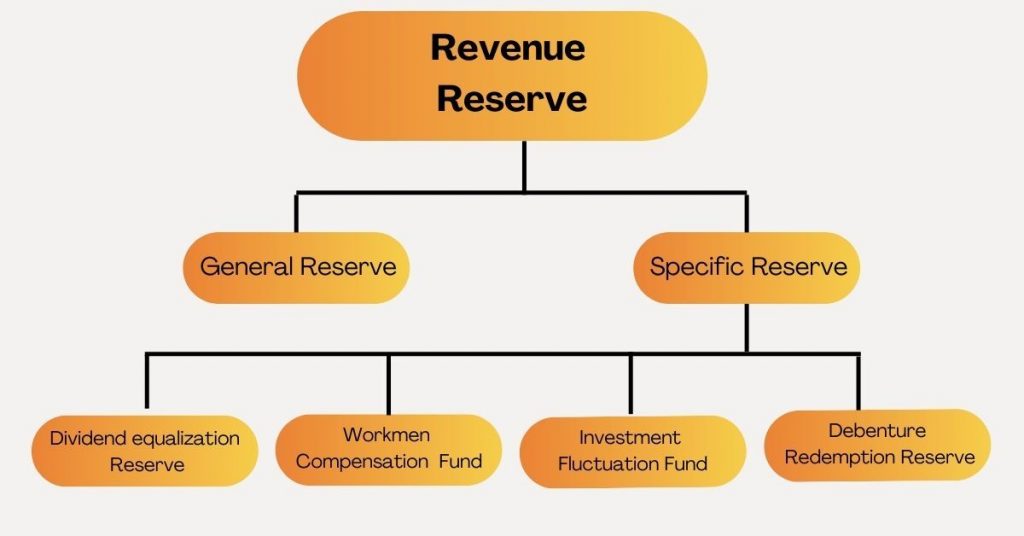

There are two types of reserve revenue.

General reserve

The type of revenue reserve in which a fund is reserved for an unknown purpose. It is also known as free reserve.

Specific reserve

The type of revenue reserve in which funds can be utilized for a specific purpose. Some examples of the reserve are:

- Debenture redemption reserve

- Investment Fluctuation funds

- Dividend equalization reserve

- Workmen compensation fund

Comparison Chart

Conclusion

To sum up, the above articles, every venture requires some capital reserve to keep its day-to-day operations running smoothly. On the other hand Revenue reserve, on the other hand, is a source of funding that employees can draw upon when they have an urgent requirement.

Shabana has been a committed content writer and strategist for over a 5 years. With a focus on SaaS products, she excels in crafting compelling and informative content.

Related Post

Copyright © 2024 – Powered by uConnect

Shabana