15 Nov

There are countless organizations and charities that work to help individuals or communities in need. Have you ever wondered how these non-profit organizations get donations and how they use them? The most common donations non-profit organizations gets are from endowment fund. Endowment funds are an essential part of the economy of these organizations. They are essential in order to advance their long-term objectives and foster a culture of trust. They ensure that the charity will continue to exist, which is why donors and foundations want them.

What Is An Endowment Fund?

An endowment fund is a donation or a gift given to a charitable or non-profit organization. These funds are invested and reinvested for decades. The income generated from the investment, instead of the original fund, i.e., the principal amount, is used to meet the organization’s needs. In this way, these funds provide long-term capital support.

It is a permanent fund used to generate income for a specific purpose. The money from this fund cannot be used for purposes other than those specified by donors. The entities that get funding from endowments include churches, hospitals, universities, orphanages, nursing homes, and other non-profit organizations.

How Does An Endowment Fund Work?

Donors spend the endowment funds for specific charitable causes. An endowment fund’s capital value is typically preserved, but the investment income may be applied to particular causes. As a result, it can be kept forever or for a longer period of time. The donors place limitations on how an endowment fund may be used.

For example, a donor visited the orphanage and decided to donate money for the education of orphans. The monthly education expenses of orphans cost $10,000. The donor donates $100,000 to the orphanage, which can only be used for ten months. Therefore, the donor advised the orphanage to save this amount in the bank and use the monthly interest income for education purposes. In this way, the donation can be used for the long term. The amount of $100,000, donated by a donor, is an endowment fund. The orphanage can only use this amount to meet education expenses.

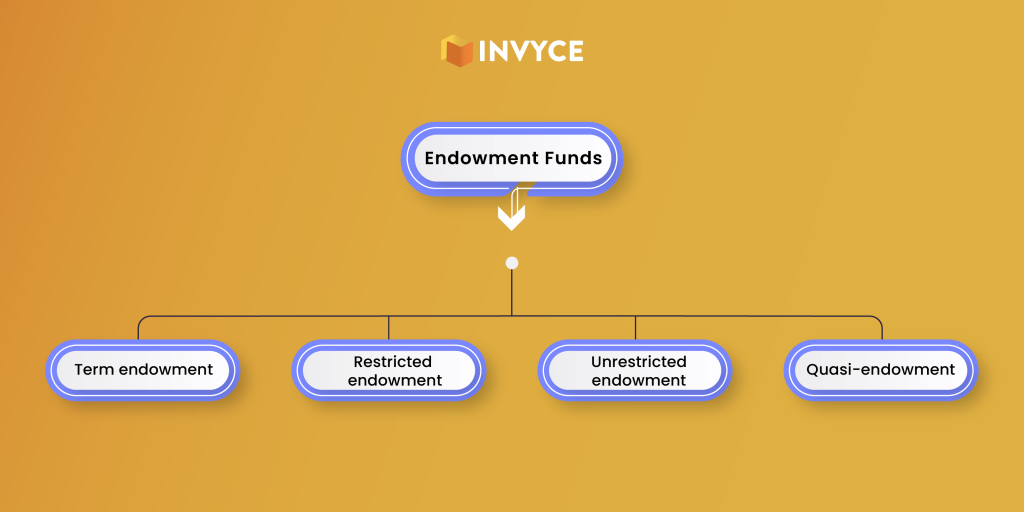

Types Of Endowment Funds

Restricted Endowment

These are the most commonly used endowment funds. A restricted endowment fund is limited to specific purposes. Donors decide these specific purposes or events. For example, a restricted university endowment fund might only be used to award scholarships to pupils who meet specific academic standards.

Unrestricted Endowment

Compared to restricted funds, an unrestricted endowment fund’s donor does not specify the user’s purpose. The recipient is free to use the funds however they see fit. Moreover, Funds of this kind are far less typical than funds with restrictions.

Term Endowment

Term endowment funds are similar to permanent endowments, except that the charitable organization is free to use donation amounts as per their policies, after the maturity of a predetermined period or after the occurrence of a specific event.

Quasi-Endowment

This is a fund made by an individual or organization with the intention that the fund would be used for a certain purpose. The regulatory body of the charitable organizations is in power to decide where and how to use funds, not the donors.

Endowment Fund Policies

The endowment funds have three policies according to the intent of the donor; investment policies, withdrawal policies, and usage policies.

Investment Policies

Investment policies explain permitted investment kinds and investment managers roles in achieving return targets. These policies may cover asset allocation, risk tolerance, desired return, and other topics. In addition, many endowment funds have specific investing guidelines integrated into their legal framework, requiring long-term money management of the fund pool.

Withdrawal Policies

The withdrawal policy specifies the maximum amount that an institution or organization may withdraw from the fund per period or payment. The annual withdrawal is often restricted to a particular portion of the fund’s entire value. Moreover, the percentage is typically low to ensure that the money can last forever.

Usage Policies

The usage policy explains the purposes for which the fund can be used. In addition, it also ensures that all funding is adhering to these purposes and being used appropriately and effectively.

Conclusion

A well-managed endowment fund provides a long-term source of revenue for the institution. Endowments help institutions continue to grow and thrive, providing stability and security for an organization. These funds can be a powerful tool for institutions looking to ensure their financial stability. However, establishing an endowment requires careful consideration and planning to ensure that the fund will continue providing resources into the future.

Content writer at Invyce.com

Related Post

Copyright © 2024 – Powered by uConnect

Meena Khan