27 Oct

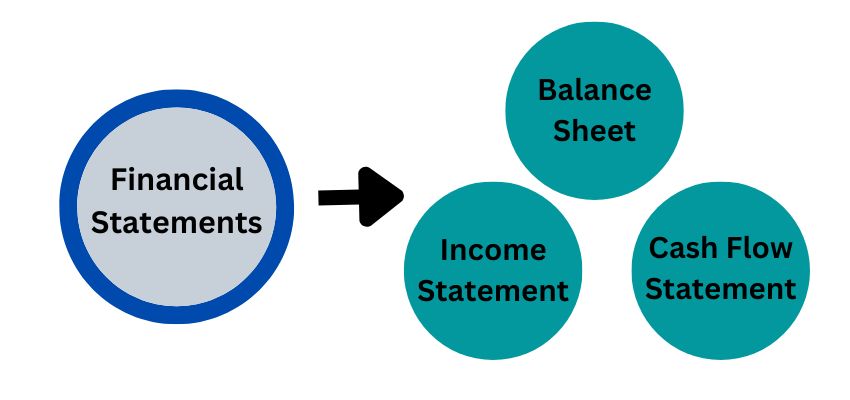

Financial reports are essential to analyze a business’s financial position. Different types of financial reports cover various aspects of a business. The most common are balance sheets, income statements, and cash flow statements. Financial reporting is done by an external or internal auditor, depending on whether the company is public or private.

Table of Contents

What Is Financial Reporting?

Financial reporting is the process of recording transactions and events related to a company’s business operations. They provide information about an entity’s financial position, performance, and cash flows. Investors, creditors, regulators, management, and other stakeholders use financial reports to make decisions. They also provide information on how your company’s performance has changed over time and whether its performance compares favorably with other companies in its sector.

Types Of Financial Reports

There are three main types of financial statements used for financial reporting are:

Cash Flow Statement

The CFS gives an overall picture of a company’s cash flows related to its financing, investing, and operating activities. The CFS provides stakeholders with information on how a company manages cash to settle debt, pay for current expenses, and finance current and future investments. Therefore, a cash flow statement is more viable than an income statement because CFS provides a true picture of the inflow and outflow of cash.

Balance Sheet

A company’s assets, liabilities, and shareholders’ equity are outlined in the balance sheet as a snapshot in time. Contrasting different asset and liability line items can assess a company’s liquidity and capacity to pay off debts. Of the four financial statements, it is the most significant. A company’s actual net worth can be determined using balance sheets.

Income Statement

A business’s sales, costs, and earnings for a given period are summarised in the income statement. This statement’s primary objective is to determine whether the company is profitable or not. It accomplishes this by compiling a list of the significant sales activities, production costs, and other operational costs for a specific accounting period. Then, the company’s profit (or loss) is calculated by deducting all expenses from the revenue.

Who Uses Financial Reports?

The significant individuals or groups of individuals who use financial reports are :

Investors: Investors use financial statements to help decide whether or not they should invest in a company. They also use the information in these reports to evaluate companies’ performance and make investment decisions based on this evaluation.

Lenders: The lenders will access companies’ financial reports before lending money because they want to know the companies’ debt repaying capacity and how well it uses loan amount to generate income. This is because lenders often require a certain minimum amount of liquidity available at all times to not only be able to extend credit but also guarantee repayment if necessary.

Customers: Financial reporting is essential for fostering market transparency and educating customers about business operations. Open lines of communication with customers about earnings, investing activities, and donations can help customers stay informed and increase sales.

Shareholders: The shareholders of a company are usually interested in reviewing financial reports to assess its capacity to produce profits and cash flow. Because both of these variables determine the frequency of dividends, the company can pay to shareholders.

Employees: Financial reports may be distributed internally for review by all staff members in an organization that practices open book management. These reports may be utilized in a system of responsibility accounting, in which workers are accountable for activities that fall under their control.

Importance of Financial Reports

Communicate essential data: Current financial information is used by key shareholders, executives, investors, and business people to set budgets, monitor performance, and make choices. As a result, funding, investment opportunities, and financial reviews depend on open communication and transparency. In addition, many investors and creditors rely on the information companies convey in financial documents to evaluate profitability, risk, and future returns.

Compare actual results to budget: Financial reporting results are compared to a company’s budget to determine how closely actual performance matches desired outcomes. This knowledge can be used to modify current activities to match future outcomes with the plan better. This is especially concerning when actual performance falls short of the covenants required by lenders because this violation may lead to calls on outstanding loans from those lenders.

Identify trends: Whatever aspect of financial activity you want to monitor, this kind of reporting will enable you to spot historical and current trends, giving you the power to address any possible issues and drive improvements that will improve the overall health of your company.

Debt management: Business owners and management can directly understand their organization’s current assets and liabilities through financial statements. Therefore, they know exactly how to manage the outstanding debt for their business.

Monitor compliance: To make sure that a company is adhering to legal, tax, and regulatory standards, financial reporting is necessary. Thus, a publicly traded firm must submit its financial statements to the Securities and Exchange Commission.

Conclusion

Financial reporting can be difficult to understand, but it’s important to remember that it’s essential to any business. The information provided by financial reports helps investors, employees, and other stakeholders make decisions about how the company works and what its future looks like.

Related Post

Copyright © 2024 – Powered by uConnect