24 Nov

The forward P/E ratio (known as forward earnings yield) is one of the most important factors that determine the value of a particular stock. It is a stock or company’s forecasted earnings per share over the next 12 months, divided by the current share price. In this article, you will find out everything you need to know about this stock valuation.

Table of Contents

What Is Forward Price-to-Earnings Ratio (Forward P/E ratio)?

The forward P/E ratio is a measure of the price-to-earnings ratio using forecasted earnings to calculate the Price-to-earnings ratio. The difference between the forward price to earning ratio and the trailing price to earning ratio is that the latter uses actual earnings while the former uses estimated or forecasted earnings. The profits considered in this calculation are only estimates and not as accurate as actual or historical earnings data, but the data is still useful for some aspects.

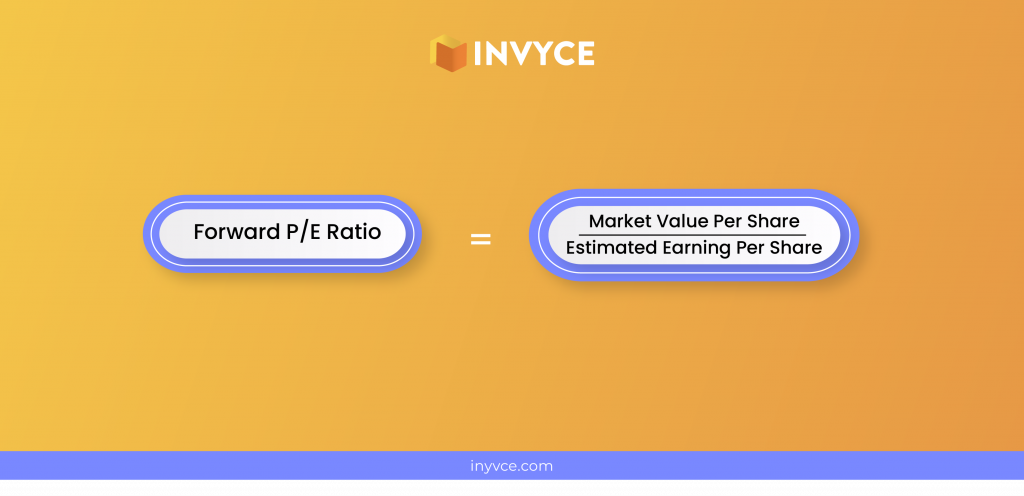

How to Calculate The Forward P/E Ratio?

To calculate the forward price to earnings ratio, divide the current stock price by the forecasted earnings per share (EPS) for the next 12 months.

For example, if a company’s stock is trading at $100 per share and analysts are forecasting EPS of $10 for the next 12 months, then the company’s forward price to earning ratio would be 10.

Interpretation

A high forward P/E ratio might indicate that investors are expecting higher growth in the company’s earnings. Conversely, a low forward price to earning ratio might indicate that investors are expecting lower growth or even a decline in the company’s earnings.

Pros of Forward P/E Ratio

- An advantage of the forward P/E ratio is that it can provide a more accurate picture of a company’s future valuation. It takes into account expected future earnings growth, rather than just historical earnings. This can be helpful when making investment decisions, as it can give you a better idea of the future earnings of a company.

- Forward price to earning ratios are the only method available to some unprofitable businesses because a negative EPS would make the ratio useless. However, as both the trailing and forward price to earnings ratios are shown side by side, the forward valuation may not be used usually by unsuccessful businesses.

- The forward P/E ratio can be useful for comparing companies on a long-term basis. This is because it uses projected earnings for the next 12 months, rather than actual earnings from the past 12 months. This can give you a better idea of how a company’s share price is likely to move over the next year or two, and help you make more informed investment decisions.

Cons of forward P/E Ratio

The forward P/E ratio isn’t perfect. Here are some cons:

- It’s based on future earnings estimates, which can be inaccurate.

- It doesn’t take into account the company’s growth rate. A company with a high P/E ratio could be growing quickly and therefore have a higher P/E ratio than a slower-growing company with the same earnings per share (EPS).

- It doesn’t reflect the company’s capital structure or dividend payout ratio, both of which can affect a stock’s valuation.

- Like all ratios, it should be used in conjunction with other information about the company before making any investment decisions.

Key Takeaways

- A company’s forward P/E ratio can give you an idea of how expensive its shares are relative to earnings expected in the future.

- To calculate a company’s forward price-to-earning ratio, divide its current share price by the earnings per share (EPS) expected for the next 12 months.

- A higher forward P/E ratio means that investors are expecting higher earnings growth in the future.

- A lower forward price-to-earnings ratio could mean that earnings are expected to grow more slowly or that the stock is undervalued.

- There are many factors that can affect a company’s future EPS, so it’s important to do your own research before making any investment decisions.

Content writer at Invyce.com

Related Post

Copyright © 2024 – Powered by uConnect

Meena Khan