16 May

Table of Contents

Shares are the small dominations of capital that firm issues to the general public, insiders, institutional investors, and financial institutions to increase the shareholding of a company. A company’s shares can be issued at par, at a premium, or at a discount. When the shares are sold at their nominal value, they are said to be issued at par. The amount above the face value is the premium, and shares are sold with a premium cost more than their nominal value. Conversely, shares sold at a discount cost less than the face/nominal value.

A Prospectus is required when a public business asks the public to apply for and subscribe to its shares. The prospectus is a company’s marketing use for its shares. It is attached to the share application form. When a corporation issues stock to the public, there are three possibilities:

Full Subscription: Full Subscription occurs when the number of shares offered to the public and the number of applications for shares received are the same. In this case, shares will be distributed to all applicants.

Under Subscription: When a corporation offers more shares to the public than the number of shares for which it gets an application, this is referred to as an under subscription. In this case, all applicants will be allotted the shares only, if a company receives a minimum subscription.

Over-Subscription: Over Subscription occurs when the number of shares offered to the public is less than the number of shares for which the application is received. In this case, the company will reject the excess amount of applicants.

Issuance of Shares at Par

The stock is reported to have been issued at par value when subscribers are only needed to pay the nominal or face value of the shares issued. The par value of shares determines a shareholder’s maximum liability and protects a company’s creditors. Unlike the market value, the par value is constant and does not fluctuate.

Journal entries are passed on the basis of whether a share is issued against lumpsum payment or on an installment basis.

Issue of shares for cash in lumpsum

If shares are issued at par and are receivable in a single payment, the shares are said to be issued against a lump amount.

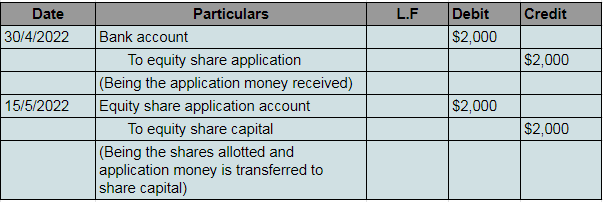

Illustration:

The company ABC proposes to issue 100 equity shares of $20 each to the public on April 30, 2022, with the total price payable on application. By March 31, 2022, the people had applied for all of the shares allotted on May 15, 2022. Make the necessary journal entries

Issue of shares for cash in installments

The system in which issued shares can be paid in various installments is said to be shares issued on an installment basis. The amount is collected in application, allotment, first call, and final call.

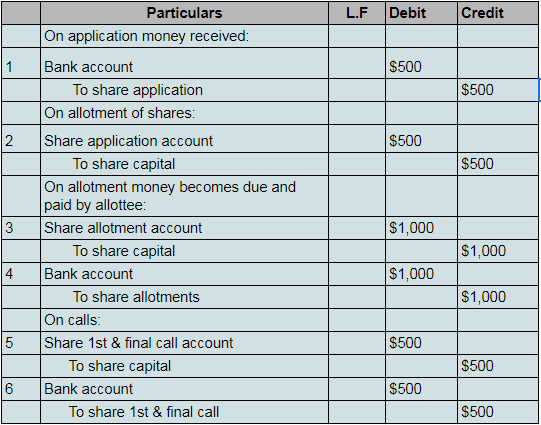

Illustration:

The company issued a call for applications for 100 shares. The value of each share is $20. The fee is paid in three installments by applicants: $5 on the application, $10 on an allotment, and $5 on the first and last call. The issue was subscribed entirely, and payment was received on time. Make the journal entries for the transactions listed above.

Issuance of Shares at Discount

The issue of shares at a discount occurs when a corporation issues its shares at a lower cost than the nominal value of the share. For example, suppose a share has a face value of $20, and the company issues it at $15. In that case, the difference of $5 represents the discount granted by the firm on the issue of each share.

Conditions for Issue of Shares at Discount

The following are some of the conditions that must be met when a corporation issues discounted shares:

- The shares that the company wishes to issue should be in the same category as those that the company has already offered in the market.

- If a company intends to issue shares at a discount rate, it must first obtain permission from the appropriate government. To get this license, the corporation must first summon and hold a general meeting to conduct a thorough debate on the matter.

- The rate of discount is restricted. For example, an organization cannot issue shares at a discount of more than 10%.

- The company must issue shares within 60 days of receiving approval from the appropriate government. However, the corporation may extend this time range under particular circumstances, although consent from the general meeting is required.

- One year must have passed since the company was granted permission to begin operations.

If the company issues shares at a discount, the accounting entries should be made as follows:

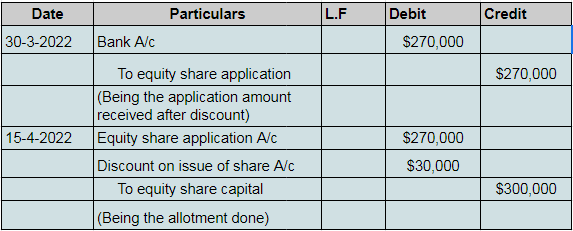

Issue of shares for cash in lumpsum

A company issued 30,000 equity shares of $10 each at a discount of 10%. The total amount payable on shares is to be paid along with the application. The issue was fully subscribed. Pass the journal entries;

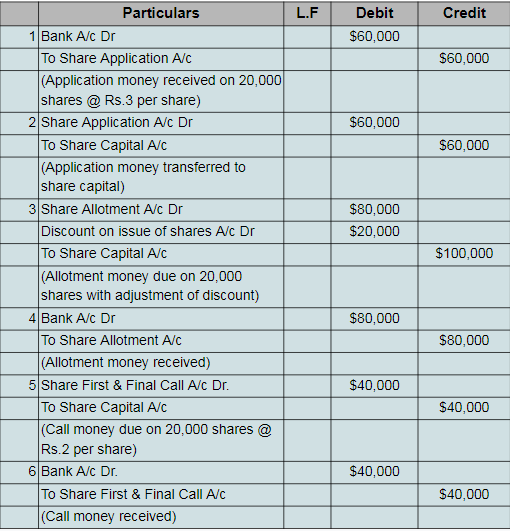

Issue of shares for cash in installment

A company issued 30,000 shares of $10 each at a discount of 10%. The shares were payable as under;

- on application, $3

- on allotment, $4 (with adjustment of discount)

- on the first and final call, $2

The public applied for 20,000 shares, which have been duly allotted. The company duly received all money. Pass journal entries

Issuance of Shares at Premium

If the sum received for issued shares is greater than the face value of the shares, they are considered to be issued at a premium. The difference between the share issue price and the par value of the shares offered for sale is used to compute the premium.

For example, the public receives 500 shares from a Company. The shares have a par value of $10 each. The share of $10 is issued at $15 per share. As a result, the company has received $5 per share as a share premium. The total share premium of $2,500 will be credited to Company’s share premium account.

Illustration

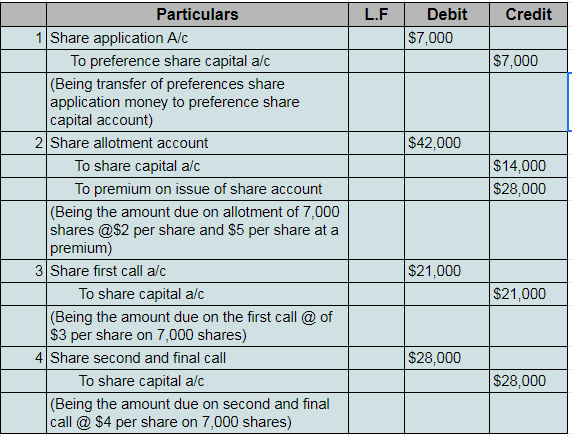

A company issued 7,000 shares of $10 each at a $4 per share premium. The shares were payables as follows;

- On application, $1

- On allotment of, $6 (including the premium)

- On the first call, $3

- On the final call, $4

Pass the journal entries

Conclusion

A share in the stock market refers to a small portion of a company’s stake or a percentage of the company’s total capital. A company’s primary source of money or funds is its shares. A corporation can raise capital by selling its stock to individuals or institutions in the market. Buying shares is also advantageous for investors because it delivers a high return on investment instead of fixed-rate debentures. A firm can issue its shares in various ways and at multiple values, such as par, premium, and discount.

Content writer at Invyce.com

Copyright © 2024 – Powered by uConnect

Meena Khan