11 Jan

Trading securities is a way to invest in financial markets by buying and selling various types of securities, such as stocks, bonds, and options. It can be an exciting way to earn potential money, but it’s important to have a good understanding of how it works and the risks involved. In this blog, we will cover the basics of trading securities and provide the benefits and risks associated with it. Whether you are just starting out or have some experience with trading, there is always more to learn and discover.

Table of Contents

What are Trading Securities?

Trading securities are financial instruments that are bought and sold with the intention of generating a profit from short-term price movements. They can include stocks, bonds, options, and other financial instruments that are traded on exchanges or over-the-counter markets. These securities are held by a company or individual to generate short-term profit, rather than for the purpose of long-term investment or financing. The value of trading securities can fluctuate significantly over time. Therefore, they carry a higher level of risk compared to other types of investments, such as long-term securities or cash equivalents.

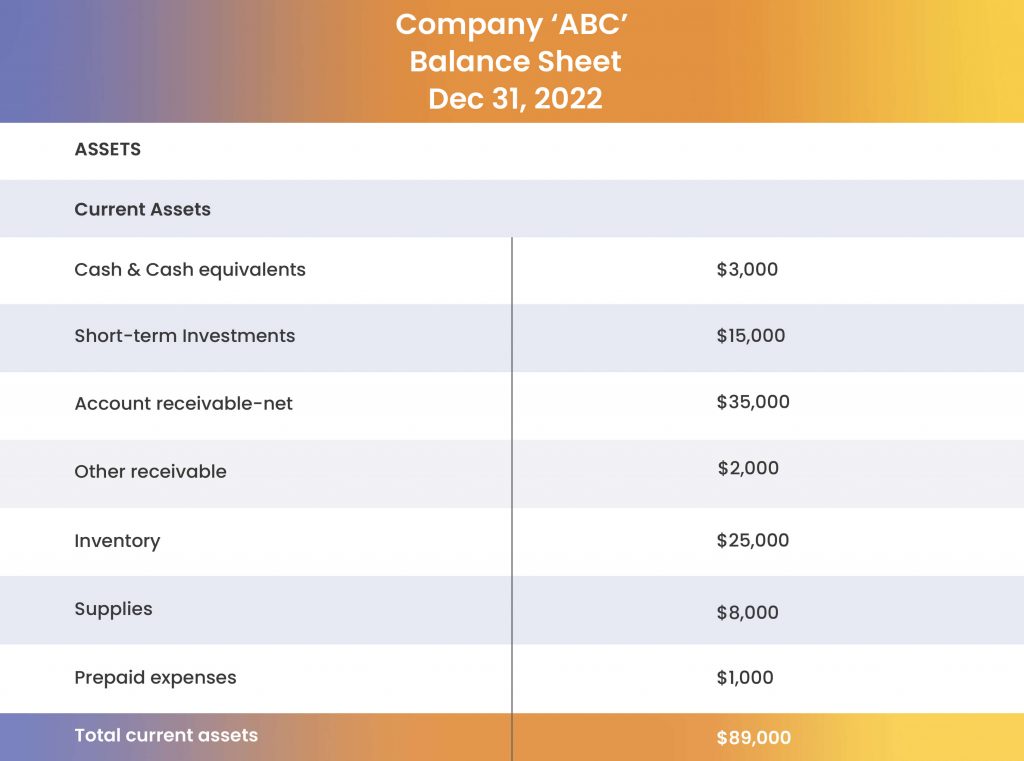

Trading Securities On Balance Sheet

Trading securities are listed under the assets section of the balance sheet, along with other current assets such as cash, accounts receivable, and inventory. They are typically presented in the order of liquidity, with the most liquid assets listed first.

Here is an example of how these securities might be listed on a company’s balance sheet:

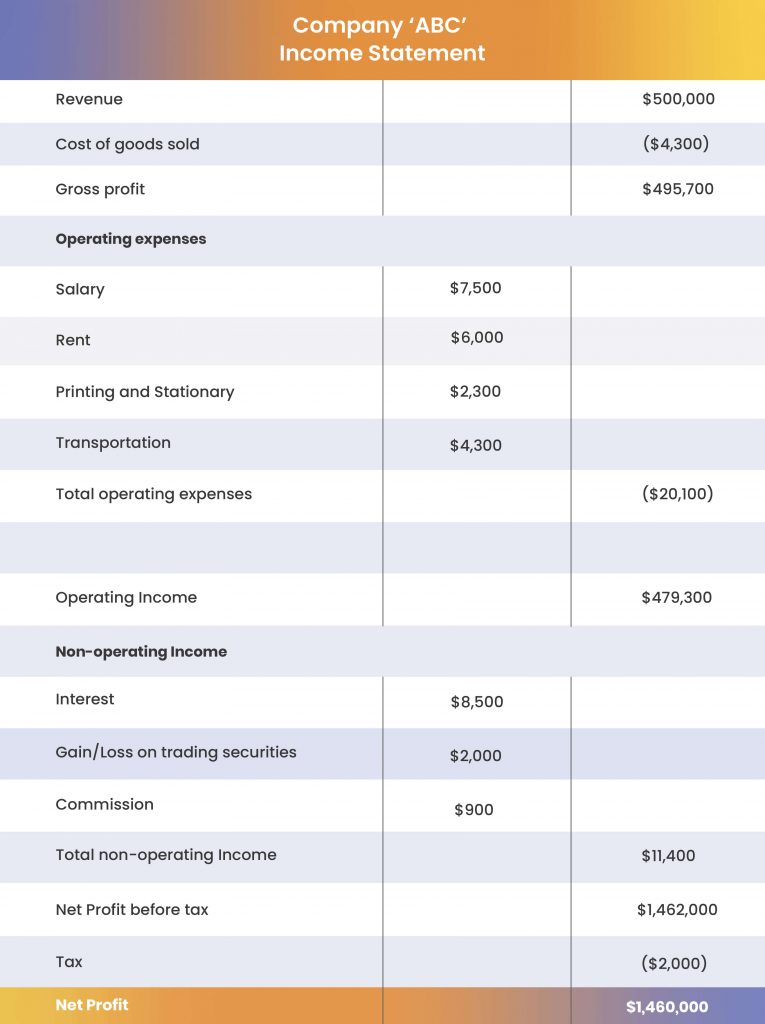

Trading Securities On Income Statement

If the company sells some of its trading securities, the gain or loss on the sale will be reflected in the income statement as a “realized” gain or loss.

Here is an example of how these securities might be reflected on a company’s income statement:

Benefits

Potential of short-term profits: One of the main benefits of tradable securities is the potential to generate profits through short-term price movements. By carefully selecting and timing the purchase and sale of securities, traders can potentially realize profits in a relatively short period of time.

Flexibility to take advantage of market opportunities: They allow investors to be agile and responsive to changing market conditions. This can enable traders to take advantage of new opportunities as they arise, rather than being tied to a long-term investment strategy.

Diversification of investment portfolio: They can also provide an opportunity to diversify an investment portfolio, by allowing investors to hold a variety of different securities within a single account. This can help to spread risk and potentially improve the overall performance of the portfolio.

Risks

Volatility of market prices: One of the main risks of these securities is the volatility of market prices. Prices can fluctuate significantly over short periods of time, and this can result in substantial losses for traders who are unprepared or unable to manage their risks effectively.

Higher level of risk compared to other investments: They generally carries a higher level of risk compared to other types of investments, such as long-term securities or cash equivalents. This is due to the short-term nature of the investment and the potential for significant price movements.

Possibility of losing money: As with any type of investment, there is always the possibility of losing money when securities are traded. This is particularly true for traders who do not fully understand the risks or who are unprepared to manage them effectively. It is important for traders to carefully assess their risk tolerance and to have a solid understanding of the securities and markets in which they are trading.

Conclusion

In conclusion, trading securities can be an exciting and potentially lucrative way to invest your money. However, it’s important to have a solid understanding of the markets and the securities you are buying and selling, as well as the risks involved. By learning the basics of trading and staying up-to-date on market trends and developments, you can make informed and strategic trades that align with your financial goals. Remember to always do your due diligence and never invest more than you can afford to lose. With the right knowledge and approach, trading securities can be a rewarding and successful part of your investment portfolio.

Marjina Muskaan has over 5+ years of experience writing about finance, accounting, and enterprise topics. She was previously a senior writer at Invyce.com, where she created engaging and informative content that made complex financial concepts easy to understand.

Related Post

Copyright © 2024 – Powered by uConnect

Marjina Muskaan