24 Oct

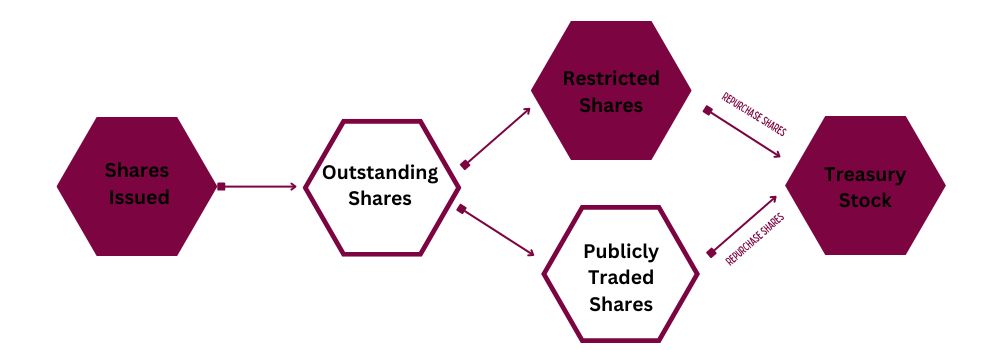

Treasury stocks are shares of stock in a company that the issuing company has repurchased from its shareholders but has not yet retired. Companies may repurchase shares if they believe the price of the company’s shares will rise in the future. Everything you need to know about Treasury Stocks is covered in this article.

What Is Treasury Stock?

Treasury stock is a term used to describe a company’s shares repurchased by the company. These shares are repurchased from shareholders and kept in the company’s treasury. Hence, the repurchase reduces shareholders’ equity. As a result, the company’s treasury shares can fluctuate depending on how many shares are repurchased.

There are a few key things to know about treasury stock:

- Treasury stock is not the same as authorized share capital.

- It does not confer voting rights or dividend privileges.

- On the balance sheet, equity is reduced by the cost of treasury stock.

- They can be resold back into the market at a lower price than what was paid originally (due to the lack of voting rights and dividends).

Why Do Companies Repurchase Their Shares?

Treasury stock can be repurchased for a variety of reasons. Some companies buy back their shares to increase the value of the remaining shares. Other companies do it to prevent another company from buying a controlling stake in the business. Once a company buys back its shares, they are no longer available for public trading. In some cases, companies may simply want to maintain control of their destiny by keeping a large portion of their shares in-house.

Advantages Of Treasury Stock

There are many advantages to holding treasury stock, including the following;

- It can be used to finance future growth or acquisitions without taking on additional debt.

- It can be used to protect the company from an aggressive takeover effort.

- They can be used to repurchase shares from investors who wish to sell, thereby supporting the share price.

- It can provide employees with equity-based compensation without having to issue new shares.

- They can be used to protect against changes in the company’s share price.

Disadvantages Of Treasury Stock

Treasury stock can be a valuable tool for companies, but still, some disadvantages exist.

- One of the most significant drawbacks is that it can dilute existing shareholders. When a business repurchase its stock, it lowers the number of outstanding shares, cutting earnings per share (EPS).

- Another consideration is that buying back treasury stock can be expensive. Companies need to have enough cash on hand to repurchase their shares, and this can put a strain on liquidity. Additionally, businesses could need to employ loans or other types of debt finance to raise the required capital.

- There is always the risk that the shares will not be worth as much when repurchased; if a company decides to resell its stock, it may end up overpaying for its shares.

Key Takeaways

There are certain things you should remember when it comes to treasury stock:

- Treasury stocks are created when a company repurchases its shares.

- They do not have voting rights and do not receive dividends.

- The company can resell them at a later date.

- The purpose of treasury stock is to reduce the circulation of shares, which can increase the value of the remaining shares.

Marjina Muskaan has over 5+ years of experience writing about finance, accounting, and enterprise topics. She was previously a senior writer at Invyce.com, where she created engaging and informative content that made complex financial concepts easy to understand.

Related Post

Copyright © 2024 – Powered by uConnect

Marjina Muskaan