06 Sep

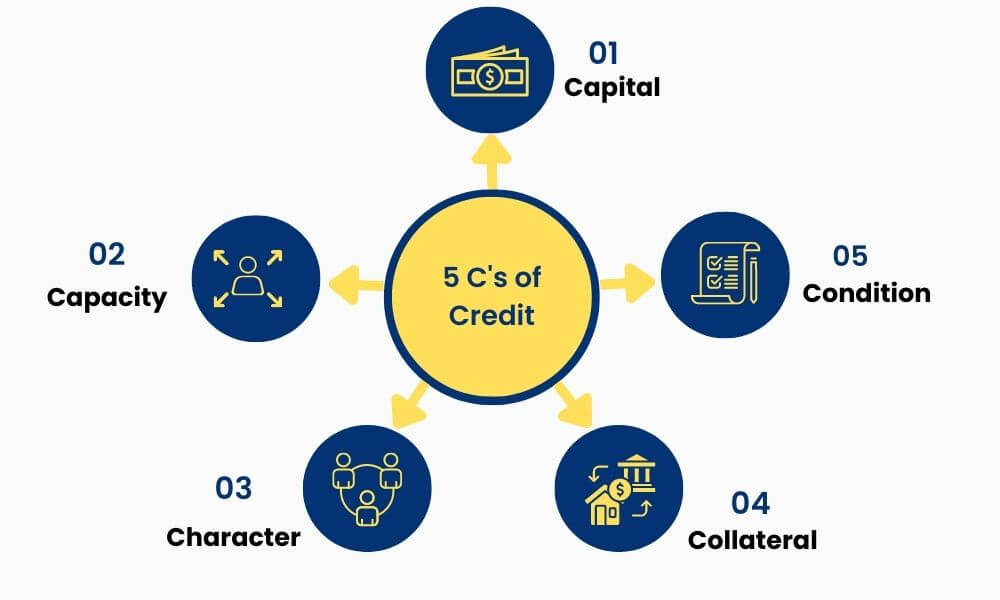

Credit is like fuel for a business. It allows businesses to run smoothly and helps the company to grow and expand. Credit evaluation requires the lender or investor to look at the applicant’s credit score while also considering the applicant’s character and condition. This is because a particular individual may have an excellent financial history but inadequate character issues such as excessive debt or past disreputable behavior, making a person less desirable as a borrower. A lender generally prefers a borrower with five essential characteristics known as 5 C’s of credit. These 5 C’s include; capital, character, collateral, capacity, and condition.

What Are The 5 C's of Credit?

Financial institutions and other non-bank lenders assess a borrower’s creditworthiness and the strength of a borrowing request using a framework known as the 5 Cs of Credit. When evaluating a borrower’s financial status, the lender examines the credit reports, financial statements, credit scores, and other financial records. These five C’s attempt to evaluate the likelihood of default and, subsequently, the risk of a financial loss for the lender.

The 5 C’s of credit include;

Capacity

Capacity is your capability to repay the loan amount. Lenders examine your capacity, your business plan’s revenue, expenses, cash flow, and repayment schedule. Additionally, they check your credit ratings and credit records. The company should generate enough cash flow to comfortably cover its operating costs and debts while paying the principals’ salaries and protecting their personal debts and expenses.

Some lenders may evaluate capacity by calculating the debt-to-income ratio (DTI). DTI is determined by multiplying the borrower’s gross monthly income by the sum of all monthly debt payments. Applicants with lower DTI have more chances of being approved for a new loan.

How to improve your capacity

By increasing your pay or wages or reducing your debt, you can increase your capability. A lender will probably want to see proof of consistent income in the past. Although changing professions could result in a greater salary, the lender might want to ensure that your employment situation is secure and that your payments will remain constant.

Be aware that lenders are frequently more concerned with monthly responsibilities than total loan sums. Therefore, paying off a loan completely and getting rid of that monthly payment will increase your ability.

Capital

When a borrower wants to take a loan, a lender is interested to know if the borrower is committed enough to contribute some of their own funds. To know this, lenders assess capital structure, i.e., the amount borrower invested in the business, whether it is debt or equity financing.

The likelihood of default is reduced if the borrower makes a significant capital contribution. Contributing personal assets also demonstrates that you are prepared to take a personal risk for the sake of your company.

How to improve capital

To improve your capital, you should increase your savings and investments. Sometimes asset building is more advantageous than saving money. Therefore, consider purchasing as an asset, such as real estate, because the value of these assets increases over time.

Collateral

Collateral is any valuable asset pledged by the borrower to the lender. It includes; real estate, vehicles or machinery, investments, gold or jewelry, etc. Collateral guarantees the lender that, if a borrower defaults, they will be able to recover some of their investment by seizing the collateral. Collateral loans are secured loans typically offered with cheaper interest rates and better conditions than other unsecured loans since some asset secures them.

How to improve collateral

Signing into a particular kind of loan agreement will allow you to increase your collateral. Lenders frequently place liens on particular kinds of assets to protect their right to be compensated for damages in the case of your default. Your loan can be subject to this collateral agreement.

Character

Character refers to the credit history or a borrower’s reputation or track record for repaying loans which can be seen on the borrower’s credit reports. By studying a borrower’s credit history, typically with the aid of a credit score, the evaluation aims to determine what kind of “person” they are. Character includes your professional and personal credit histories, as well as your educational background. It is advantageous if you and your team are well-known in your field.

Lenders look at your credit scores and reports to assess your eligibility for a loan or credit. However, the standards used by each lender to evaluate your credit history vary. While pulling your credit reports, they will examine your borrowing and payment history specifics. Additionally, they will look for issues like missed payments, foreclosures, and bankruptcies.

How to improve character

Prospective borrowers should check that their credit report has accurate information about their credit history. Your credit history and credit score can suffer from negative, incorrect differences. Consider instituting automatic payments on recurring billings to guarantee that future commitments are paid on time. Your credit score is increased by monthly recurring bills and establishing a history of timely payments.

Condition

The loan conditions, including the interest rate and principal amount, affect the lender’s willingness to lend money to the borrower. Conditions could describe the borrower’s intended method of use for the funds. The lenders evaluate whether the business’s current conditions will persist, improve, or worsen. The lender will also inquire about the intended use of the loan money, such as working capital, improvements, new equipment, etc.

How to improve the condition

Make sure your justification for taking on debt is compelling and supported by your financial situation. Businesses, for instance, might need to show that they have promising futures and sound financial projections.

Conclusion

When you apply for a loan, your lender scores your loan application based on five main characteristics. These characteristics of a borrower are known as the 5 C’s of credit and include; capacity, credit, character, collateral, and condition. These five C’s are the instruments used by lenders to evaluate the creditworthiness of the borrowers. The borrowers with higher creditworthiness are more likely to get a loan. To make yourself eligible for a loan, you should know in detail about these 5 C’s of credit and how to improve them.

Content writer at Invyce.com

Related Post

Copyright © 2024 – Powered by uConnect

Meena Khan