13 Sep

When getting goods or services from a company, customers often do not immediately pay the full amount of their purchases. Therefore, they might be given 30, 60, or even 90 days to repay the full amount to make it easier for them to buy and for companies to sell. These outstanding invoices owed by customers to the company are known as accounts receivable.

What are Accounts Receivable?

The business typically offers cash and credit purchase opportunities to customers when selling its products and services. When a company permits a customer to pay for its products or services on credit, AR is generated. The term “accounts receivable” describes the cash that customers owe. The word refers to accounts that a company is entitled to after delivering a good or service. Receivable represents an outstanding payment that has not been realized.

Accounts receivables are considered an asset because they represent future revenues for a business. Therefore, they are shown as a current asset on the balance sheet as accounts receivables. A business loses money if it does not receive payment for goods or services. Businesses use ARs to collect money owed to them to prevent losing money.

How AR Works?

Accounts receivable are generated when both parties, the company, and the client, agree to make credit transactions. The business offers the client credit for a period agreed upon between both parties for example credit period may be of 1 week, 15 days, 30 days to a few months. Typically, companies will record sales as account receivables once they sell goods or services to customers before payment is made. The company waits for payment after recording receivables on the balance sheet. If the company collects all of its account receivables, then they can add this revenue to their cash holdings. If customers don’t pay bills on time, the company can take legal action against them.

Businesses that fail to collect their AR over time will most likely experience problems with cash flow and liquidity. The AR or finance team ensures that all the bills under account receivables are paid on time.

Example

Let’s say you own a manufacturing company named ABC manufactures. Your company manufactures shoes for females. One of your customers buys 100 pairs of shoes that cost $100 for each pair. The buying company and your company decided to extend the payment period for 30 days, meaning that the customer owes you $10,000. Now, this amount is accounts receivable until the customer pays it. Therefore you will record $10,000 in account receivables under assets on the balance sheet. When the customer pays the amount before the expiry period, the cash segment will increase by $10,000.

Accounts Receivable Ratios

When recording account receivables, one should consider several ratios that depend on those AR.

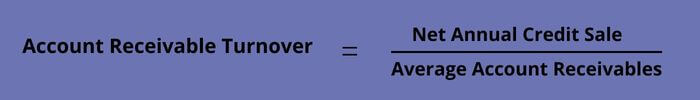

Accounts Receivable Turnover Ratio

AR turnover ratio or receivable turnover ratio evaluates how long it takes to collect unpaid debt over the course of the accounting period. It is used in business accounting to quantify how well businesses manage the credit they extend to their customers.

Formula;

Account receivable turnover = net annual credit sale ÷ average account receivables

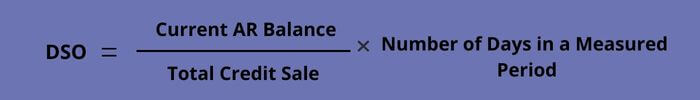

Days Sale Outstanding Ratio (DSO)

DSO is a metric that describes how long a business typically takes to collect revenue after completing a transaction. It serves as a crucial performance measure for examining receivables.

Formula;

DSO= (current AR balance ÷ total credit sale) ✕ number of days in a measured period

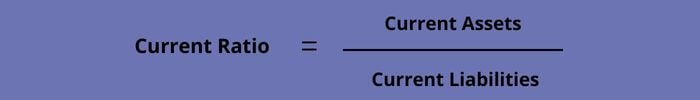

Current Ratio

Current ratio is an indicator of liquidity, also known as working capital. It tells you whether your business can meet its short-term obligations using cash on hand or other liquid assets that can be turned into cash within a year.

Formula;

Current Ratio= current assets ÷ current liabilities.

Benefits of Accounts Receivable

- If you’re running a small business, you may not want to take out loans to fund your company’s operations. Instead, you could use your accounts receivable to finance your business. By using your accounts receivable, you’ll get a tax deduction for the amount of money you owe.

- Your customers will feel loyal to you if you offer them discounts and credits. Customers appreciate being treated well, especially when they know it comes at no cost to them.

- AR measures the ability of the company to cover its short-term obligations. For example, the account receivables turnover ratio is determined by analysts to measure how many times a company collected its receivable balance.

Conclusion

To sum up, AR is the amount of money customers owe to a company against goods or services that a business has already provided. Accounts receivables are as important to business success as cash. It is a way of showing your customer that you trust them and their intention to pay. Keeping track of these payments is thus very important in order to monitor whether a given customer is an active paying customer with good payment habits or just someone who has occasionally forgotten to pay.

Content writer at Invyce.com

Related Post

Copyright © 2024 – Powered by uConnect

Meena Khan