14 Sep

If you’re in business and dealing with credit purchases, then chances are that you’ll be required to deal with accounts payable. Accounts payable is where your business deals with the money that was spent on goods and services you get from vendors or suppliers on credit. It is a crucial component of every business. This post walks you through the basics of AP and discusses how it works and some examples of how it can benefit your business.

What are Accounts Payables?

Accounts payable are short-term obligations of a company owed to its suppliers or creditors. These invoices are generally outstanding amounts for particular goods or services purchased. This can be through a credit purchase from a vendor, a subscription, or an installment payment that is required after receiving goods or services. AP is usually an accounting term for the debts of a business.

Accounts payable is the process of recording and settling all expenses incurred by a business. It is sometimes referred to as customers’ bills or invoices. They are listed as current liabilities on the balance sheet, unlike accounts receivable, which are considered current assets. For example, if your boss buys a set of pens at the office supply store on credit, you will need to record it in a general ledger.

Example of Accounts Payable

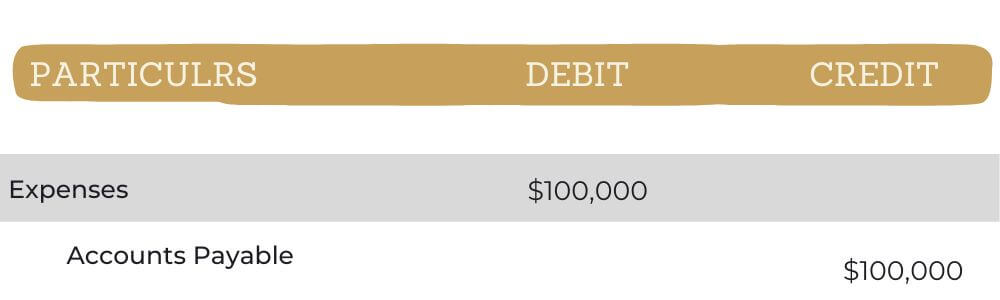

Let’s say that you are the owner of ABC Manufacturing company. Your business makes shoes for women. To manufacture shoes, you need leather that costs $100,000. As you cannot pay such a huge amount, your company and the vendor decided to extend the payment period for 30 days, meaning that you owe $100,000 to the vendor.. Now, this amount is accounts payable until you pay the amount. Therefore you will record $10,0000 in accounts payable under current liabilities on the balance sheet. The journal entry for this transaction will be as follow;

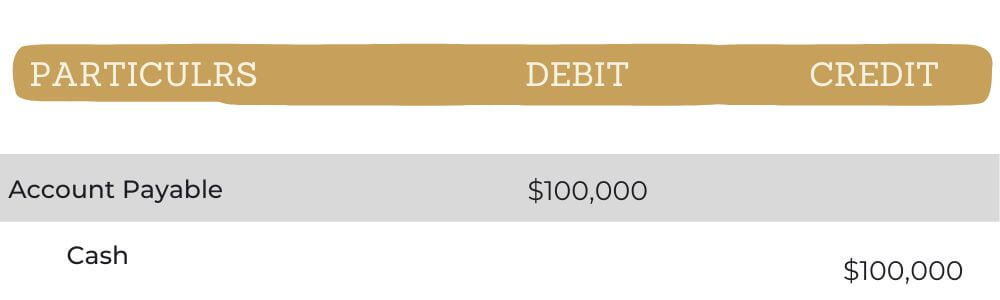

Once you pay the amount, the company will debit the account payables, and hence cash segment will be decreased by $100,000.

Accounts Payable Process

The accounts payable process involves paying out money owed to vendors and suppliers. The vendors should be paid during a specified credit period, the liability should be recorded on right time in right financial statements to assure accuracy. If don’t the suppliers and vendors will be less interested to provide credit next time . The proper process of accounts payable is given below.

Invoice Capture

The first step in accounts payable is invoice capture. An invoice capture is a process of capturing an invoice for approval. This is done by entering the invoice details into the accounting system. The invoice capture screen contains fields where the customer’s name, address, phone number, invoice date, amount, and description should be entered. The invoice capture screen also includes a field where the payer’s name and address should be entered.

Invoice Approval

After an invoice is captured, it is sent to the approver. The approver reviews the invoice and either approves or rejects the invoice. Approver Make sure that the vendor invoice has a proper vendor name, payment authorization, date, and verified and matching requirements to the purchase order.

Payment Authorization

Once an invoice is prepared for payment, you must obtain authorization before sending the money. This information comprises the due date, the manner of payment, and the payment sum.

Making Payments

According to the agreement between a vendor and a purchasing business, all payments must be completed before or on the day they are due on a bill. Necessary paper documents must be created and checked. This one is one of the best practices since it improves your relationship with the provider.

Benefits of AP

- Accounts payable are crucial to any business. It aids in your comprehension of the amount owed to your suppliers and vendors. Keeping track of your pending payments will ensure the smooth functioning of your organization.

- AP ensures that incoming invoices are paid on time. It also ensures that deductions for discounts, rebates, and quality defects are properly handled

- Increases and decreases in AP help a company analyzes outstanding debts. If AP increases, it means that the company is buying more products and services on credit instead of paying debts. If it decreases, it means that the company is paying for outstanding obligations.

- Management uses AP to manipulate the company’s cash flow to certain limits. If your company wants to increase cash reserves, they extend the time to pay the outstanding bills.

- A company’s accounts payable is essential to ensure timely payment of suppliers and to record liabilities within the correct time frames. Incorrect accounts payable records can lead to problems such as creating disputes with vendors.. For these reasons, accounts payable procedures must be consistent and repeatable.

- The Ap department manages a company’s short-term obligations to its vendors and suppliers. It keeps a company’s financial statements clean and up-to-date and maximizes the financial performance of your business.

Conclusion

AP is a critical part of any business. It is the outstanding bills for the services and products companies receive from vendors. Therefore, ensuring that your accounts payable are done correctly and on time is important. If your outstanding bills are not paid on time, it will negatively impact your companies reputation, you will have late payment penalties and may lose valuable business relationships. In addition, accounts Payable mistakes can be costly; therefore, take measures now to keep your accounts payable in good shape.

Content writer at Invyce.com

Related Post

Copyright © 2024 – Powered by uConnect

Meena Khan