29 Jun

John wants to start a new business. He needs $600,000 to convert his idea into a business. Unfortunately, he has no cash to fulfill his dream. His friend kylie suggested that he can borrow money from a lender (Debt financing) or sell his partial ownership of his business (Equity financing). As he is not a student of accounting, he doesn’t know much about debt and equity financing. He is, therefore, unable to choose the best method of financing for his business. So let’s help him learn more about both financing methods and find the best financing method for his business.

Table of Contents

Debt Financing

Debt financing is borrowing from a bank or other financial institution. The borrower is responsible for paying the principal and interest rates at a specified agreed date. Debt financing is usually used to finance a business or a project, and it can take many forms: bonds, mortgages, and lines of credit. Debt finance tends to be cheaper than equity finance in the long run—but You must pay interest on it, making it more expensive. This means that debt-financed projects may take longer to break even than their equity-financed counterparts.

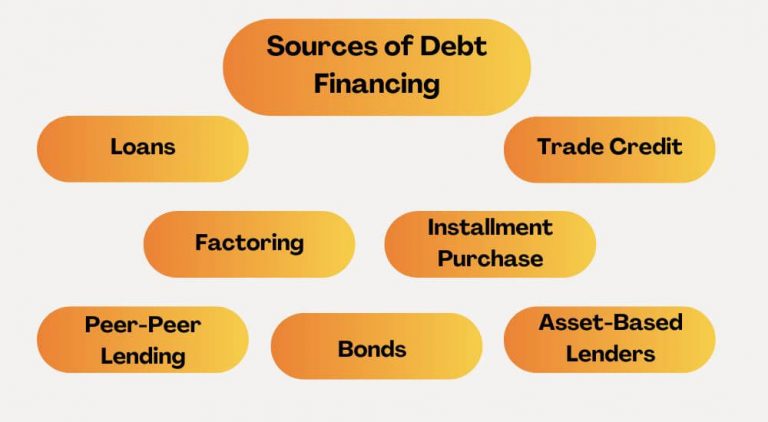

Sources of Debt Financing

The various source of debt financing include;

Loans: A loan is an agreement under which a lender grants access to funds to a third party in return for an interest payment and the return of the funds at the end of the loan. You can get a loan from a bank, corporation, financial institution, or government.

Trade credit: A trade credit arrangement is one in which a seller agrees to let a buyer make purchases on the seller’s terms and pay the seller later without charging interest. This is one of the options for short-term debt financing. This method is one of the best sources of debt financing for new businesses because they can’t bear to apply for bank loans with collateral as security.

Installment purchase: It is an agreement signed between the buyer and the seller to buy and sell products. At the time of contract signing, the buyer provides a certain down payment, and the remaining balance is paid over time in installments.

Asset-based lenders: Asset-based finance is a specialized way of giving businesses term loans and working capital by using inventories, machinery, equipment, accounts receivable, or real estate as collateral.

Bonds: Bonds are issued by borrowers to attract capital from investors ready to extend a loan to them for a specific period. They have maturity dates, after which the entire principal must be repaid to avoid default.

Factoring: In this method of debt financing, one company buys a debt or invoice from another company at a discount. Accounts receivable are discounted in this purchase to enable the buyer to profit from the debt settlement. In essence, factoring transfers account ownership to a different party, which then collects the loan.

Peer-peer lending: Peer-to-peer (P2P) lending allows people to lend or borrow money directly from other people without going to the bank or any other financial institution. P2P lending often offers higher interest rates than conventional savings accounts do. Therefore there is a higher risk in this type of debt.

Advantages of Debt Financing

- When you choose debt financing, you don’t give control to others. Therefore, you are the only one who makes all the decisions for your business.

- In this type of financing, lenders do not claim for profit in the future other than the interest rate.

- You know the exact principal and interest payments you must make each month. This makes creating a budget and financial plans simpler.

Disadvantages of Debt Financing

- You have to repay the debt with an interest rate.

- You must repay a high-interest rate each month, which cuts your profit.

- It can be challenging to qualify for debt, depending on financial status and credit score.

- If you agree to give the lender collateral, you might risk certain business assets.

- If your company isn’t entirely on safe ground, debt financing can be a dangerous alternative.

Equity Financing

Equity Financing is raising fresh capital by selling company shares to public investors. For example, you own a restaurant and want to expand, so you go to your bank for a loan. They say no because they don’t like the idea of lending money for an expansion. So instead, they suggest that you sell some shares in your company and use that money instead. This is equity financing. It’s called equity financing because it gives investors partial ownership of the company in exchange for their investment—and it’s considered one of the most common types of financing available today, both for small businesses and large corporations

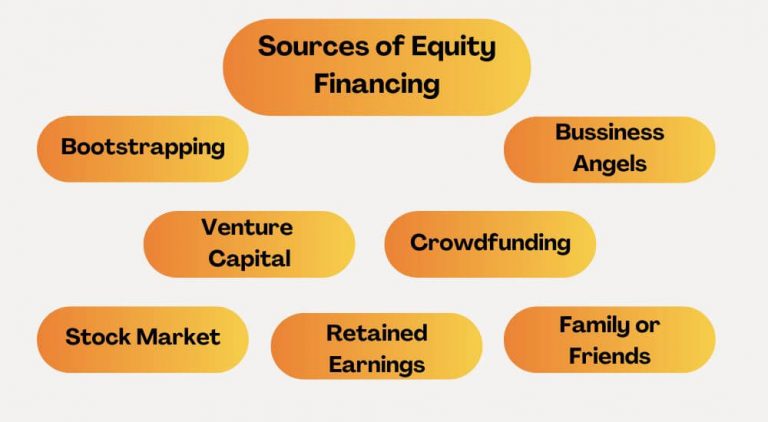

Sources of Equity Financing

The various sources of equity financing include;

Bootstrapping: Bootstrapping is a word used in business to describe the process of starting and growing a firm utilizing solely available resources, such as personal funds, personal computing equipment, and garage space. It is the process of creating a business without taking out large loans or accepting investor funding.

Venture capital: A corporation can acquire long-term finance in exchange for a portion of its stock through venture capital (VC) funding, a type of private equity investment. Most start-ups or new companies with significant growth potential seek VC capital.

Business angels: Wealthy people known as “business angels” (BAs) make investments in high-growth companies in exchange for a portion of the company. Many actively participate in the businesses they finance by offering guidance and mentorship to the management.

Crowdfunding: Crowdfunding is when many individuals lend, invest, or make tiny financial contributions to your company or idea. Together, these funds will enable you to meet your financial target. Typically, those that support your proposal will also benefit financially or with benefits.

The stock market: Joining a public market, sometimes known as the stock market, is another way to raise equity financing. Companies can access funding for growth and raise money for additional development with the aid of a stock market listing.

Retained earnings: The amount of profit a business keeps after paying all of its expenses and dividend is known as retained profits. Business can invest their retained earnings in their business instead of taking loans from others or sharing their equity.

Family or friends: A simple option to obtain capital is frequently to offer a partnership or a piece of your company to family or friends in exchange for stock. To ensure that your choice won’t harm your relationship, thoroughly evaluate your options.

Advantages of Equity Financing

- There is no loan to repay with equity financing. Although you will eventually owe your investors a percentage of your future income, you don’t need to pay them interest.

- If a business fails, investors’ money is not required to be returned.

- With equity financing, you could create unofficial alliances with people with more skill or experience. Therefore you can learn a lot of business growth ideas from them.

Disadvantages of Equity Financing

- Giving up some control over your business or its assets is a need for equity financing, which allows you to raise money from investors who desire interest on their investment as well as a return on their investment.

- A set amount of future corporate income must also be distributed to shareholders as dividends if the business is profitable and successful.

- Getting a loan can be easier than attracting investors.

- When raising money, legal and regulatory requirements may be followed, such as when promoting investments.

- If there are variations in vision, management style, and business operations, sharing ownership and working with others may cause stress or conflict.

Difference between Debt Financing and Equity Financing

Debt Financing Vs. Equity Financing | |

Debt Financing | Equity Financing |

Business borrows money from outside sources and lenders | The business sells stock to outside investors. |

You need to repay debt with interest on it. | Owe investors a percentage of the future income. |

Don’t give control to others | Provide some control to investors |

Only the owner of a business will make all the decisions of the company | Need to involve investors in decision making |

It is easier to get a loan | It isn’t easy to attract investors |

Less flexible | Comparatively more flexible |

Less expensive as you don’t have to pay the lender once you pay the debt and interest | More expensive because you have to pay some percentage to investor until he takes their share back |

Which Method is Better? Debt financing or Equity financing?

Debt financing and equity financing both have their pros and cons. However, debt financing is better than equity financing for some businesses because giving equity means you are giving them control of your business to investors while in debt financing you don’t give your business control to others, also you can get rid of lenders after an agreed period of time.

Although both methods are useful for businesses, analyzing a business’s financial status is essential. The choice between equity and debt funding ultimately depends on your business type. Investigate your industry’s standards and what your rivals are doing. Look into various financial solutions to see which ones best meet your needs.

Conclusion

When a small business needs to raise capital, it has many options, including debt financing and equity financing. Debt financing allows a company to use borrowed money to grow without giving up any company ownership. This may be advantageous if your company is unable or unwilling to issue shares of stock. Equity financing is a way of financing method that involves selling shares in your company to investors who provide capital in return for partial ownership. While this method gives up ownership, it can allow you more flexibility with how you operate your business because you don’t have creditors breathing down your neck.

Content writer at Invyce.com

Related Post

Copyright © 2024 – Powered by uConnect

Meena Khan