09 Nov

Are you wondering what equity dilution is? Do you want to know how it happens and how to avoid it? Well, this blog will guide you through each of these topics and more. We will take you through what equity dilution is, the reasons and consequences of dilution, and some ways to avoid it.

What Is Equity Dilution?

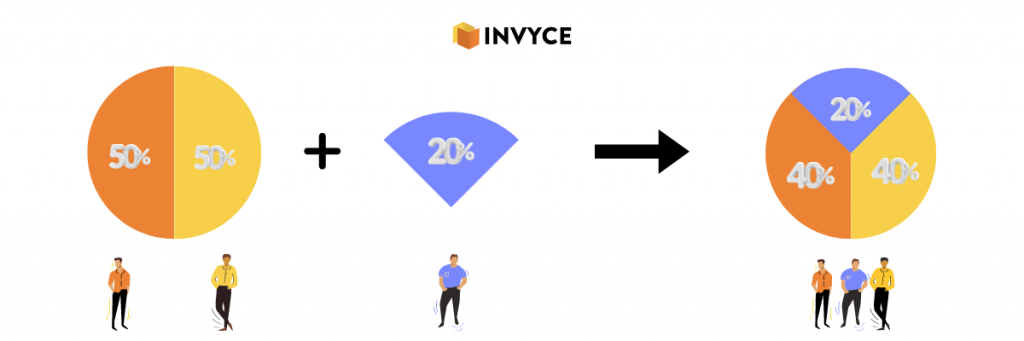

When a company needs to raise more share capital, they issue more shares to investors. Due to an increase in new shares, the value or the percentage of existing shares decreases. Equity dilution is the decrease or cut down in stock holdings of existing shareholders due to the addition of new investors. This happens when the number of shares goes up but the profit earned remains the same, due to which earnings per common share go down.

For example, company ABC has two founders. Each founder holds a 50% share in the company. The company wants to increase equipment, for which they need more capital. To raise capital, they decided to issue new shares. The value of the new share will be 20%. When a new investor buys the share, the value of existing shares will decrease to 40% each. This decrease in the share’s value from 50% to 40% due to adding a new share of 20% is equity dilution.

Why Do Companies Issue Additional Shares?

- The companies issue shares to raise capital. There are several reasons why companies want to raise their capital. Some companies may need capital to expand their business, while others may need capital to buy new equipment.

- Startups and new companies always need capital to run their operations. The first option these startups have is to issue shares. These new shares dilute the ownership of the existing founders.

- When a business is unprofitable and has debts to pay off, it issues new shares. This way, the company gets capital and can pay off its debts. But at the same time, it causes equity dilution.

- Some companies provide stock-based compensation to their employees, in which the company provides shares to their employees. When a company has the policy to issue shares to employees fulfilling certain conditions, they need to issue new shares for them and thus reduce the value of existing shares.

Consequences 0f Equity Dilution

Equity dilutions have both positive and negative consequences. Therefore, before issuing more shares, a company should estimate positive and negative consequences.

Positive Consequences

- There is a higher probability for a company to become successful by wisely using share capital than by having low funding in lack of share capital.

- As shareholders become part of a company, they will be personally involved in the growth and expansion of the company.

Negative Consequences

- The company’s founders lost a certain percentage of ownership and control in their business. In addition, the voting right and decision-making power of founders also decreases.

- The founders and other shareholders will receive less profit, which may decrease their interest in the company.

How To Avoid Equity Dilution

Don’t raise more money than you need: Raising additional money frequently feels like a sign of achievement and the secret to growth, especially at the company’s early stage. However, it’s crucial to consider how much cash you will need to invest in your company at different stages of its development. So do your best to estimate how much money you will need to raise to advance your firm before going out to raise money.

Keep an eye on the capitalization table: A capitalization table is a table that displays the total number of shares outstanding along with each shareholder’s ownership stake in a company. It is a very helpful tool for controlling your ownership of a developing business. A capitalization table can be used to simulate how different funding options will affect the ownership stake of current shareholders and profit per share.

Don’t create a bigger pool of employees: If you recruit more than you need, your ownership will dilute more. To avoid this, develop a recruiting strategy to determine your ideal pool size. This strategy could also be useful in negotiations with investors.

Conclusion

To summarize the lesson, equity dilution occurs when the value of your ownership share decreases. This can happen when your company raises funds, sells new shares, or issues options to new employees. It may be necessary if you need to dilute your ownership to raise money. Still, you will want to slowly and carefully apply a dilution to avoid real damage to your company’s or your personal equity.

Related Post

Copyright © 2024 – Powered by uConnect