25 Mar

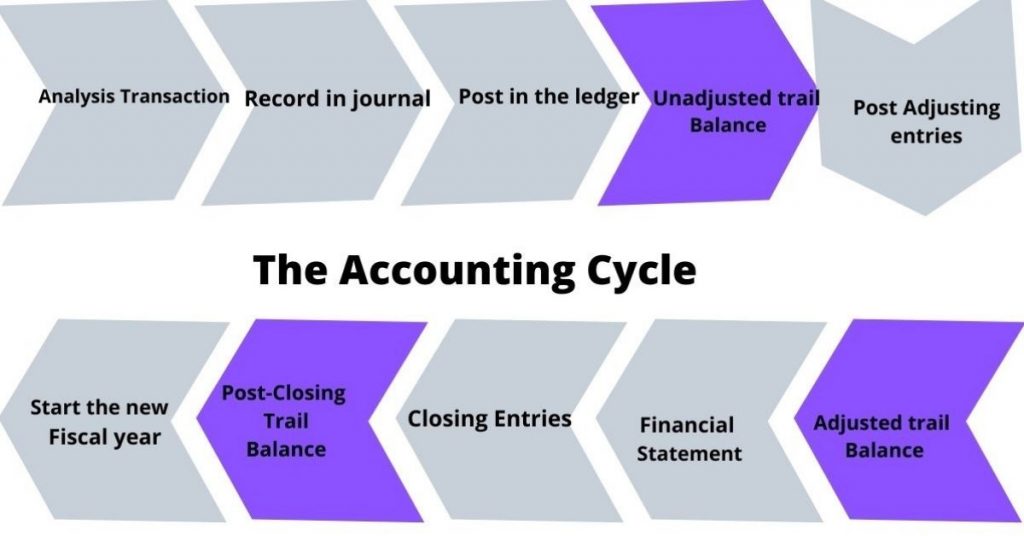

The post-closing trial balance is the ninth (and last) step of the accounting cycle. It can be prepared before the new accounting period begins and helps to prepare your general ledger for the new accounting period. The primary purpose of the post-closing trial balance is to ensure equality between the debit and credit to result in a net of zero. In addition, to ensure no more temporary or nominal accounts(revenue, expenses, withdrawal) exist before the books forward to the next year. So, this article unveils information about post-closing trial balance, types, format, examples, and the importance of preparing a post-closing trial balance.

Table of content

- What is the post-closing trial balance?

- Types of trial balance

- Post-closing trial balance format and explanation

- Examples of the post-closing trial balance

- Why is it important to prepare a post-closing trial balance?

- Conclusion

What is the post-closing trial balance?

A post-closing trial balance is a list of balance sheet accounts with net-zero balances at the end of the reporting period. A net-zero indicates that all temporary accounts are closed with zero beginning balance so the next accounting period can begin.

Moreover, the accountants make sure the equality between debit and credit. Hence, they can record the additional transactions for the next period. As mentioned above, no more temporary account exists.

Types of trial balance

There are three primary types of trial balance in the accounting cycle: each type comes in different accounting cycle steps.

- Unadjusted trial balance

- Adjusted trial balance

- Post-closing trial balance

Unadjusted trial balance

The unadjusted trial balance is the first draft of the trial balance after the balances are posted in the ledger to prepare a financial statement. The purpose is to test the debit and credit accuracy after the recording phase.

Adjusted trial balance.

The preparing adjusted trial balance comes after recording and post-adjusting entries. The main purpose is to test equality between debit and credit after preparing the adjusting entries.

Post-closing trial balance.

The last and final type is the post-closing trial balance. It comes after record and post-closing entries. The purpose is to check debit and credit equality after recording and posting closing entries.

Post-closing trial balance format and explanation

A post-closing trial balance format is similar to the other trial balances in the accounting cycle. It consists of three columns: Account name, credit, and debit.

In both adjusted and unadjusted trial balances, the total of both credit and debit is calculated at the bottom of the trial balance, and they should be equal. If they aren’t equal, there may be two reasons. First, the trial balance was incorrectly prepared and didn’t accurately transfer closing entries to the ledger account. Second, there may be a mistake while creating closing journal entries.

Examples of post-closing trial balance

After adjusting entries, you can prepare closing entries to complete the post-closing trial balance. Closing temporary accounts is a crucial step in the accounting cycle that helps to make sure the post-closing trial balance has been completed accurately. Three general closing entries must be made.

Close all revenue and gain accounts

All expenses and loss account

All dividends / withdrawal accounts

| SPARE PART COMPANY Closing entries March 15, 2022 |

| Date | Accounts | Debit | Credit |

| 15-03-2022 | Revenue | 25,000 | |

| Income summary | 25,000 | ||

| 15-03-2022 | Income summary | 11,500 | |

| Rent expenses | 1000 | ||

| Wages | 10,000 | ||

| Interest expenses | 500 | ||

In closing entries, your income and expenses have been posted to your income summary account. After closing entries, the post-closing trial balance is prepared as given below.

| SPARE PART COMPANY Post-Closing Trial Balance March 15, 2022 |

| Accounts | Debit | Credit |

| Cash | $30,000 | |

| Account Receivable | $50,000 | |

| Inventory | $35,000 | |

| Accrued revenue | 63000 | |

| Account Payable | $35,000 | |

| Long term liability | $71,000 | |

| Equity Share | $10,000 | |

| Dividend Paid | $5,500 | |

| Revenue | $25,000 | |

| Spare part company capital | 31500 | |

| Total | &178000 | &178000 |

As discussed above, the temporary and nominal accounts are absorbed by the capital account(Spare Part Company, Capital).

The total balances of the total debit and credit should be equal for continuing the new accounting period with zero net balance.

Why is it important to prepare a post-closing trial balance?

It is necessary to prepare a post-closing trial balance to show the final balance of the company account to continue for the next year.

It helps to prepare your general ledger for the new accounting period and closes out balances in both expenses and revenue accounts.

Conclusion

The above write-up provides complete information about preparing a post-closing trial balance. Apart from that, you will get detailed information about different types of trial balances.

Shabana has been a committed content writer and strategist for over a 5 years. With a focus on SaaS products, she excels in crafting compelling and informative content.

Related Post

Copyright © 2024 – Powered by uConnect

Shabana