04 Jul

After reading an article about methods of raising funds i.e debt and equity financing, john found two methods (shares and debentures) that he wants to consider to raise the money for his startup. This article will help john to find out the differences between shares and debentures. After reading this article, he can choose the best financing method for his business.

Table of Contents

What is a Share?

A share is a financial instrument. It gives the holder the right to hold company equity and profit from dividends if any are paid. In addition, it acts as a tradable asset that can be bought or sold on exchanges such as the stock market.

It is a type of security that offers ownership or partial ownership of a company. You can buy them through an online broker or in person at a stock exchange. Like bonds, shares have an initial price called the “issue price,”. Which is determined by the issuing company and set high enough to cover its costs (such as printing and mailing prospectuses) and make it attractive to investors.

Shares represent ownership in a company. As such, they entitle you to vote on decisions affecting the business (such as appointing directors). They also allow you to receive any profits passed down by directorship—this is called “dividends,” and it’s how shareholders make money!

What is a Debentures?

A debenture is a long-term loan to the company, like a bond. The main difference between debentures and shares is that investors don’t own ownership in the company when they buy a debenture. Instead of receiving interest payments in cash, companies issue fixed-rate coupons (usually quarterly) to the holders of their debt instruments called “debentures.”

Debentures are not traded on public exchanges like stocks but sold directly by companies to investors through private placements, syndicates, or other arrangements. They do not confer ownership rights such as voting rights and dividends, though some types of debenture may be convertible into common stock at some point in time after issuance if certain conditions are met.

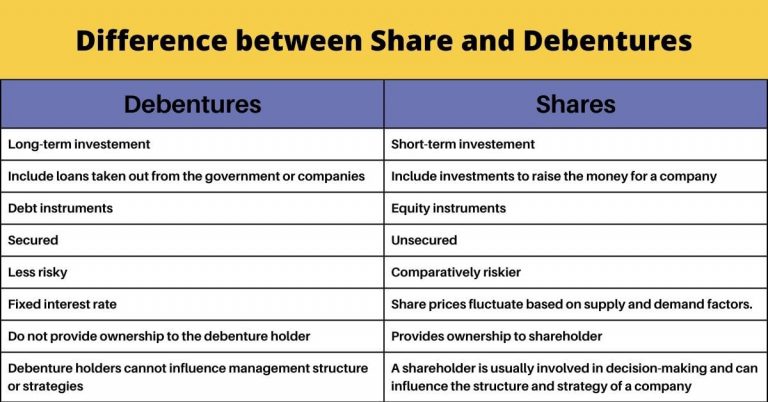

Differences between Shares and Debentures

Ownership: The main difference between shares and debentures is that shares give ownership of the company to its holders, whereas debentures do not.

Type of financing: Shares are equity instruments, whereas debentures are debt instruments.

Voting rights: Debenture holders usually have no voting rights in the company and cannot influence its management structure or strategies. In some cases, however, debenture holders can receive dividends from the issuer (usually at an agreed-upon rate). Conversely, the shareholders have a voting right and are involved in a company’s decision-making.

Form of return: Interests are usually paid on debentures regardless of the profit or loss of the company. While in the case of shares, dividends are paid to shareholders only if a company makes a profit.

Conversion: Debentures are divisible in that they can be converted into equity shares of the issue companies later, while shares cannot be converted into debentures.

Type of investment: A debenture is a long-term investment, while shares are more like a short-term investment.

Risk level: Debentures are generally less risky than stocks since they’re backed by collateral (the assets owned by the company) compared to shares and can be converted into common stock if needed.

Reporting requirements: There’s less regulatory oversight on debentures because they don’t trade publicly on exchanges as shares do; therefore, there’s no need for constant reporting requirements or audits required by law (although some are still done voluntarily).

To sum up, the following are the differences between Shares and Debentures.

Key Takeaways

- Shares and debentures are two different securities with characteristics that give the investor more choice and flexibility.

- Debentures are certificates of debt representing an amount borrowed by a corporation/company or other entity. They have a fixed rate of interest, and payments made to purchase debentures are considered interest payments, not dividends. Debentures have fixed maturity and, once issued, cannot be redeemed. Debentures are divisible in the sense that they can be converted into equity shares of the issue companies at a later date.

- A share is a class of ownership in the business of the corporation. It confers ownership rights to the shareholder, including voting rights and a residual claim on assets in the event of liquidation. On the other hand, a debenture is a loan instrument. The holder of a debenture gets interest payments until redemption or maturity, but unlike shareholders, they have no ownership stake in the company itself.

Content writer at Invyce.com

Related Post

Copyright © 2024 – Powered by uConnect

Meena Khan