07 Mar

The debit and credit are two of the most crucial accounting terms you need to understand. This is particularly important for accountants and bookkeepers using double-entry accounting.

Debit and credit are the true backbones of accounting. Therefore, any transaction recorded in a ledger, whether hand-written or in your accounting software, needs debit and credit entries.

Moreover, debit and credit are used to monitor incoming and outgoing money in your business account. A debit is a money coming into business, whereas a credit is money going out from business. However, most businesses use a double-entry system for accounting.

Table of Contents

What are debit and credit?

Debit

A debit is an accounting entry that increases an assets or expenses account or decreases a liability,income or equity account. Its position to the left in an accounting entry.

Credit

A credit is an accounting entry that increases a liability,income or equity account or decreases an asset or expense account. Therefore, it is positioned to the right in an accounting entry.

Why are Debit and Credit important?

Debit and credit are the foundation of double entry system which says that for every debit entry there should be a credit entry of same amount otherwise the books maintained will not be accurate,efficient and reliable. Therefore, it is vital to balance each transaction in double-entry accounting to have a clear and accurate general ledger, financial statement and to look into the financial health of your business.

Examples of Debit and Credit

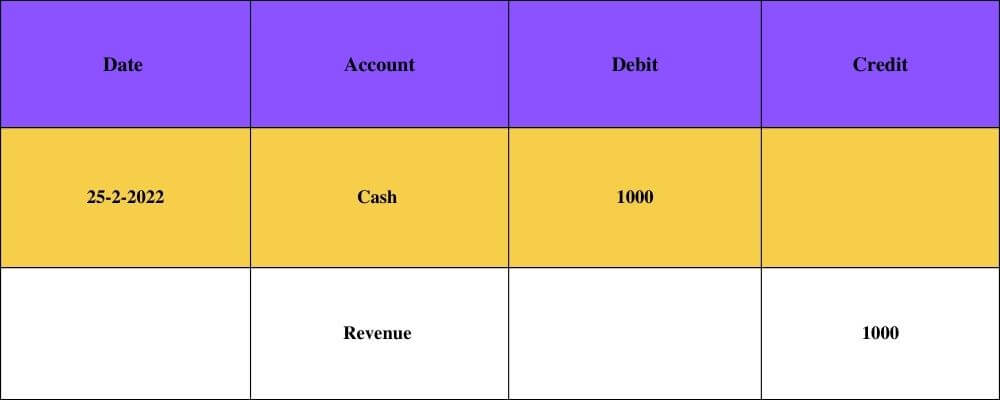

Afaq corporation sells goods to a customer for $1,000 in cash. This resulted in sales revenue of $1,000 and cash of $1,000.Afaq must record an increase of the cash asset account with a debit entry and an increase of revenue account with credit entry, the journal entry will be

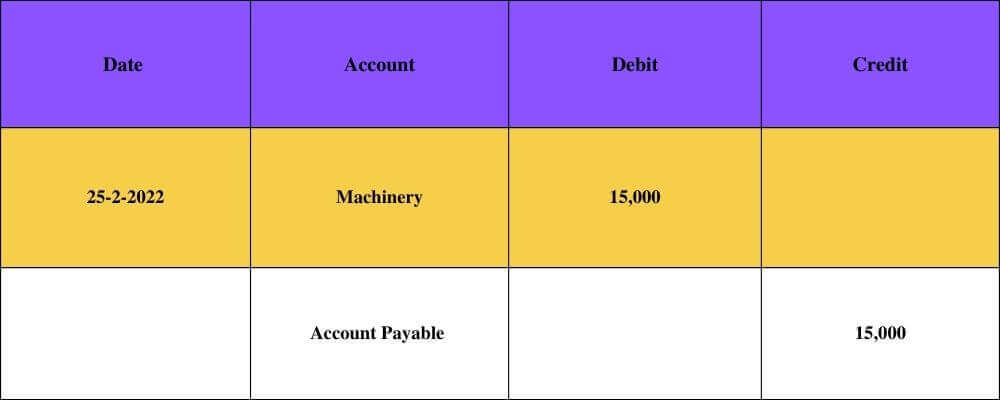

Afaq Corporation also buys a machine for $15000 on credit. This result in addition to the machinery, a fix asset account with a debit and increase in the account payable, a liability account with credit, the entry will be

Difference between Debit and Credit

To understand the difference between debit and credit, you must know about two sides of accounts (debit and credit) will always be affected in every accounting transaction. The transactions recorded in debit and credit for each transaction must be of the same amount as the other. So that you have to balance the transaction. If the transaction is not in balance, it will affect the financial statement.

That’s way, debit and credit in a two-column recording format is essential. Some points explain the difference between the two, namely,

| Debit is the left side of the general ledger account | Credit is the right side of the general ledger account |

|---|---|

| The debit account will record all the recipient accounts | The credit account is for the giver |

| Debit is used to record increase in asset and expense accounts and decrease in liability, equity and income accounts. | Credit is used to record decreases in asset and expense accounts and increase in liability, equity and income accounts. |

| In general journal account with a debit balance is recorded first | Account with a credit balance is recorded by the following word “TO”. |

| Some major examples of the increase in debit is due to an increase in cash, inventory, equipment, machinery, building, land, insurance | An increase in shareholder funds, retained earnings, sales, liability, and other causes an increase in credit. |

Accounts Impacted by credit and debit

Generally, debit happens when things are added to accounts. Credit happens when items are subtracted. Seems pretty simple right?

The crafty part in understanding these two categorizations is that both debit and credit have different impacts across different types of accounts.

For example, what happens if you debit an account showing how much you owe someone instead? Is it same as debiting an account that shows how much you were just paid?

The typical accounts in question are:

- Assets Account

- Expense Accounts

- Liability Accounts

- Equity Accounts

- Income Accounts

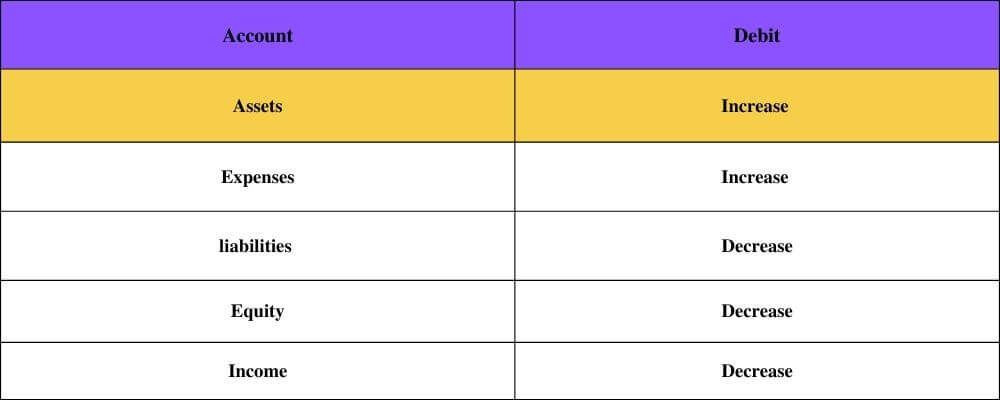

Rules of debit by Accounts

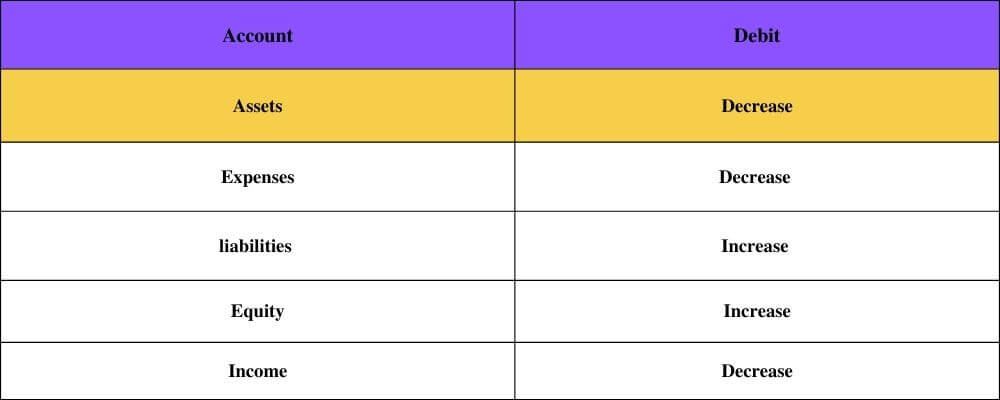

The debit rule says that all accounts of assets and expenses containing a debit balance will increase when debited and reduce when credited. However, when account balances of liability, equity and income decrease we use debit to show reduce in their balance and increases when credited. So here when it’s debited, what happens in each account type.

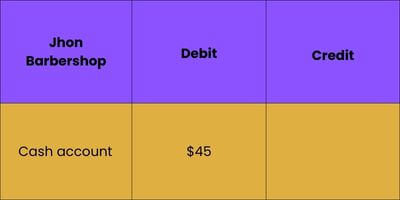

We can look at John’s barbershop to understand a type of transaction that would be labeled on the debit side of an account. For example, John sells hair shampoo to a customer for $45 and receive payment in cash.

Looking at the above chart , we can tell that asset ( cash ) will increase by debiting. you would record this $45 as increase of money with a debit in the asset account of John’s books

Here is what debiting that account looks like.

Rules of Credit by Account

Opposite to debit, the credit rule” says that that all accounts of equity, liability and income that normally contain a credit balance will increase in amount when credit is added to them and reduce when a debit is added to them. However when balances of asset and expense accounts reduce we use credit to show reduction in assets and expenses. The chart below can help visualize how credit will affect the account.

Remember when John’s barbershop sold some hair shampoo for $45 cash?

We know that there is always an equal amount of credit entry to a debit entry, and also know that we must credit an account in order to balance out the transaction.

The sale of the hair shampoo would also be labeled as income for the John Barbershop, to show income of $ 45 we will use a sales account.

Here’s what that looks like, alongside our debit. Debits are always listed first on the left side of the table, while credits are listed on the right.

By recording transaction on both sides of journal the debit is is now equal to credit. As a result, the transaction will be balanced and will be reflected properly on the financial statement.

Bottom Line

Debit and credit are two equal but opposite entries in your books and also two backbones of accounting. .If a debit increases in an account, you will decrease the opposite account with a credit.

A debit is an entry made on the left side of an account. It either increases an asset or expenses account or decreases equity, liability, or revenue accounts.

Marjina Muskaan has over 5+ years of experience writing about finance, accounting, and enterprise topics. She was previously a senior writer at Invyce.com, where she created engaging and informative content that made complex financial concepts easy to understand.

Related Post

Copyright © 2024 – Powered by uConnect

Marjina Muskaan