03 Aug

A financial instrument known as security is any financial asset that can be traded. Securities are classified as marketable and non-marketable securities. This article will teach you about non-marketable securities, their features, examples, advantages, and disadvantages.

Table of Contents

What are Non-Marketable Securities?

Non-marketable securities are debt or equity securities that are not actively traded in the secondary market. Instead, the government issues these securities, and you can only buy them through a private transaction or at the over-the-counter (OTC) market. Therefore, it is difficult to sell and buy these securities.

Features of Non-Marketable Securities

Illiquid: Non-marketable securities are not traded on the stock market, and therefore they do not have a public market for buyers. These types of securities are also known as illiquid or non-tradable assets.

Transferability: These security holders cannot sell securities to other individuals until maturity. However, some securities can be transferred and used as gifts.

Difficult to sell: The lack of liquidity in these types of investments can make them difficult to sell quickly; this makes it difficult for investors to cash in their investment if they need money quickly.

Unlisted securities: They are sometimes referred to as “unlisted” securities because they trade under different rules than listed stocks (stocks that trade on an exchange).

High return: These securities are usually issued at a discount rate less than face value but are redeemable at face value at maturity. Hence you get a higher return with low risk.

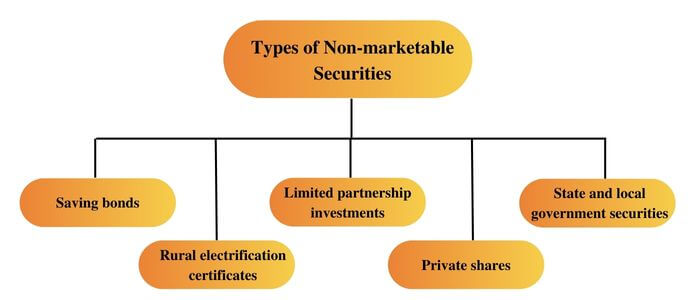

Examples of Non-Marketable Securities

Following are examples of non-marketable securities.

Saving bonds: These are long-term securities. Government savings bonds may only be redeemed by the individual whose name appears on the security documents pertaining to the initial purchase.

Private shares: Due to the fact that private shares are not traded publicly on stock exchanges, they are also regarded as non-marketable securities.

State and local government securities: These include a certificate of obligation and notes purchased on the Treasury Market with maturities ranging from 15 to 40 years. Daily interest is accumulated on these securities.

Rural electrification certificates: these are included in non-marketable securities because they are difficult to resell.

Limited partnership investments: These are private investment securities and are also difficult to resell in the secondary market.

Others include federal government series bonds, Bank and Post Office Accounts, etc.

Advantages

- In comparison to marketable securities, the return is typically higher.

- The rate of return is guaranteed; therefore, they have minimal risk.

- They can be purchased for other people and used as gifts.

- These securities are considered the safest investment because they cannot be sold or bought easily.

- Market fluctuations do not influence these securities since they are not traded in the secondary market.

Disadvantages

- They are highly illiquid and cannot be converted into cash when required.

- They have a longer maturity period as compared to marketable securities. Therefore, the investors have to wait until maturity is held.

- Although the return is assured on these investments, there is also a chance of loss. They don’t guarantee higher returns if the market performs well as marketable securities do.

Marketable Securities Vs. Non-Marketable Securities

| Marketable securities | Non-marketable securities |

|---|---|

| These are easily tradeable in the secondary market | These securities are not tradeable in the secondary market |

| They have both market value and book value | They do not have market value |

| They carry high risk because market fluctuations influence | They carry low risk because market fluctuations do not influence them |

| Purchase rate depends on the type of security | Security holders purchase these securities at a discount rate |

| Highly liquid | Highly illiquid |

| Rate of return can fluctuate | High rate of return is guaranteed |

| Examples include; Stocks, Treasury bonds, Exchange-traded funds, Derivatives, etc. | Examples include; saving bonds, rural electrified certificates, private shares, etc. |

Conclusion

The non-marketable securities are a type of investment that can be very useful in your portfolio. They are not as risky as stocks or bonds but carry some risk. Therefore, it is essential to understand what type of security you buy to know how much risk is involved with investing in one.

Content writer at Invyce.com

Related Post

Copyright © 2024 – Powered by uConnect

Meena Khan