07 Dec

If your bookkeeper provides you with monthly financial statements or if you regularly schedule quarterly or mid-year reviews with your accountant, you are using interim financial reports. These financial statements provide you with information about your company’s current performance rather than its annual performance. The purpose of interim financials is to provide a snapshot of your current financial status while you are still in the process of completing an audit.

Interim Financial Statements

As part of their annual reporting, most companies prepare annual financial statements. Investors and other stakeholders receive these financial statements as an overview of the company’s performance year-over-year. In contrast, the interim financial statements cover a period of less than one year. These statements are usually prepared quarterly, but they can also be prepared monthly or even every six months. In interim financial statements, the company’s operations and financial position are updated for management, investors, and other users. They are likely to be unaudited, more condensed, and more detailed.

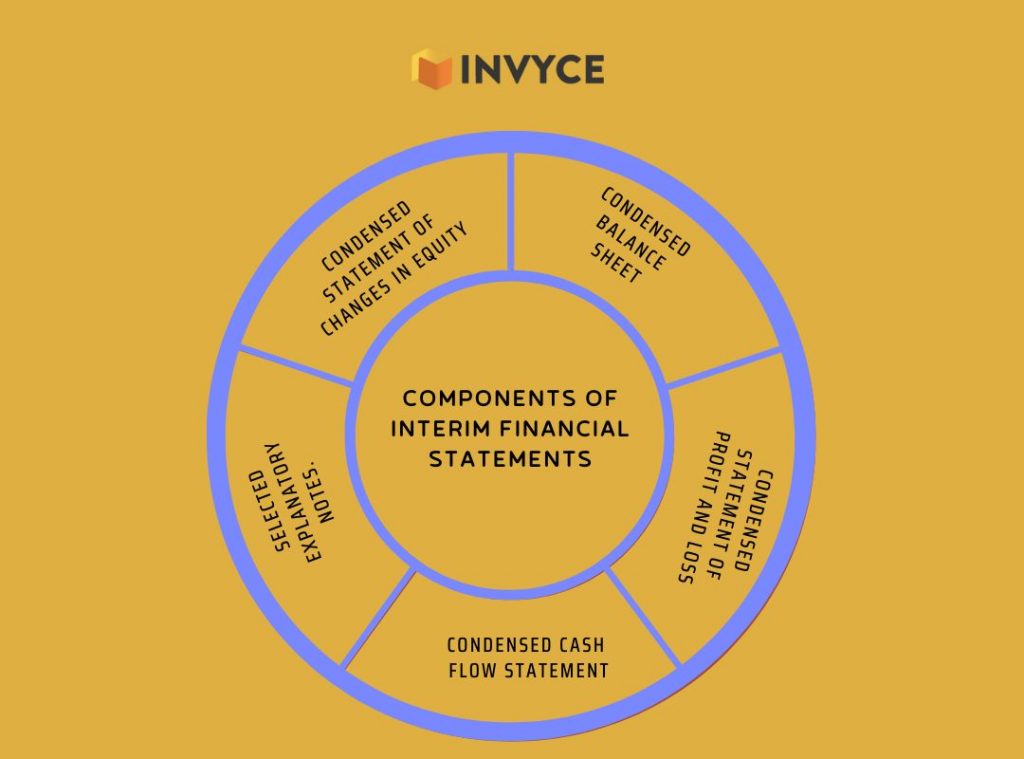

Components of Interim Financial Statements

Interim financial statements include the same basic reports as annual financial statements but there are a few key differences between what’s included in interim reports and what’s included in annual financial statements.

An interim financial report should include following components:

(a) condensed balance sheet

(b) Condensed statement of changes in equity

(c) condensed statement of profit and loss

(d) condensed cash flow statement

(e) selected explanatory notes.

Benefits

Prevent future troubles: The interim accounts aid in performance analysis and, detecting troubles. You would have adequate time to plan your strategies and recover from losses or financial troubles since these statements are filed before the conclusion of a fiscal year. These Reports might therefore prevent you from experiencing financial problems in the future.

Helps to get loans easily: The benefit of submitting an interim report is that it can help you get bank loans more easily. Your bank may ask you for a company’s most recent financial report as previous fiscal year reports have long since ended. in this case you can use an interim report to show that you have no debts or if have debts your business has sound creditworthiness and your business is viable enough to repay the loan. This statement will present a favorable picture of your business to the bank.

Persuade clients easily: Before finalizing a purchase, clients frequently want a thorough analysis of your company’s financial performance. A yearly report can struggle to persuade them if the prior year was a long time ago. You can use interim financial statements in this case. Your chances of closing the business will increase and your client will be impressed by these new details.

Future Planning: You will have the chance to correct any mistakes and improve areas where you could have done better with a summary of your company’s financial situation to this point. As a result, you will be able to more precisely plan your future.

Interim Financial Statements vs. Annual Financial Statements

The main differences between annual financial statements and interim financial statements can be found in the areas noted below;

Accounting basis

In interim reporting periods, the basis on which accrued expenses are made can be differ from annual financial statements. For instance, the recognition of an expense may occur over a number of months or may occur altogether during a single reporting period.

Seasonality

Seasonality may have a substantial impact on a company’s revenues. Interim financial statements may indicate periods of considerable losses and gains that are not apparent in the annual financial accounts.

Disclosure

Some businesses, particularly those that are publicly traded, are required to include disclosures in their yearly financial statements. Disclosures are made with complete transparency. As transparency is not necessary in interim statements, they don’t require disclosure.

Conclusion

The interim financial statement is a short-term assessment of a company’s assets, liabilities, and equity. As the name suggests, it’s intended to be used in situations where the normal accounting period has not yet started. The interim financial statement is prepared during a time when a company cannot take all the time it needs to prepare its annual financial report but still wants to improve its cash position and make sure they have enough money to continue producing useful services.

Related Post

Copyright © 2024 – Powered by uConnect