09 Mar

Recording transactions in the general journal is an essential step of the accounting cycle. it comes after analysing the transaction. In simple words, recording is the second step of the accounting cycle, where all financial transactions are recorded in systematic and chronological order. The purpose of recording transactions in the general journal is to keep business finance well organized and accurate.

So, this article covers the basic procedures involved in recording transactions in the journal. Upon completing this article, you will understand journalizing and how to record various business transactions.

What is a journalizing/ general journal?

Journalizing is the process of recording transactions in an accounting general. The general is the book where the entity records all the financial transactions, and these transactions are recorded in chronological order. This activity applies to the double-entry book system.

A double-entry book is a bookkeeping method in which an entry is recorded in at least two accounts affecting debit and credit accounts. The amounts recorded as debit must equal the amount recorded as a credit.

Other names used for jourmalization are “ General journal,” “journal book,” and “book of original entry.

Types of journalizing transactions

The journalizing transaction is divided into two main categories: general and special. The general journal is the most common type of journalizing and keeps a record of all business transactions. However, this type of record isn’t for large companies, and they need separate special journals to record specific transactions daily.

Some of the common types of special journals are as follow:

- Purchase journal-This journal includes all the purchases you make for your business. For example,if you purchase software for your office, you will record it here.

- Sales journal-This journal is related to recording credit sales bu debiting accounts receivable and crediting related revenue account.

- Cash payment journal- It records all transactions related to cash outflow from business. Foe example if you paid for a hotel hall for a business meeting using cash, you would record it here.

- Cash receipt journal- It includes all transactions related to the cash flowing into the business. If you receive a cash payment from the client, you will record it here.

- Account receivable journal- It includes all the receivables of your business

- Account payable journal-it includes all the payable of your business.

Steps of journalizing

To journalize your transaction, you have to follow four simple steps:

Classify business transactions by account

The first step states that there will be two types of accounts involved in each transaction, the debit and credit accounts.

Determine the account type involved

The different accounts involved in journal entry include assets, liabilities, expenses, revenue, and capital. Therefore, it is essential to identify the correct account types when using double-entry bookkeeping.

Apply the fundamental accounting equation to the transaction

In this step, your financial transaction must always be balanced, the sum of credit always equal to the sum of debit. So don’t forget to ensure that you credit the corresponding accounts every time you debit one account.

Journalize the transactions

To complete the journalizing process, add the date of the transaction, brief description, and reference number of the financial events you are recording.

Examples of journalizing

Some of the most common types of journalizing with examples are as follow

Journal entry for purchasing goods

When you purchase goods of $2000 from vendors on credit, inventory increases and gets debited and the account payable also increases and is credited

Journal entry for receiving an invoice payment

When a client pays $2500 for a sale invoice. Cash is debited and accounts receivable are credited.

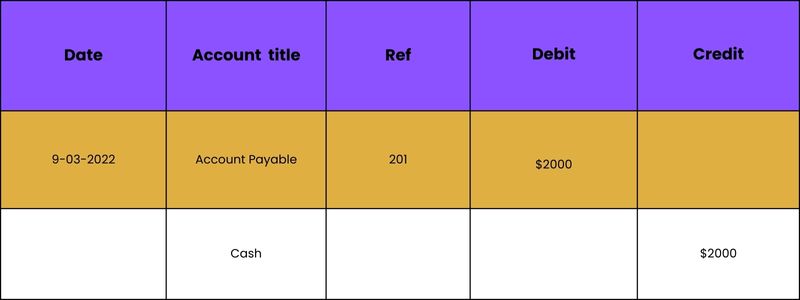

Journal entry for making payment of bill

In journalizing of account payment, cash will be credited and account payable Will be debited to show a decrease in liability and cash.

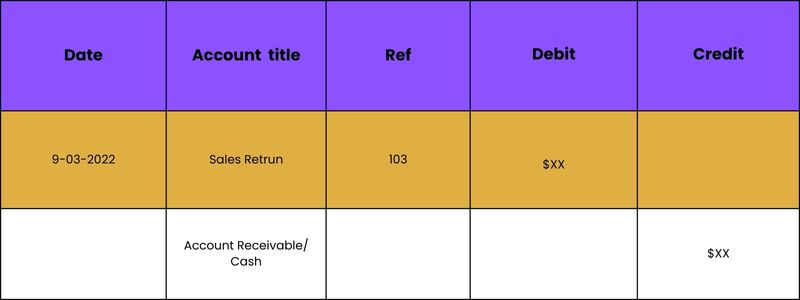

Journal entry for sales return

In the journal entry for sales return you directly debit sale return and credit account receivable or the cash if the client paid for the sale.

The double-entry system of recording transaction

A double-entry system is a method of recording business transactions. According to this system the amount must be recorded minimum in two accounts, and the amount entered as credit must be equal to the amount entered as a debit.

So, this system works on the basic accounting equation and keeps the accounting equation in balance.

Final thoughts

I hope this article will help you in understanding the journalizing transaction process and why it is important in financial transactions.

Thus, I have covered some important points and hope they will help you in recording transactions in a journal and keeping your business finance accurate and well organized.

Shabana has been a committed content writer and strategist for over a 5 years. With a focus on SaaS products, she excels in crafting compelling and informative content.

Related Post

Copyright © 2024 – Powered by uConnect

Shabana