30 Dec

When jane reviewed her investment portfolio, she felt a sense of excitement. She had made some smart choices over the past year and was eager to see how they had paid off. But as she looked at the numbers, she realized that she had no idea what they meant. She had heard of annual return before but wasn’t sure exactly what it was or how to calculate it. If you are feeling the same and want to know more about annual return and how to calculate it, keep reading!

What is Annual Return?

Annual return is a measure of how much investment changes over the course of a year. It is an important measure of the performance of an investment, as it gives you an idea of how much your money has grown or declined over the course of a year. If you made more than the amount invested, your annual return would be positive. On the other hand, if you made a profit less than the investment, the value will be negative. However, it is important to keep in mind that yearly earnings is just one factor to consider when evaluating an investment and that past performance is not necessarily indicative of future results.

Annual Return Formula

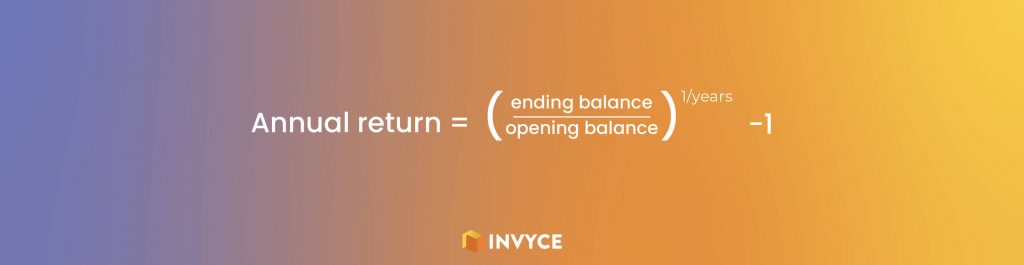

To calculate the annual return on your investment, you can use the following formula:

Where,

- Ending value means the value of the investment at the end of the period for which return is calculated.

- Beginning value means the value of the investment at the beginning of the period.

- Years mean the number of years for which an investment is held.

To express the result as a percentage, multiply the value by 100.

Calculations

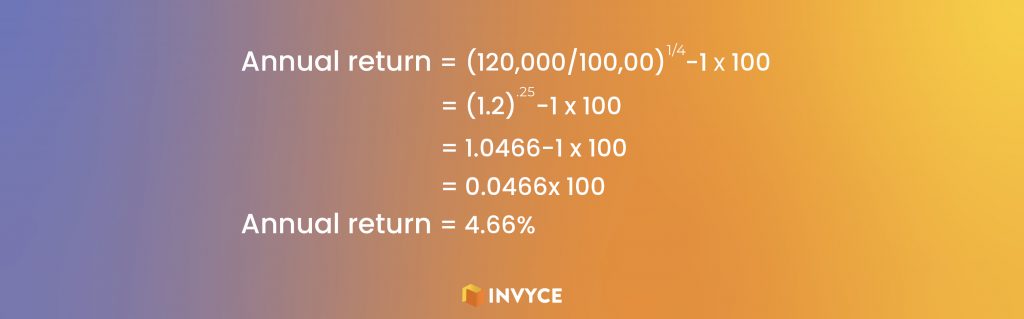

Let’s say the company has a starting balance of $100,000 and an ending balance of $120,000 after four year. Using the formula, the annual return would be calculated as follows:

Advantages Of Annual Return

- It provides a snapshot of the performance of an investment over a specific time period. Calculating yearly income for your investment gives you an idea of how well an investment has performed over the course of a year.

- Annual returns can help you assess the risk-return trade-off. Higher yearly earnings may be associated with higher risk, while lower yearly earnings may be associated with lower risk. By considering an annual returns, you can evaluate whether the potential returns of an investment are worth the associated risks.

- It can be used to track the performance of an investment over time. By calculating earnings for an investment over several years, you can see how the investment has performed over time and make informed decisions about whether to continue holding it or not.

Disadvantages Of Annual Return

- It does not take into account the effects of compound interest which can significantly increase the overall return on an investment over a longer time period.

- It does not consider when an investment was made, and may not accurately reflect the return on an investment that was made at different points in time.

- Annual return does not take into account the impact of fees and expenses, which can significantly reduce the overall return on investment.

Conclusion

In conclusion, annual return is a valuable measure of the performance of an investment over a number of year. It allows you to compare the relative performance of different investments and assess the risk-return trade-off. However, it’s important to keep in mind that calculating yearly earnings for an investment is just one factor to consider when evaluating an investment. There are many other factors that can affect the value of an investment, such as changes in market conditions, company performance, and macroeconomic trends. By considering all of these factors, you can make informed decisions about your investments and maximize your chances of success.

Content writer at Invyce.com

Related Post

Copyright © 2024 – Powered by uConnect

Meena Khan