23 Dec

Are you wondering what appropriate retained earnings are and what are its benefits? Appropriate retained earnings are a crucial component of a company’s financial health and play a significant role in decision-making and long-term planning. In this blog, we’ll explore what appropriate retained earnings are and why they are important for your business.

Table of Contents

Appropriated Retained Earnings

Appropriated retained earnings is a portion of a company’s earnings that have been set aside for a specific purpose. They are the portion of a company’s profits that are not distributed as dividends to shareholders and are instead kept by the company for re-investment or other specified purposes. However, it is important for a company to communicate clearly to shareholders and other stakeholders about the purpose of appropriated retained earnings and how they will be used.

The retained earnings are typically earmarked for a specific purpose, such as the repayment of the debt, the financing of future business ventures, or the funding of employee benefits programs etc. Having an appropriated retained earnings account is not a requirement under the law. However, the fund is maintained in order to protect itself in the event of bankruptcy or a similar situation in the future.

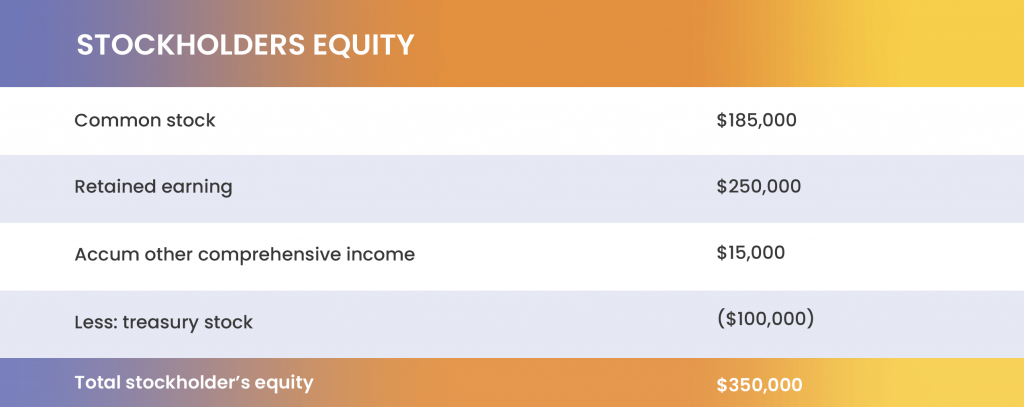

Retained earnings is a component of a company’s equity that is reported on the balance sheet as a part of the “stockholders’ equity” section.

Example

Anna was the CEO of a successful technology company called Tech Innovations. She had always been focused on the long-term growth of the company and had always been careful to set aside a portion of the company’s profits for future investments and strategic initiatives. One year, Anna noticed that the company had a large amount of debt that needed to be repaid. She knew that paying off this debt was essential for the long-term stability of the company, so she decided to appropriate a portion of the company’s retained earnings for this purpose.

Anna called a meeting with the company’s board of directors to discuss her plan and they agreed. Over the next few years, Anna and her team worked hard to pay off the debt, using the appropriate retained earnings to make regular payments. As the debt was paid off, Anna noticed that the company’s credit rating improved, and she began to receive more favorable terms from lenders.

Appropriate Retained Earnings Accounts

Here are some examples of appropriate retained earnings accounts:

- Capital expenditures: Appropriate retained earnings is used to fund capital expenditures, such as the purchase of new equipment or the construction of new facilities.

- Research and development: This fund is used to fund research and development activities, which can help a company stay competitive and innovate.

- Debt repayment: Appropriate retained earnings is used to pay down debt, which can improve the company’s financial health and creditworthiness.

- Dividends: Used to pay dividends to shareholders, which can help create value for shareholders and increase investor confidence in the company.

- Working capital: Used to fund working capital needs, such as the purchase of inventory or the payment of employee salaries.

- Expansion: Used to fund expansion efforts, such as the opening of new locations or the acquisition of other businesses.

- Stock repurchases: Used to repurchase company stock, which can help increase the value of remaining shares and create value for shareholders.

Journal Entries For Appropriate Retained Earning

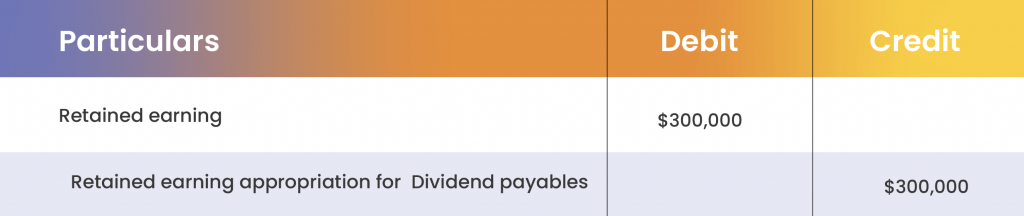

Here is a fictional example of how a company might record retained earnings in its general journal.

Let’s say, ABC Company is a manufacturing company that has been in business for several years. At the end of the current accounting period, ABC Company decides to set aside $300,000 in retained earnings to distribute among shareholders as dividends.

The journal entry to record this transaction would be;

Advantages of Appropriate Retained Earnings

There are several advantages to appropriating retained earnings for a specific purpose:

Planning for the future: Appropriating retained earnings allows a company to set aside funds for future business ventures or investments, which can help the company achieve long-term growth and success.

Improving financial stability: By appropriating retained earnings for purposes such as debt repayment, a company can improve its financial stability and reduce its risk of financial distress.

Maintaining flexibility: Retained earnings allow a company to set aside funds for specific purposes while still maintaining flexibility in how it uses its profits. This can be especially useful if the company’s financial needs change over time.

Communicating with stakeholders: These earnings can help a company communicate its financial priorities and plans to shareholders and other stakeholders. This can be especially important for companies that want to be transparent about their financial decision-making.

Managing shareholder expectations: Appropriating retained earnings can help a company manage shareholder expectations about dividend payments and other financial matters. This can be especially important for companies that want to maintain a consistent dividend policy or that have specific financial goals they want to achieve.

Difference Between Appropriate and Unappropriated Retained Earnings

| Appropriate retained earnings | Inappropriate retained earnings | |

|---|---|---|

| Purpose | Include the earnings set aside for a specific purpose | Include the earnings set aside without any specific purpose |

| Legal compliance | Used in compliance with relevant laws and regulations | May not always be used in compliance with laws and regulations |

| Distribution to shareholders | These funds are used to benefit shareholders | These funds not available for distribution to shareholders or to benefit them |

| Insights of the company | It cannot be used to give the insight of the company | It can give an insight of the company in terms of the amount distribution of dividends |

Conclusion

In conclusion, appropriate retained earnings are an important aspect of a company’s financial management and can have a significant impact on its long-term success. By carefully considering how much to retain and how much to distribute, and properly recording and reporting retained earnings, companies can effectively use retained earnings to support their business objectives.

Content writer at Invyce.com

Related Post

Copyright © 2024 – Powered by uConnect

Meena Khan