17 Aug

Private companies are involved in a process called initial public offering occurs when a private business or corporation makes its stock available to the general public to raise investment cash. This process is also known as going public and is usually an exciting event for both the owners of the company and investors who participate in the IPO. The process involves selling shares to institutional investors such as banks, mutual funds, and pension funds, then allowing them to sell them on an exchange so retail investors can buy them.

Table of Contents

What is an Initial Public Offering (IPO)?

An IPO is a type of public offering in which shares of a company are sold to the public for the first time. The shares may be sold by the company or a group of investors. It is a method of raising capital for a company. An IPO involves selling shares of stock directly to investors. In addition, companies use IPOs to increase awareness of their company and its products or services.

An IPO is a crucial step for a company because they get access to capital from the public markets. They also raise funds at a lower cost than other sources such as venture capitalists or private equity firms. A company may choose to go public if they want to raise additional funds to expand its business further.

How Does Initial Public Offering Work?

An IPO is often the final step taken by companies looking to raise capital from investors. The company then goes through a process where they sell its shares to the general public at an agreed price. This means that shareholders now own part or even all of the company.

After the IPO, the company has to pay a fee to list services that provide support during the IPO process. The IPO usually lasts between 90 to 120 days, depending on the size and structure of the company.

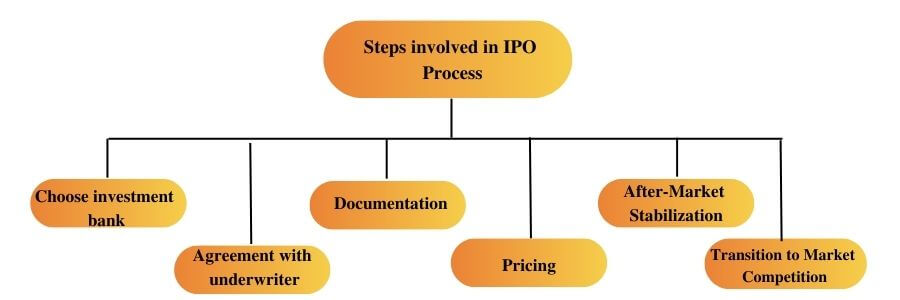

Steps Involved in IPO Process

The following steps tell us how a company goes public;

Choose Investment Bank

The initial IPO process step is selecting investment banks, also known as underwriters. The underwriters act as a broker between the company and investors. Before choosing an underwriter, the company should consider some points, including their reputation in the market, expertise, prior relationship with other companies, and ability to distribute shares to multiple investors.

Agreement With Underwriter

The corporation selects its underwriters through an underwriting agreement and formally accepts underwriting terms and conditions.

Documentation

After the company chooses an investment bank, the investment bank prepares the company’s IPO prospectuses and sends them to the Security and Exchange Commission (SEC). The prospectus describes the company’s business, products and services, and future plans. The prospectus includes the company’s financial statements, including its balance sheet, income statement, cash flow statement, and statement of changes in stockholders’ equity.

Pricing

The effective date is established upon the SEC’s approval of the IPO. The issuing company and the underwriter choose the offer price (i.e., the price at which the issuing company will offer the shares) and the specific number of shares to be sold on the day before the effective date. The price at which the issuing firm raises funds for itself is crucial, hence choosing the offer price.

After-Market Stabilization

After the company raises money through an IPO, it must stabilize the market for its shares before selling them publicly. To do this, the company must meet certain requirements set forth by the Securities Exchange Act of 1934. These requirements include listing the company’s shares on a national exchange, maintaining continuous reporting, and having enough shares outstanding to cover the company’s debts.

Transition to Market Competition

As the company transitions to the open market, it faces fierce competition from other companies trying to sell their own stocks. Investors want to buy shares in companies offering high investment returns. Thus, the company must compete with other companies to attract investors. The company’s success depends on its ability to create value for its customers while remaining profitable.

Is it Safe to Invest in IPOs?

IPOs are usually considered safer investing because you don’t own a stake in the company. Instead, you share in its success. In addition, some private investors sell their stakes at a higher price than the IPO. This allows them to cash out sooner instead of waiting for the stock to go through a complete secondary offering.

Investors are advised to carefully analyze each IPO before deciding whether to invest or not. They must also check whether the management team has enough experience to run the company successfully. The goal is to have a successful IPO, and the timing is crucial.

Advantages and Disadvantages of Initial Public Offering

Following are the advantages and disadvantages of initial public offerings.

Advantages

- Raises money for business expansion

- Shares are traded publicly on stock exchanges

- Allows shareholders to trade stocks

- Raise funds at a lower cost than other sources such as venture capitalists or private equity firms

Disadvantages

- Shares are not guaranteed

- IPO shares are not always listed on major exchanges

- Shares are not liquid

- Companies need to pay fees to the exchange

Conclusion

An initial public offering (IPO) is the first sale of stock by a company to the public. It can be very stressful for companies, especially at the height of their growth stage. An initial public offering is when a private company or corporation raises investment capital by offering its shares to the public for the first time.

Content writer at Invyce.com

Related Post

Copyright © 2024 – Powered by uConnect

Meena Khan