16 Jan

Investing in the debt or equity market can be a tricky business. With so many options available, it can be difficult to know where to put your money for the best return. One option that is often overlooked is available-for-sale securities. These types of securities are long-term investments that can provide a balance of stability and growth for your portfolio. In this blog post, we will explore the available-for-sale securities, their accounting treatment, and how they are beneficial for your business.

Table of Contents

Available-for-Sale Securities

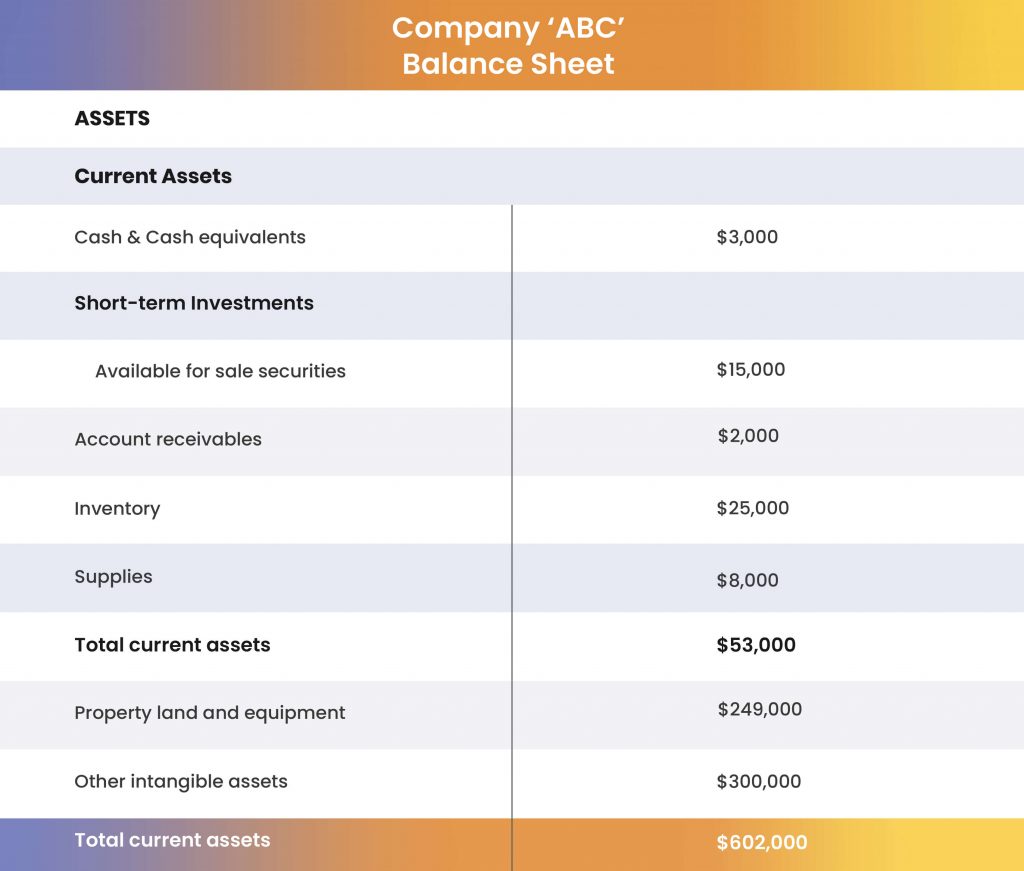

Available-for-sale securities are investments in debt or equity securities that are not intended to be held to maturity and are not classified as trading securities. These securities are held as long-term investments and are reported on the balance sheet as non-current assets, except in case management wants to sell the investment within 12 months. Meanwhile, any unrealized gain or loss arising from the investment in available-for-sales securities is reported in accumulated other comprehensive income under the equity side of the balance sheet.

The company does not intend to sell these securities in the short term but may do so in the future if market conditions change or if the company needs to raise cash. A similar nature of investment available for sale securities is trading securities, but the difference is that trading securities are purchased with the intention of disposing off within 12 months, hence trading securities are listed on the current assets side of the balance sheet.

Accounting Treatment

The accounting treatment for available-for-sale securities is different from that of trading securities. Available-for-sale securities are reported at fair value on the balance sheet, with any changes in fair value recognized in other comprehensive income (OCI) rather than in the income statement. This means that any changes in the value of the securities due to market fluctuations will not affect the company’s current income but will be reported in the OCI section of the shareholder’s equity on the balance sheet. When the company does decide to sell the available-for-sale securities, the gain or loss on the sale is recognized in the income statement, and the amount is transferred from the OCI to the income statement.

Journal Entries

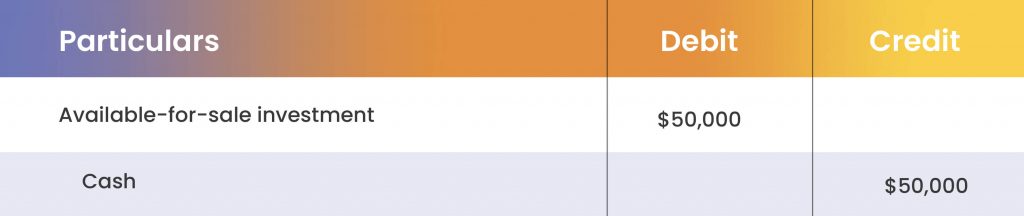

Let’s say that a company buys 10,000 shares of XYZ Corporation’s common stock for $50 per share or a total of $500,000 and classified the investment as available for sale. The journal entry to record this purchase would be:

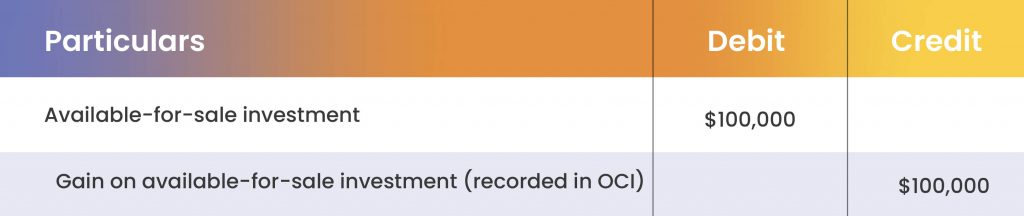

Now, let’s say that six months later, the market value of XYZ Corporation’s stock has increased to $60 per share. The company has not decided to sell the shares yet, but it wants to record the change in value. The journal entry to record this change would be;

This entry records the increase in the value of the securities and the corresponding increase in other comprehensive income. It is important to note that the increase in value is not recognized in the income statement but in the shareholder’s equity as other comprehensive income.

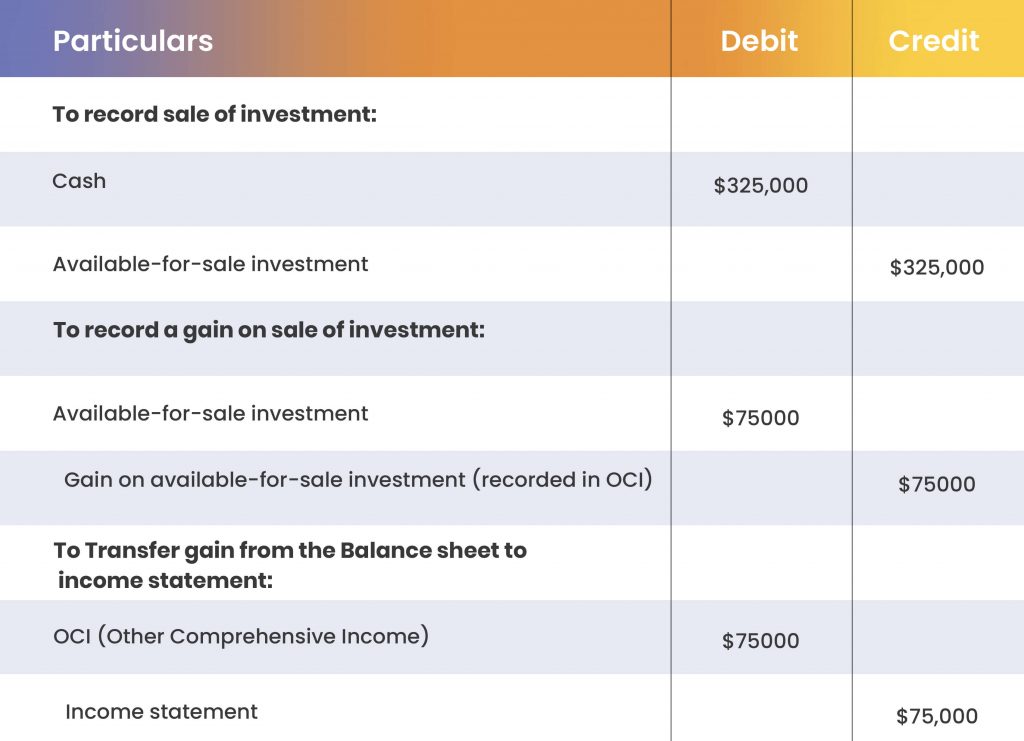

Finally, let’s say that the company decides to sell 5,000 shares of XYZ Corporation’s stock for $65 per share after one year. The journal entry to record this sale would be:

This entry records the sale of the securities, the cash inflow from the sale, and the transfer of the gain from other comprehensive income to the income statement. The gain on the sale is $75,000.

Importance of Available-for-Sale Securities

Available-for-sale securities have several important benefits for companies:

Liquidity: These securities provide a source of liquidity for companies. They can be easily bought and sold in the market, which allows companies to raise cash quickly if needed.

Capital preservation: They can provide a relatively safe way for companies to invest their cash and preserve capital. Unlike trading securities, available-for-sale securities are not intended to be held to maturity and are not classified as trading securities.

Investment return: Available for sale securities provides an opportunity for companies to earn a return on their investments. As the value of the securities increases, the company’s shareholders’ equity will increase, which can be beneficial for the company and its shareholders.

Risk management: They can be an effective tool for companies to manage risk. By diversifying their portfolio across different securities, companies can reduce the risk of losing money if one particular security performs poorly.

Fair value accounting: These securities are reported at fair value on the balance sheet, with any changes in fair value recognized in other comprehensive income rather than in the income statement. This means that any changes in the value of the securities due to market fluctuations will not affect the company’s current income but will be reported in the OCI section of the shareholder’s equity on the balance sheet.

Conclusion

In conclusion, available-for-sale securities can be a valuable addition to your investment portfolio. They provide liquidity, capital preservation, investment return, and risk management benefits that can help you achieve your financial goals. By understanding the basics of available-for-sale securities and how they work, you can make informed decisions about where to put your money. It’s important to keep in mind that these securities are subject to market risk, interest rate risk, and credit risk, so it’s important to monitor your investments regularly and make adjustments as needed. Ultimately, incorporating available-for-sale securities into your investment strategy can help you achieve a balance of stability and growth for your portfolio, helping you reach your financial goals.

Content writer at Invyce.com

Related Post

Copyright © 2024 – Powered by uConnect

Meena Khan