16 Jul

Oil, natural gas, coal, and other types of natural resources are among those that are drilled for or harvested from mineral-rich soil. Until all resources are removed from the ground, it is impossible to estimate their whole value. Therefore, the cost of extracting natural resources is allocated through depletion expenditure using an accrual accounting approach.

Table of Contents

What is Depletion?

Depletion is an accrual accounting concept. This term describes the decline or fall in the value of any natural resources. However, often used in mining, timber, petroleum, and other similar industries. Generally, it is like a method of depreciation of natural resources. Sometimes they are referred to as waste assets because they are physically used over time. The depletion account measures the cost of extracting natural resources from the earth.

It is included as an operating expense on the income statement. This expense is non-cash because it does not involve cash exchange and therefore does not appear on the balance sheet.

How to Calculate Depletion Expenses?

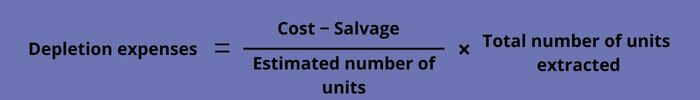

Depletion expenses can be calculated by using the following formula;

Formula

Example

Company ABC is a mining company bought on 1st Jan 2021, costing $400,000. The company spent $500,000 on its development. The salvage value is zero, while the estimated capacity of the mine is 2,00,000 tons. The company extracted and sold 120,000 tons of coal.

Calculate the depletion expense.

Depletion expenses= 400,000+500,000- 0 / 200,000 × 120,000

=$700,000

Types of Depletion Expense

There are two types of depletion expenses.

Cost Depletion

Cost depletion allocates the cost of natural resource extraction to the units produced. The concept determines the amount of extraction cost that can be charged to expense. There is no cost depletion if no natural resources have been extracted.

Percentage Depletion

A tax credit for depreciation is known as percentage depletion. It is available to companies who mine minerals, extract fossil fuels, and exploit other nonrenewable resources from the earth.

The percentage measures the amount brought on by the extraction of nonrenewable resources. It is a deduction that can be used for the taxable gross income of a producing well’s property by independent producers and royalty owners.

Uses of Depletion

Depletion helps a corporation determine the value and rate of use of its natural resources. A business can ensure it is not overpaying for its natural resources by including the depletion charge on its income statement. Depletion accounts are used to track the cost of natural resources. Moreover, they are also used to provide tax deductions for mines and similar investments.

It is also used for accounting and financial reporting purposes. For example, it is also used to precisely determine the value of the assets on the balance sheet and record expenses in the proper time period on the income statement.

In addition, this method of accounting allows for taxpayers to deduct from their income taxes a portion (or all) of money spent during a given period on exploration activities; development activities; production activities; or any other purpose that results in the acquisition or use of the tangible property (such as drilling sites).

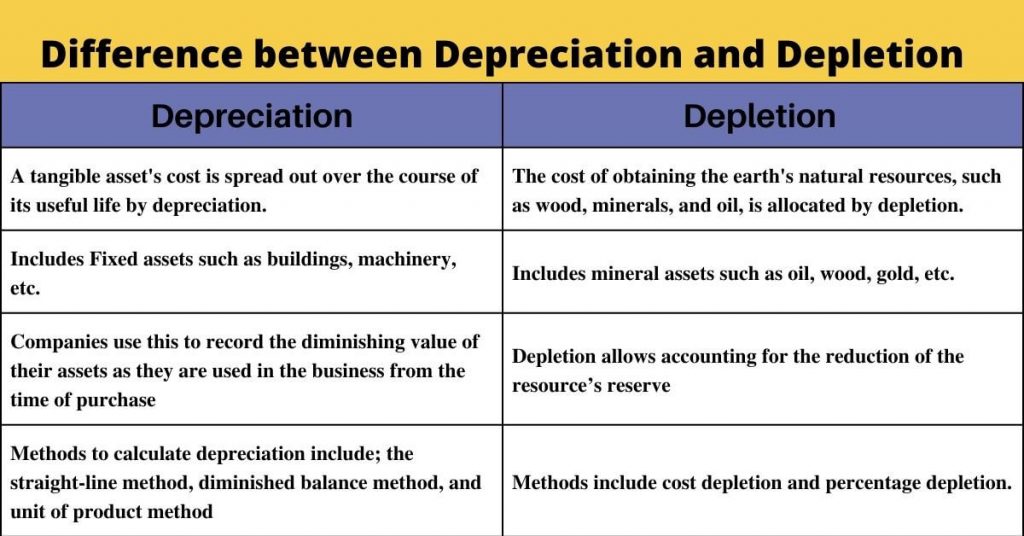

Difference Between Depreciation and Depletion

Conclusion

Depletion allows companies to recover costs by providing tax deductions for mines and similar investments. It is included as an operating expense on the income statement, which means it is an operating loss or a credit until the company recovers its cost through depreciation.

Content writer at Invyce.com

Related Post

Copyright © 2024 – Powered by uConnect

Meena Khan