08 Jul

Technically, cost and expense are the same meaning. However, they have distinct meanings when used in the context of business. The difference between cost and expense is essential, especially in business. If you work for a company or manage your own business, it’s necessary to know what both terms mean and how they differ from one another. In short, a cost is an obligation that must be paid to accomplish something. An expense is a specific type of cost that can be directly tied back to some sort of benefit received from completing the obligation or goal.

Table of Contents

Concept of Cost

Cost is the value of money. It can be an amount of money or the price you pay to get fixed assets. Cost is a one-time payment of capital and is forward to the balance sheet as a capitalized item. For example, if a company buys machinery for $50,000, then a company can say that a car costs $50,000. Businesses reflect it as a balance sheet item because it is a one-time payment.

Concept of Expenses

Expenses are the money you spend to run your business. Expenses include fixed monthly expenses such as rent, utilities, etc. It is the sum that people should utilize for normal expenses and the payments that go along with them. The expenses are recorded in the profit and loss statement as they impact profit. The cost of the product is related to the price that the producer or vendor offers. In addition, expenses are not the same as costs, which a company incurs to provide products and services to customers. For example, in the above example, a company buys a car for $50,000, which is the cost of a car. Now, if we charge depreciation on a car @10%, it would be $5000. The $5000 is an expense and recorded in profit and loss statement.

Difference Between Cost and Expenses

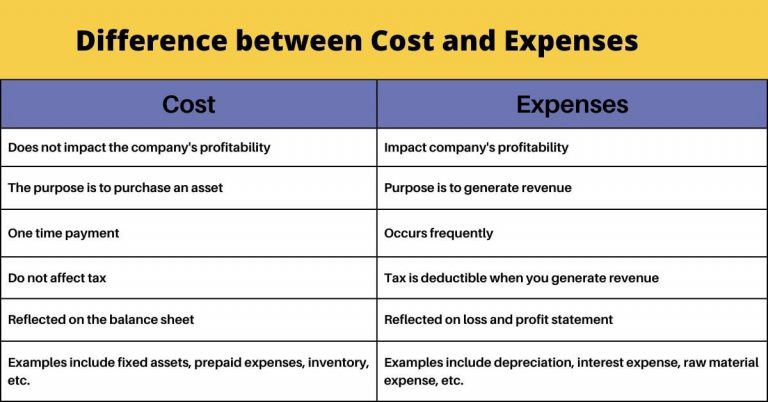

- Cost and expenses are terms businesses use to describe the money spent on something. However, there is a difference between cost and expense.

- Costs are essential for purchasing an asset (for example, purchasing a new computer for your company), whereas expenses are for necessary payments to generate revenue

- When the advantage of the resources forgone can be achieved in the future, it is referred to as expenses. However, the cost is when businesses sacrifice resources with no chance of future gain.

- Cost is, by nature, a one-time payment, whereas expense occurs frequently.

- Costs belong on the balance sheet, whereas expenses are the income statement item.

- Expenses generate revenue and can be deducted from your business tax return. In contrast, costs do not affect taxes.

- Cost does not directly affect the company’s profitability. Conversely, expenses directly affect the company’s profitability.

Conclusion

There are many differences between cost and expense. However, these two types go hand-in-hand when figuring out how much things cost us financially. In this article, we have explained the key distinction between costs and expenses with a comparison table.

Content writer at Invyce.com

Related Post

Copyright © 2024 – Powered by uConnect

Meena Khan