31 Aug

Down payment is a term that comes in the context of buying expensive assets, or services or when borrowing a loan. The down payment amount is the sum of the amount that needs to be paid before you enter into a contract to purchase a property. It is used to unburden buyers’ pockets while buying high-priced assets. Moreover, a down payment allows the buyer to pay a portion of the purchase price upfront; it also enables them to get a loan from a financial institution to pay the remainder at low-interest rates.

Down Payment Meaning

Down payment is the amount the buyer pays early in purchasing an expensive product or service. In other words, A down payment, also known as a principal down payment, is a sum of money that a buyer pays up-front to acquire property or sometimes to secure an interest rate reduction or closing discount. Moreover, a down payment is also referred to as a deposit.

Example

A common example of a down payment is when a buyer purchases a car or home, he pays a portion of the total purchase price. For example, suppose a buyer purchases a house, and the house’s total purchase price is $500. In a down payment, the buyer may pay 5% to 25% to the seller, while the buyer pays monthly installments plus interest to cover the remainder.

How To Calculate a Down Payment?

A down payment can be calculated through a mortgage calculator. It figures out how much you will have to pay in monthly installments.

Let’s calculate the down payment.

John wants to purchase a house. The cost of a house is $8000.The house seller asked him to put 2.5% as the initial payment for the house, and he agreed and paid the initial payment; after that, he applied for a mortgage loan at a bank to pay the remaining purchasing amount.

Based on the initial deposit he agreed to pay, the bank provided him a 20-year mortgage with a 2% interest rate. However, John wants to keep the monthly payment as little as feasible. As a result, he made an upfront payment of 20% of the purchase price. He used the online mortgage calculator to determine his monthly installments to choose between the two options.

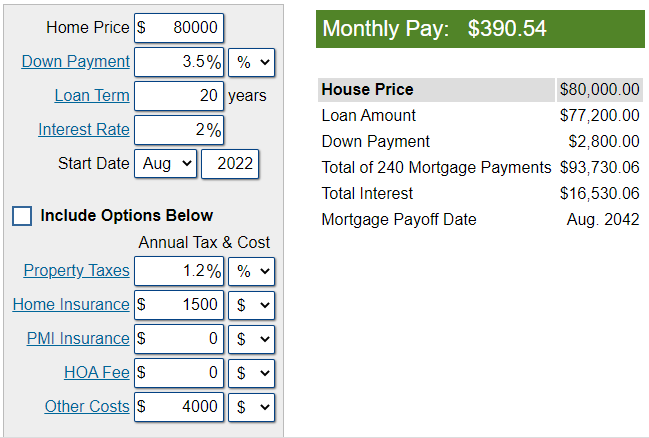

Scenario 1

- House value = $80000

- Down/initial payment = 3.5% = 3.5*80000=$2,800

- Remaining amount = $80000- $2,800 = 77200

- Loan term = 20 years

- Interest rate = 2%

However, when calculated using the online mortgage calculator, the monthly payment will be $390.54. This is because it excluded property taxes and homeowners insurance premiums.

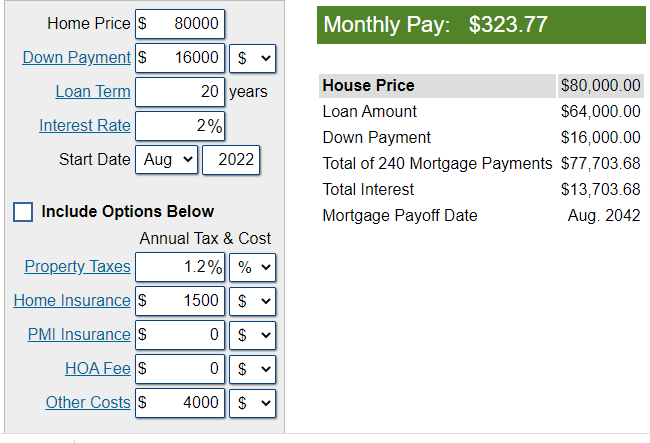

Scenario 2

- House value = $80000

- Down/initial payment = 20% = 20*80000= $16,000

- Remaining amount = $80000- $16,000 = 64,000

- Loan term = 20 years

- Interest rate = 2%

However, calculating monthly payments using the online mortgage calculator, the monthly payment will be $323.77. This is because it excluded property taxes and homeowners insurance premiums.

Thus, the difference in the monthly payment will be:

$390.54 – $323.77 = $67.43

$ 67.43*12 = $809.16 yearly payment

Thus the monthly payment will be $809.16

$809.16*20=$16,183,2 20 years payment

Conclusion

In this article, we have discussed the definition and calculation of a down payment. It should give you a fair idea about the same. Moreover, a down payment is a sum of money the asset buyer needs to pay to the bank or seller immediately after signing the contract. The purpose of putting down a deposit is common sense: it shows that you are serious about buying the house and shifting your residency.

Shabana has been a committed content writer and strategist for over a 5 years. With a focus on SaaS products, she excels in crafting compelling and informative content.

Related Post

Copyright © 2024 – Powered by uConnect

Shabana