26 Aug

Good and bad debt are terms used in the financial world. They refer to different borrowing types, which can affect your credit score differently. Good debt can boost your wealth or significantly improve your life. Conversely, bad debt is any kind of loan that doesn’t help increase your income. The best way to avoid bad debt is to keep a healthy mix of both debts in your personal finances, so you’re always progressing toward financial freedom.

What is Good Debt?

Good debt is a loan that helps you to purchase something that will increase in value over time. It means buying something that helps save time and money on your next purchase or investment. This could be a home, car, or anything else that will allow you to earn more money. Although good debt gives you value in the future, this isn’t always the case. Sometimes it can also be harmful. Therefore, you must consider some important points before getting a good debt.

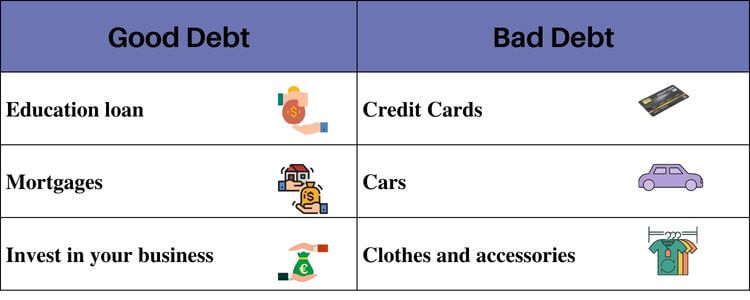

Good debt includes; Education loans, mortgages, and investment loans for own business. Let’s discuss these in detail.

Education Loan

An education loan is considered the best investment. The capacity to find employment is positively correlated with education. Educated workers are more likely to have well-paying positions and often have an easier time securing new jobs should the need arise. A student loan is always useful for lower and middle-class students who want to study but cannot pay their fees.

Despite such importance of education loans, these loans are not always worthy. Investing money in the wrong degrees or wrong persons is always harmful. When investing, always check the worth of the degree and the person. If you think this investment will pay back in the future, then go for it.

Mortgages

Mortgages are a type of loan taken to buy a property. It is one of the safest forms of investment. The price of home and land always increases from time to time. Hence, there is always a chance that mortgages will give you profit in the future. Mortgages are helpful for the people who live and pay rent for shelters. You can save a lot of money and have your own home with a mortgage.

Due to high-interest rates on mortgages, many people can’t afford them. So when taking a loan for real estate, always check the interest rates. If you can pay the interest rates, take the loan. But if you are unable to pay an interest rate, mortgages are not a good idea.

Invest In Your Business

Having own business is the best investment. If you have a good business idea, borrow money and start your own business. Most people nowadays are into business because they are more profitable than a low-salary job. If you are good at business, this type of borrowing is the best decision.

Unfortunately, most businesses fail due to certain reasons. Before starting a business or borrowing money for business, always consider the associated risks. Always choose the business that will give you more profit with fewer risks instead of starting a business with more risks and less profit.

What Is Bad Debt?

Bad-debt is a type of debt that cannot give you value or profit over time. These debts are harmful as they neither provide assets nor any other type of profit. Bad debt includes; credit cards, buying a car, clothes, or other unnecessary accessories.

Credit Cards

Credit cards are convenient and easy to purchase when you use them correctly. However, they are included in bad debt once you cross the limit. Credit cards are usually expensive due to high interest rates. Credit cards are always a risky and unsecured form of debt. Due to high-interest rates, these debts become expensive over time.

Always use credit cards only to purchase necessary items. Don’t buy everything, such as clothes, shoes, food, etc., with your credit card. Keep cash in hand whenever you go shopping.

Cars

Having a car is essential but not a necessity. Borrowing money to buy a car is not always a good idea. The value of cars always decreases with time. Both price and worth of the car decrease over time. In addition, your expenses also increase after buying a car. Because you have to pay for car gas or petrol, car loans can be good debt if you get them at a reasonable price and your car remains valuable for longer.

If you want to buy a car on loan, compare the interest rates and get a loan with less interest. Then, you can also use your car to earn money.

Clothes And Accessories

Clothes are as important as food and shelter. But borrowing money to buy expensive clothes is always bad debt. So it is unnecessary to buy expensive garments with credit cards or loan money.

Many stores sell quality clothes at less price. Buy clothes from such stores. In addition, buying clothes with credit cards is also a bad debt due to its high-interest rates. Always try to pay cash when buying clothes and accessories.

Difference Between Good Debt And Bad Debt

There is a straightforward rule for debt. If it increases the net worth in the future, it is “good debt.” Conversely, if it doesn’t increase net worth, it is “bad debt.”

Bad debts are different from good debts because good debts can be used as collateral for loans or investments (like buying stocks), whereas bad debts cannot be used as collateral for loans. After all, their value won’t be enough to pay off the original sum owed with interest rates at reasonable levels.

Bad debt is any kind of loan that doesn’t help increase your income by earning more money or saving time (or both). For example, taking out an auto loan for $20,000 at 9% interest per year doesn’t help with earning more money because it does nothing for the value of whatever vehicle you’re purchasing; instead, it just adds another monthly payment onto your credit card balance which doesn’t make much difference until its due date rolls around again later this month!

Good debt tends to be secured by assets such as real estate, student loans, and business loans. If used wisely, these debts provide you high value in the future.

Conclusion

Understanding the difference between good and bad debt is important to making informed decisions about your finances. It’s also important to understand what is included in good debt and what is included in bad debt So that you can wisely make a decision whether you should go towards obtaining a loan or not.

Content writer at Invyce.com

Related Post

Copyright © 2024 – Powered by uConnect

Meena Khan