22 Aug

Having a home or property is the goal of many people worldwide. If you’re thinking about buying a home or land, taking a mortgage loan is the best option. Mortgages can be relatively inexpensive, long-term financing, but because such significant amounts are at stake, it’s essential to select a good package for you. For your guidance, our article examines mortgages’ types, benefits, and drawbacks.

What is a Mortgage?

A mortgage is a type of loan given to purchase a property. A mortgage is a type of debt where the borrower agrees to pay interest (usually at regular intervals) to the lender until the principal amount is repaid. In return, the borrower receives ownership rights to the property. They are often secured by real estate but may also be unsecured. An example of an unsecured mortgage would be a personal loan.

How Do Mortgages Work?

A mortgage is given to a person who wants to buy a house or land. For this purpose, the individual looks for a lender who can provide a loan. Next, a contract between a lender and borrower is made where the former agrees to lend money to the latter. Finally, the borrower promises to repay the amount borrowed plus interest over a period of time. If the borrower cannot return the loan, the lender may take possession of the property.

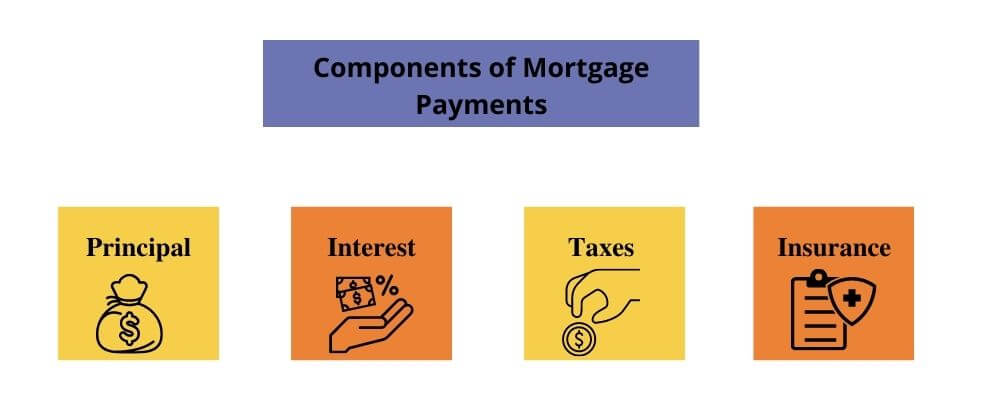

Components of Mortgage Payments

Following are the components of the mortage payement.

Principal

The loan amount, sometimes called the mortgage principal, is what you borrow to buy the house. It is the amount a borrower must pay throughout the loan.

Interest

The interest rate is the amount of money charged per year on a loan. The interest rate is determined by many factors, including the borrower’s credit score, the type of loan taken out, the length of time the loan is being taken out, and the current market conditions.

Taxes

Taxes are a term used to describe the property taxes that your community imposes, which are often calculated as a proportion of the value of your home. In addition, a lender typically receives 1/12th of the annual property tax amount each month.

Insurance

The mortgage payment may cover two different insurance plans. One is property insurance, which guards against fire, theft, and other catastrophes for the house and its contents. Another is that mortgage insurance premiums are additional charges added to the monthly payment to protect lenders if the borrower doesn’t pay the loan.

Types of Mortgage

Following are types of mortgages.

Fixed Rate Mortgage

A conventional mortgage is a loan obtained from a bank where the borrower pays interest on the principal amount borrowed. It requires a down payment and generally takes longer than a government-backed mortgage to close.

Government-Insured Mortgage

Government-insured mortgages are loans backed by the U.S. Department of Veterans Affairs (VA) or the U.S. Small Business Association (SBA). Loans backed by the VA are known as VA loans. Loans backed by the SBA are called 504 loans. Both types of loans require less documentation and lower closing costs than conventional mortgages.

Home Equity Line of Credit (HELOC)

HELOC is a revolving line by the value of a homeowner’s primary residence. Borrowers use HELOCs to borrow money against the equity in their homes. Unlike a traditional mortgage, HELOCs do not require any down payments. Instead, borrowers make monthly payments to the lender over time using the equity built up in their homes.

Reverse Mortgages

Older homeowners can use reverse mortgages to turn all or part of the equity in their homes into cash. There are two types of reverse mortgages. A first-time purchase reverse mortgage and a refinance reverse mortgage. First-time purchase reverse mortgages are only available to first-time buyers who don’t already own their homes. Moreover, refinance reverse mortgages are open to anyone looking to tap into the equity in their homes to pay off existing debts.

Conventional Mortgage

A conventional mortgage is a loan obtained from a bank where the borrower pays interest on the principal amount borrowed. In addition, conventional mortgage requires a down payment and generally takes longer than a government-backed mortgage to close.

Advantages of Mortgages

- A mortgage is the best opportunity for individuals who wants to buy a home but don’t have enough cash or credit.

- Different mortgage types are provided, so you can frequently find one that fits your needs and preferences.

- It is easy to repay this loan because it is payable monthly in small amounts.

- The interest rates on mortgages are usually lower than other types of borrowing.

Disadvantages of Mortgages

- Mortgages are hard to get. You might not find a lender willing to give you a loan. Banks are risk-averse these days. Therefore, they want to make sure that you can afford to repay your debt.

- By taking out a mortgage, you agree to repay a sizable sum of money with interest over an extended period. You will pay back a lot more than you borrowed, even over a 25-year period.

- Borrowers will have their property repossessed if they are unable to make the payments.

- Mortgages are complicated. Hence, learning how to navigate the paperwork involved in buying a home takes time. Moreover, you’ll need to fill out forms, sign contracts, and meet with lenders.

Conclusion

Mortgages are a form of debt that allows you to buy a property. They’re great for people who want to buy a home but lack sufficient funds.

Content writer at Invyce.com

Related Post

Copyright © 2024 – Powered by uConnect

Meena Khan