25 Feb

In accounting and finance, accounting rules are the most famous and commonly used term. These rules are universally applicable, and everyone follows them to bring uniformity and account for transactions correctly. They are also known as traditional rules of accounting or debit and credit rules. In this article, you will understand Golden accounting rules with examples.

Table of Contents

Types of accounts under the accounting system

These accounts are essential aspects to understand the golden rules of accounting effectively. There are three types of accounts that come under the accounting system are as follows.

1. Personal Account

This general ledger is related to persons, firms,s, and associations. Personal accounts are divided into three accounts

- Artificial personal accounts: It includes companies, partnership firms, legal bodies, etc which are artificially created by persons.

- Representative personal accounts: It includes such accounts which directly or indirectly represent persons like a bank account.

- Natural personal accounts: These are accounts that are directly related to persons like the Haider account.

2. Real account:

This general ledger is related to assets,liabilities and shareholders equity other than people’s accounts.Real accounts are a permanent accounts that do not close at the end of accounting period, so their ending balance is carried forward to next accounting period as opening balance. Real accounts are further divided into two accounts

Tangible assets

These are the assets that have a physical presence like plant and machinery, Building.

Intangible assets

These are the assets that have no physical presence like goodwill, patent,s, etc.

3. Nominal account

This is usually related to revenue, expenses, profits, and losses. All transactions are stored for one year in the nominal account, transferring the balance to the permanent accounts at the end of the fiscal year.These are temporary accounts that are closed at the end of accounting period.

An example of a nominal account is an Interest Account.

Golden Rules of Accounting

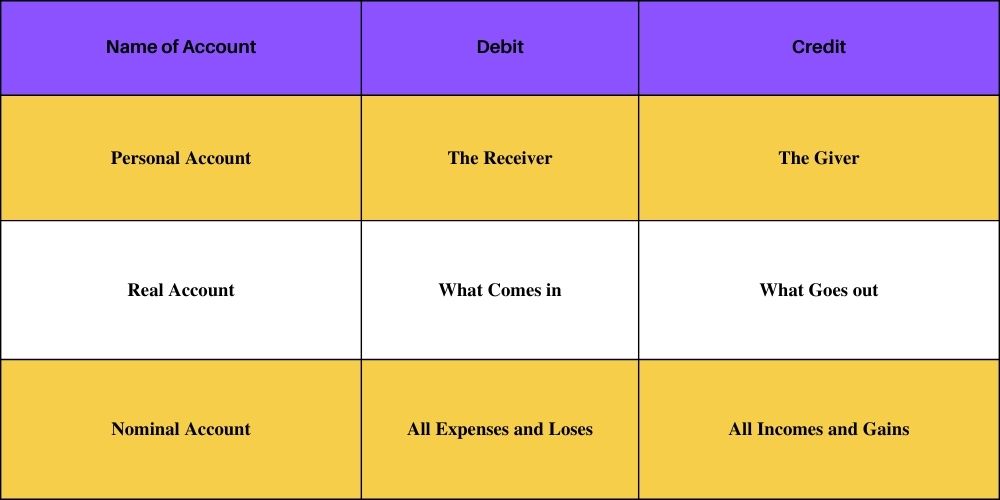

There are three types of golden rules of accounting that help you to keep your account books up to date and accurate. These revolve around credits and debits. Let’s take a look a the golden rules of accounting:

1. Debit the receiver and credit the giver

According to this rule, if you receive something, debit the account. If you give something, credit the account. The first rule deals with a personal account.

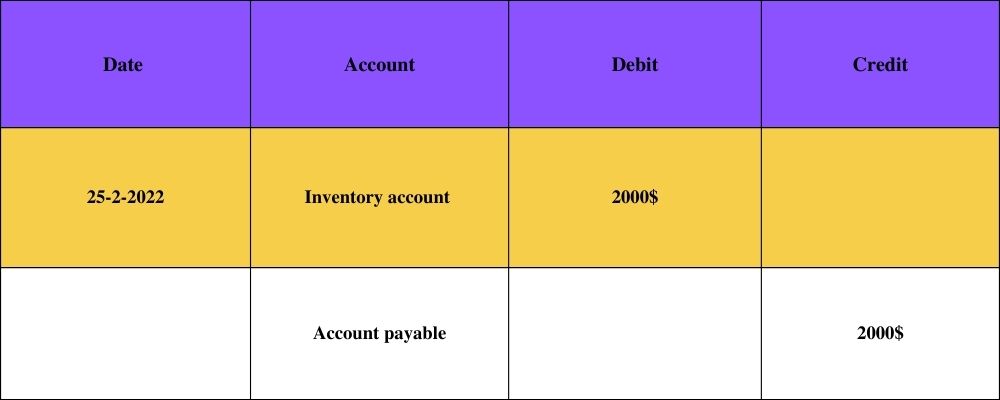

Example

Suppose you purchase 2000$ worth of goods from the company. You need to debit your purchase account and credit the company/ vendor account in your book of account.

According to the first rule, you need to debit the receiver and credit the company for providing goods.

2. Debits what is coming in and credit what goes out

According to this rule, debit the account when something comes into your business. When something goes out of the business, it credits the account.

The second golden rule is applied in the case of real accounts. A real account can be an asset, liability, or equity account.

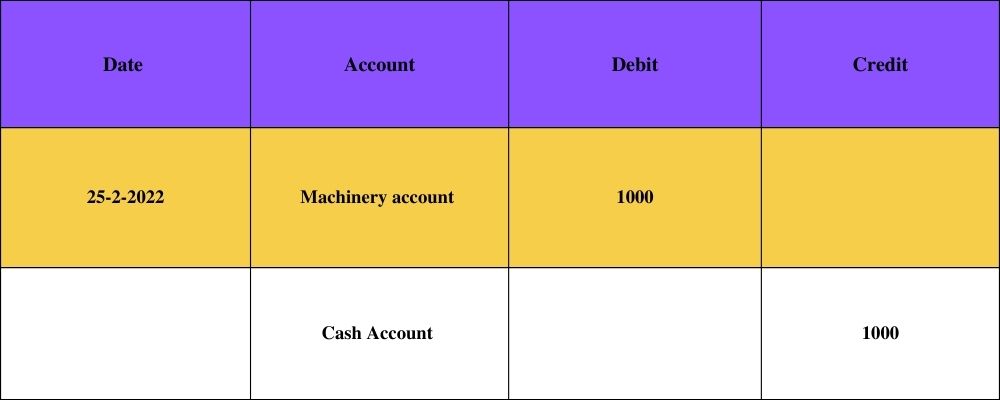

Example

Suppose you purchase machinery for $1000 in cash to debit your asset account and credit your cash account.

3. Debit expenses and losses and Credit income and gains

According to this rule, if your business has an expense or loss, debit the account, and if your business needs to record income or gains credit, the account.

The 3rd rule of accounting deals with nominal accounts. Nominal or temporary accounts include revenue, expenses, gains, and losses.

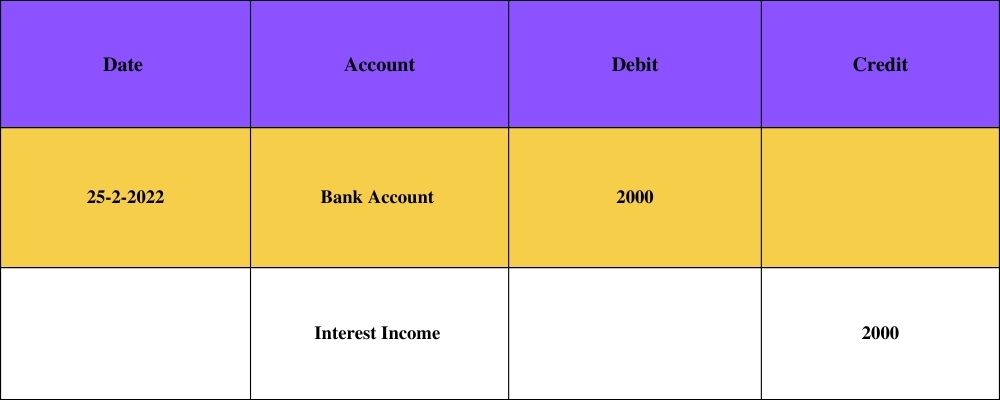

Example

Suppose You receive interest on a deposit from a bank of $ 2000. Debit bank account and credit interest income.

Conclusion

These three golden accounting rules allow you to keep your account up-to-date and accurate. In this article, I have discussed the golden rule which lays a foundation for accounting where the accounting system is standing today. Hope this article will help you understand accounting rules.

Shabana has been a committed content writer and strategist for over a 5 years. With a focus on SaaS products, she excels in crafting compelling and informative content.

Related Post

Copyright © 2024 – Powered by uConnect

Shabana