03 Nov

If you’re new to investing, you may wonder what options and stocks are. Simply put, stocks are units of ownership in a company bought and sold on a stock exchange. So when you buy a stock, you become a shareholder in that company. An option is a contract that grants the holder the rights, but not necessarily the obligation, to sell or buy an underlying asset within a specific time at a specified price. This blog post will discuss stock vs. option and discuss which one is better for your business.

Table of Contents

What Are Stocks?

When you buy a stock, you buy a piece of company ownership. Stocks are also known as equities. Stakeholders have certain rights, including voting on corporate matters and receiving dividends (a portion of the company’s profits). The market’s supply and demand determine a stock’s price. A stock’s price increases when more people want to purchase it than sell it, and it decreases when the opposite occurs. Stock prices can be affected by many factors, including earnings reports, economic news, and even rumors.

What Are The Options?

Options are contracts that grant the buyer the right but not necessarily the obligation. Options are often used to hedge against risk or speculate on the future price of an asset. When an option expires without being used, it loses value and becomes useless.

One of the most attractive features of options is that they are more flexible than stocks. As a result, options can help you generate income, hedge risk, or leverage your portfolio. They also help you avoid capital gains tax on unrealized profits.

Stock vs. Option

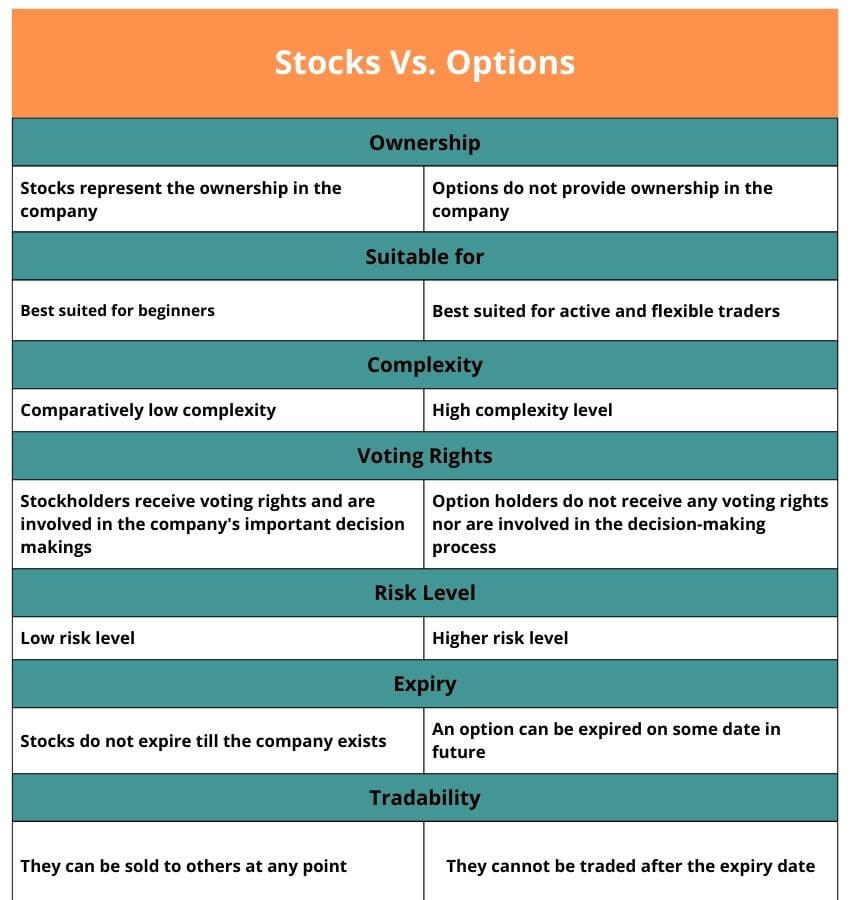

- Stocks are financial instruments that provide ownership in a company. They represent ownership rights in something and give holders the right to share in its profits over time through dividends or capital gains. On the other hand, options grant their holders the right but do not provide an obligation.

- The option cannot be traded after its expiration date even though it is a trading instrument. In contrast, stocks are a type of investment product that can be sold at any moment to another investor.

- Stocks are more stable, easier to understand, and have better liquidity than options.

- Unlike options, owning shares doesn’t give any say over how the business is run—you don’t have any control over its direction or profits.

- Until a company is in existence, its stock does not expire. The options have an expiration date, after which the investor no longer has the option to purchase or sell at a future date.

Stock vs. Option. Which One Is Better?

The answer to this query is more complicated than it sounds. It depends on your goals and the specific circumstances you face. For example, stocks will serve you better than options if you want to invest long-term or if you’re an average investor looking for a profit with minimal risk. This is because they’re more stable and offer more significant potential for growth than options that expire within a few years. They also won’t fluctuate as much in price over time because they’re less volatile by nature than options.

On the contrary, if you’re looking to make more money quickly, go for options. Moreover, options may be better if you are a risk player and know how to keep risk to a minimum. Options may be a technique to restrict your risk within specified parameters because they may enable you to receive a return similar to that of a stock while investing less money.

Conclusion

Investing in stocks vs. options is a very personal choice, and it’s essential to understand their differences before deciding. Options give you access to the market’s potential but also carry more risk if you don’t know how they work or have never traded before. If you decide to go with stocks instead, understand that this is a challenging route for beginners; however if done correctly, there will be huge returns over time!

Meena Khan