04 Mar

Posting to the general ledger is the most crucial accounting cycle phase. This process comes after the journal entries, in which entries from a general journal are posted into a ledger account.

What is a general ledger(GL)?

A general ledger/(GL) provides a complete record of all financial transactions of your business. It records all the financial data that is required to prepare financial statements of company. An account typically recorded in GL included: assets, liabilities, expenses, equity, and income or revenue. The examples may be salary account, account receivable account, furniture account etc.

On the other hand, GL is a primary source for generating the company trial balance and financial statement. The ledger accuracy is verified by trial balance, which confirms that all debit accounts are equal to the sum of all credit accounts.

The purpose of creating a general ledger

GL plays a vital role in the accurate record of all company accounts. To keep your records accurate, make sure to post to the general ledger as you record a transaction. It is crucial to transfer general entries into your ledger. Moreover, it also serves as a foundation for a company’s financial record-keeping system for an accounting cycle.

Before diving into the posting process, let’s have a quick look at the important points of ledger.

- General ledger gives an accurate picture of your business finances.

- An up-to-date ledger helps you avoid penalties

- Show you the income and expenses statement

- Find the transaction easily

- Keep you organized

- You can easily find accounting mistakes, like inaccurate financial reports and tax filing.

Process of posting to the General ledger

Posting to a general ledger is a process of classifying journal entries into a separate account in a ledger account, also known as a T account. The general journal is known as the book of original entry, and the ledger is known as the book of final entry.

T account is a graphical representation of the account balances. It is called the T account because it looks like T. Credit amounts are placed on the right side and debit amounts on the left side of the T account.

Posting refers to a process of transferring entries from the journal into the ledger account. The posting to general is a very simple process in which already recorded information from the general journal, is transferred into the ledger account. In the process of posting into the general ledger account, you can divide journal entries into two sides, debit and credit.

A debit part

The amount of the accounts in the debit part of the journal entry is post on the debit side of the general ledger.

A credit part

The amount of the accounts in the credit part of the journal entry is post on the credit side of the general ledger.

Let’s understand the posting process through an example.

Example

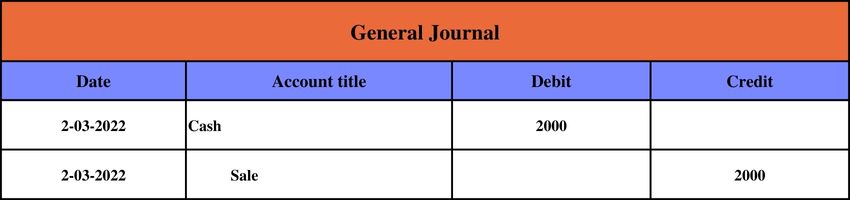

An XYZ company sold furniture for $2000. So, the posting process to the general account is illustrated in the table below.

General ledger

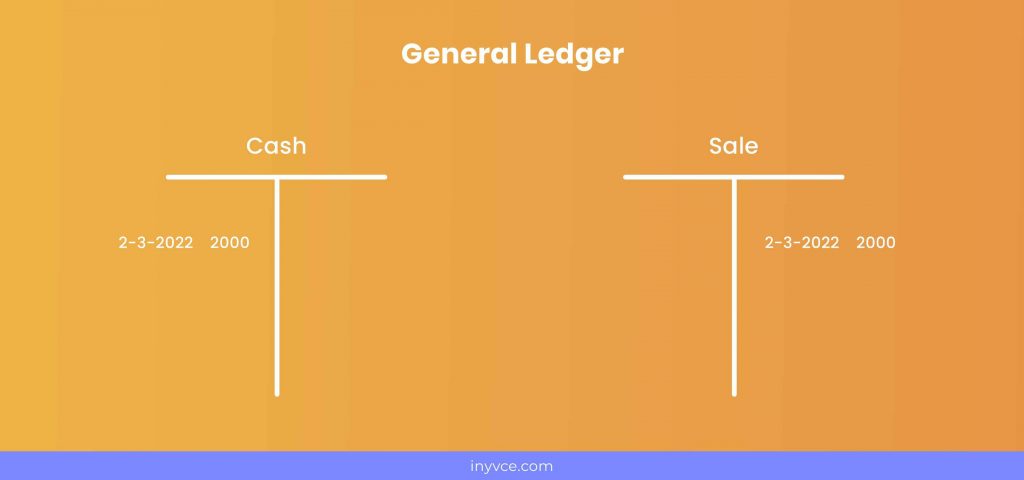

Now go to the ledger and post amounts of debited and credited on the appropriate debit and credit side. The below table is what your general ledger looks like after posting to the ledger. In this process, debit amounts goes to the left, and credit amounts goes to the right.

Explanation:

The Cash account in the journal entry is debited, so you have to place the amount on the debit side of the account in the general ledger. However, for sale, it was credited, so the amount is placed on the credit side (right side) of the account.

Posting is simply transferring the amounts from the journal to the respective accounts in the general ledger.

Rules of posting in the General ledger

An accountant must follow the rules while posting entries to the ledger. So, let’s have a look at some important rules.

- The first rule states that entries must be posted to the ledger from journal or daybook.

- The entries into the general ledger must be date-wise

- The date of entry in the daybooks should resemble the date of entry in the ledger

- The amount shown on the credit side in the journal must be posted on the credit side of the general ledger.

- The amount shown on the debit side in the journal must be posted on the debit side of the general ledger.

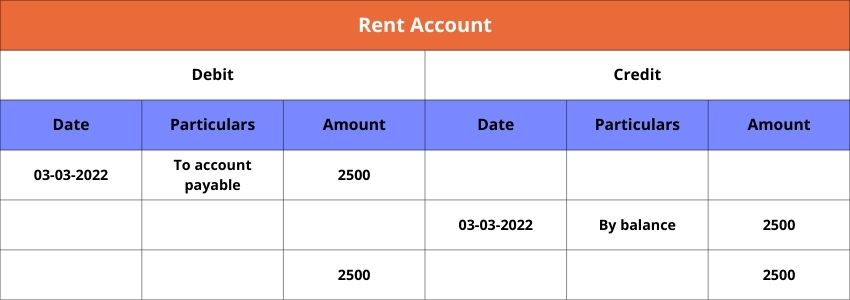

- In particulars, the account head must start with the “To” and “By.”

The final rule states that balancing the ledger can be done by doing the totals of the debit and credit sides. If the total of the debit side is more than the credit side, then the balance should be shown as debit balance in the balance column. The total of the credit side is more than the total of the debit side, then the balance should be shown as credit balance in the balance column. If the totals of debit and credit sides are equal, then the balance should be shown as ‘nil’ in the balance column.

Subsidiary ledger

A subsidiary ledger is also known as a subaccount or a subledger. Subsidiary ledgers are used to record all transactions of accounts receivable and account payable separately. The subsidiary ledger stores the details for an available ledger control account. Once data has been recorded in the subsidiary ledger, then systematically summarize and post to a control account in the general ledger. This helps to construct a financial statement of the company. Examples of the subsidiary ledger are the account payable, account receivable, fixed asset, inventory, and purchase ledger.

A subsidiary ledger is conducted in companies with large sale volumes, but there is no need of a subsidiary ledger in a small company.

Let’s take an example of the information in the subsidiary ledger.

The account receivable contains all the sales made on credit by a business, including invoice date, payment made against the credit sales, discounts and returns, and allowances. So, the sum of all invoices in the account receivable subsidiary should equal that of the account receivable on the general ledger.

Conclusion

I hope this article helps you understand the posting in the general ledger, the posting process, and the rules of posting into the general ledger.

Apart from this, it would be best to keep in mind that you need to verify all subsidiary ledgers should be completed before summarizing the totals in the general ledger.

Marjina Muskaan has over 5+ years of experience writing about finance, accounting, and enterprise topics. She was previously a senior writer at Invyce.com, where she created engaging and informative content that made complex financial concepts easy to understand.

Related Post

Copyright © 2024 – Powered by uConnect

Marjina Muskaan