22 Nov

The price-to-book ratio is one of the most common ratios used in finance. It compares the price of a share or bond to its book value. The P/B ratio is an important factor that investors consider when determining a company’s value. This article discusses what is the P/B ratio and how to calculate it.

Table of Contents

What Is Price-to-Book Ratio?

The price-to-book (P/B) ratio is one of the most widely used valuation metrics. It is the ratio analysis that expresses the relationship between the stock price and the book value of each share. It is also known as market-to-book value. The P/B ratio is applied to assess the overvaluation or undervaluation of a stock. It is used to determine the market value of a company as compared to its book value. The market value is obtained by multiplying the number of outstanding shares by their share price. On the other hand, book value is a net asset on the balance sheet. Book value may also be a value that remains after liquidating all the assets and paying off all the liabilities.

Generally, the value of a stock is better for value investors if the P/B ratio is lower because they are in a position to purchase company stock at a reasonable price. Conversely, higher P/B ratio, the stock value is overvalued i.e. the share price is too high. However, the ratio’s value differs throughout industries.

Calculating P/B Ratio

The price-to-book ratio is calculated by dividing the market value of a share and the book value of assets.

Formula;

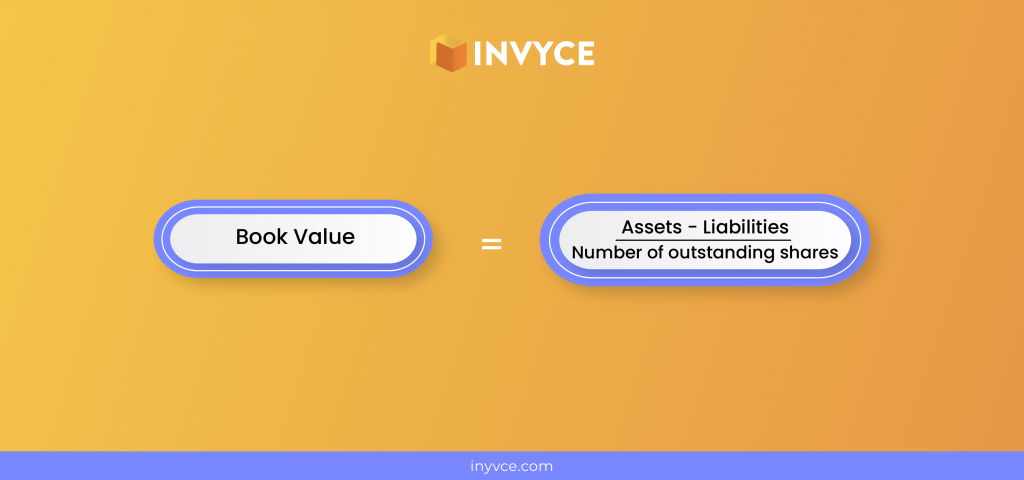

The formula to calculate book value is;

(Note: It is crucial to remember that intangible assets like patents, goodwill, or other intellectual properties should not be taken into account when determining a company’s book value).

Interpretation

A P/B ratio under 1.0x is typically seen favorably and as a possible sign that the company’s shares are currently undervalued and is a good chance for value investors to purchase a stock at a reasonable price. The more the P/B ratio the more expensive the stock is. That is why value investors always look to purchase stocks of companies that are undervalued but intrinsically strong shares. The reason value investors seek to purchase undervalued shares is that they are hoping to earn a handsome return in the future.

Calculations

To find out the P/E ratio for the company, let’s assume the following values;

- Market value = $6,000

- Assets = $7,000

- Liabilities = $2,000

- Outstanding shares = 5

To calculate the P/B ratio, first, find the book value.

Book value = (7,000 – 2,000) ÷ 5

Book value = 1000

Now, calculate the P/B ratio by using its formula.

Price-to-book ratio = market value of share ÷ book value

P/B ratio= 6,000 ÷ 1000

P/B = 6

The stock’s valuation ratio is 6, which means that the share’s current market price is six times its book value. This shows that the current price of shares is very high and it’s not the right time for a value investor to purchase such shares.

Importance Of Price-to-Book Ratio

- It is one of the most important valuation metrics that is used to compare the current market price of a share with its book value

- P/B ratio is a valuable metric that aids investors in determining how frequently a stock is trading below a company’s book value. It also provides some insight into whether an investor is overpaying for what would be left over if a firm went bankrupt right away.

- This ratio can also be used to compare different companies to others, such as those in the same sector or business.

- In comparison to other valuation metrics, the P/B ratio is less volatile. As compared to other financial ratios, the P/B ratio is known to stay age-bound and to be more stable.

- A price-to-book ratio is a tool used by investors to gauge the cost of a company’s stock.

- It is most useful for spotting stock possibilities in financial institutions, particularly banks.

Drawbacks/ Limitations

- P/B ratios may not be used to compare two different companies in different industries, especially for businesses based in different nations.

- P/B ratio for software companies is usually high for companies owing more tangible assets because this ratio is mostly related to tangible assets and does not include intangible assets. Therefore, IT companies may find P/B ratios to be less relevant.

- The book and market values of assets may differ dramatically as a result of changes in technology, intellectual property, inflation, and other factors.

- It offers relatively little insight into some industries that have highly valuable hidden assets that are not taken into account in the book value.

- Differences in Book Value might also result from the business model. The book value of assets of a company that outsources production will be lower than that of a company that manufactures its own products.

Conclusion

In conclusion, the P/B ratio is a simple and effective way to determine whether or not a company is undervalued. It provides insight into a company’s fundamentals, which allows investors to make better decisions when making investments.

Content writer at Invyce.com

Related Post

Copyright © 2024 – Powered by uConnect

Meena Khan