14 Oct

Financial reserves and surpluses are excellent sources of strength for any small or large business. Reserves and surpluses are an essential part of any business. It allows the company to be ready for multiple events. When a company’s reserves are insufficient, it needs to be able to tide over the situation. If a company doesn’t have enough cash reserves set aside, then it may run out of money when it’s time for these unexpected expenses to arise.

Table of Contents

What are Reserves and Surplus?

As the name suggests, reserves and surplus are a cumulative amount of retained earnings the company has kept over time. These earnings are recorded under shareholder’s equity. In other words, it is a portion of the amount from the profit that the management keeps aside, which can be used in bad times or to serve a particular goal in the future.

The company uses these funds or reserves for specific purposes, such as

- Buying assets

- Meeting future obligations

- Overcoming losses

- Managing working capital management

- Dividend distribution

- Fulfilling fund requirements

- Payment for legal settlements

- Debt repayment

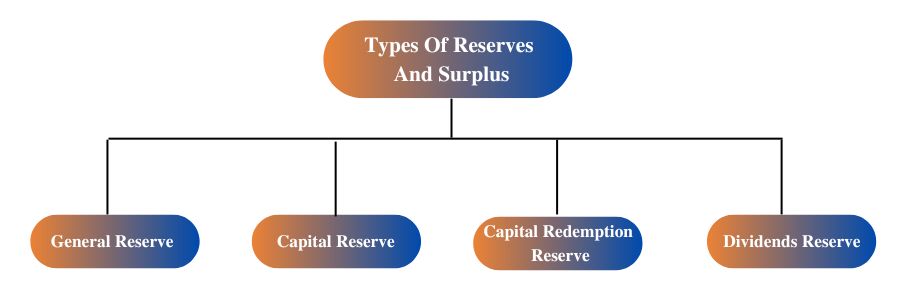

Types of Reserves and Surpluses on the Balance Sheet

General Reserve

A General reserve, also known as a revenue reserve, is the amount separated from profit earned for future purposes. It is the amount kept aside for meeting certain or uncertain obligations. It is also referred to as a “free reserve,” meaning that a business is not required to maintain a general reserve but may do so only if it generates a substantial profit.

Capital Reserve

The capital reserve includes the amount derived from capital gain or generated from non-core operations of a company rather than core operations.

It is the part of the profit that is kept aside for specific purposes, such as

- Financing long-term projects

- Writing off capital expenses

Capital Redemption Reserve

CRR is the amount or reserve generated from the undistributed profits from general reserves for the purpose of redemption of preferred shares or buyback of equity shares. The purpose of share redemption is to reduce share capital. Therefore, the CRR can be pretty helpful for businesses during the funds required for share redemption.

Dividends Reserve

It enables the business to distribute a consistent amount of dividends yearly. This kind of reserve is created as a separate account.

Example

To illustrate the concept of reserves and surplus, let’s take the example of an event management company. The company’s annual earnings from its core operation, i.e., managing events for the year 2021, were $890,000. A company’s management decided to keep aside 10% under general reserve as reserves from its earnings. If reserves and surplus were $40,000 and $20,000, respectively, at the start of the year, find out the reserve and surplus at the end of 2021.

Total earnings | $890,000 |

Opening general reserves | $40,000 |

General reserve | 10% |

Opening surplus | $20,000 |

First, calculate the general reserve,

General reserve= opening general reserve + 10% of $890,000

General reserve=$48,900

Then, calculate the surplus amount,

Surplus = opening surplus + (net profit – transfer to general reserve)

Surplus = $901,100

After getting the required values, finally calculate the value of reserve and surplus,

Reserve and surplus = general reserve + surplus

Reserve and surplus = $950,000

Therefore, the reserves and surplus for the end of 2021 will be $950,000

Advantages

A vital source of financing: When a company needs funds to pay debts or meet obligations, the easiest way is to use the amount in the reserves.

Maintain working capital requirements: The company can sustain its working capital needs with the help of reserves since reserves can be utilized to supplement working capital when it is insufficient.

Overcoming future losses: At the time of loss, the reserves can be used to pay off the liabilities. In addition,it provides a cushion for unforeseen expenses or losses.

Dividend distribution: They are the primary sources of dividend distribution since they provide an amount for uniform distribution of dividends

Disadvantages

- When a company uses reserves to pay liabilities in case of losses, the correct picture of profitability will not be shown on financial statements.

- A large part of funds in the reserves and surpluses are used for general purposes. There are chances that management will misuse these funds. Management may use reserves for purposes other than the company’s expansion.

Conclusion

Reserves and surpluses are financial assets that are available for use. The company holds on to a certain proportion of business income as a reserve and surplus for future use. They are kept aside with the intent to protect a company against adverse conditions, increase liquidity, or prepare for future needs.

Content writer at Invyce.com

Related Post

Copyright © 2024 – Powered by uConnect

Meena Khan