17 Nov

Efficiency is the goal of every business. There are several metrics to measure the profitability and efficiency of a business. The simplest of efficiency metrics is a return on assets (ROA). It reveals the profits made from assets or capital invested.

Table of Contents

Return on assets (ROA)

Return on asset is a financial ratio that measures a company’s profitability in relation to its assets. ROA indicates how a company efficiently manages its assets to generate profit over time. It is used by analysts, investors, and corporate management to identify whether a company is profitable or not so that they can make their investments and other decisions accordingly. In addition, ROA is an important metric to compare two or more different companies in the same industry.

Calculating Return On Assets

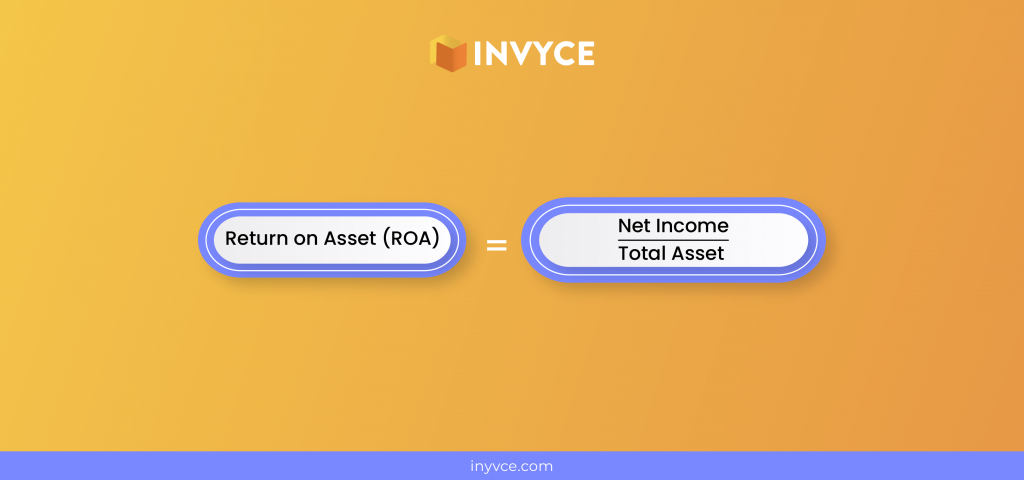

ROA can be calculated by dividing a company’ earnings after tax by its average asset. The obtained value can also be converted into percentages to understand profitability better.

RAO Formula

- Net income is calculated by using its formula, i.e., Net income = revenue – cost of goods sold – expenses.

- Average assets is the total assets at the end of current year given on the balance sheet of a company plus total assets at the begining divided by 2.

Interpretation

The ROA will enable you to assess how your business makes profits and how you stack up against your rivals. The higher ROA indicates more profitability with less investment. Conversely, the lower ROA indicates room for improvement in managing the company’s assets.

Example

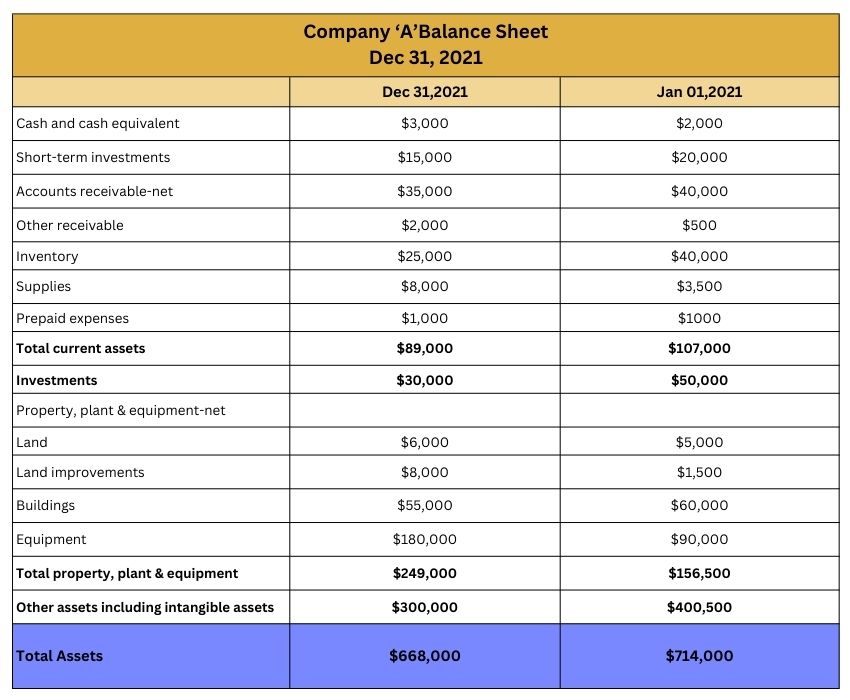

Let’s say the net income of company ABC is $500,000. The total assets value is given in their balance sheet. Calculate the return on assets.

Net income = $500,000

Average assets= $668,000 + $714,000 ÷ 2 = $691,000

Return on assets = net income ÷ total assets

ROA = $500,000 ÷ $691,000

ROA=0.72 =72%

The ROA of company ABC is 72%, which means that the company is highly efficient and productive.

Importance of Return on Assets

- ROA is an effective indicator for assessing a single company’s performance. When a company’s ROA increases over time, it shows that it is extracting more profit from assets it owns. In contrast, a decreasing ROA indicates poor investment decisions, excessive expenditure, and perhaps trouble for the organization.

- RAO ratio is used for competitive analysis, i.e., to compare different businesses in a similar industry. However, it is not useful for comparing companies in different industries.

- Calculating this ratio can be beneficial when deciding whether to invest in a firm. The ratio shows if the management team can turn a profit with the resources at its disposal.

Conclusion

In its simplest form, the return on investment (ROA) is a financial ratio that compares the earning power of a business to the amount of money invested in it. Simply put, ROA measures the effectiveness of an investment, whether it’s in terms of money or time.

Content writer at Invyce.com

Related Post

Copyright © 2024 – Powered by uConnect

Meena Khan