27 Sep

When you request a business loan, your lenders may ask for tangible net worth before making credit decisions. It provides an accurate snapshot of your finances. Therefore, it helps lenders to identify your ability to pay back credit in case of business loss. If you want to know more about tangible net worth and want to calculate it, read this article.

Table of Contents

What is Tangible Net Worth?

The term tangible net worth is a financial term. It’s the amount of assets your business owns minus the amount of intangible assets and liabilities. A company with tangible net worth carries an image of financial stability, which can be beneficial to attracting potential investors or lenders.

Tangible net worth is the value of tangible assets after deducting intangible assets and liabilities. It helps owners estimate their business’s worth or liquidation value of a company if they want to sell it. Examples of tangible assets may be cash, land and building, machinery, etc., and intangible assets may be goodwill, copyright, patent right, etc.

How to Calculate Tangible Net Worth?

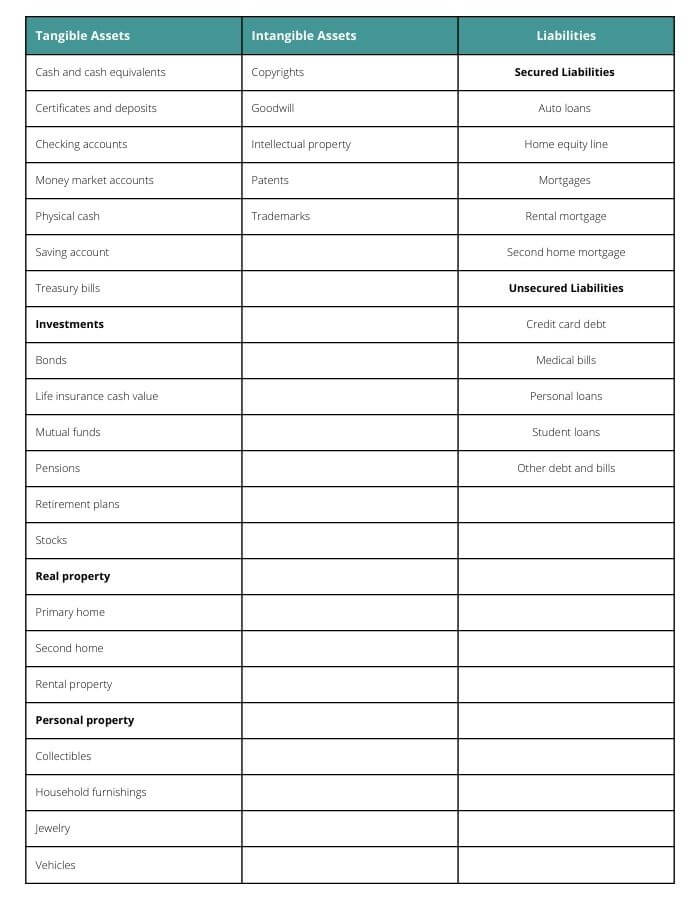

The TNW is calculated by subtracting liabilities from total assets. Assets include cash, checking accounts, investments, vehicles, and other valuable property, while intangible assets lack physical presence like goodwill, patents, etc. Liabilities include credit cards, car loans, student loan debt, mortgages, and other debts owed to others. Your tangible net worth is positive if your assets exceed your liabilities. In contrast, your TNW will be negative if your liabilities exceed your assets.

Tangible Net Worth = Total assets – Liabilities – Intangible assets

Or

TNW = Cash and cash equivalents + Investments + Property

Tangible Assets

A tangible asset is something that can be touched or felt. For example, tangible assets include cash and cash equivalents, real estate, cars, furniture, appliances, etc. Tangible assets have value because they can be touch, seen, heard, or felt. In business, tangible assets are often referred to as “hard” assets.

Intangible Assets

Assets that are intangible cannot be seen or touched. Examples of intangible assets include brand value, customer loyalty, employee training, patents, copyrights, trade secrets, and goodwill. Intangible assets are also known as non-financial assets.

Liabilities

A liability is a debt that a person or business has, typically in the form of money. They are shown on a balance sheet under current/short-term and long-term liabilities. Liabilities include loans, bills, mortgages, etc.

List of Tangible Assets, Intangible Assets, and Liabilities

Calculations

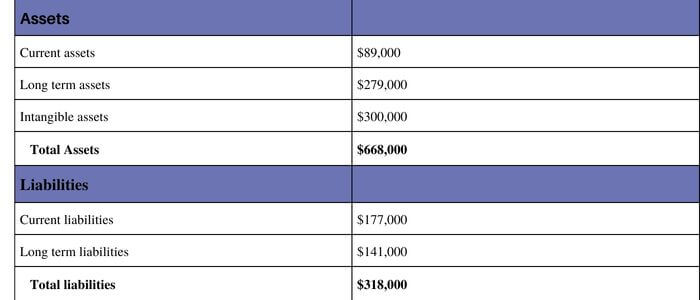

Following is the balance sheet of the company ABC. Find out the tangible net worth of the company.

Solution

By using the tangible asset formula, let’s find the tangible net worth of the company ABC.

Tangible net worth = total assets – total liabilities – intangible assets.

Tangible net worth = $668,000 – $318,000 – $300,000

TNW= $50,000

Key Takeaways

- Your tangible net worth is the value of your assets minus the value of your liabilities and intangible assets.

- Tangible assets can include cash, property, stocks, and mutual funds. In contrast, intangible assets include goodwill, intellectual assets, etc.

- Liabilities include such things as mortgages, loans, and credit card debt. Some assets and liabilities might be held jointly, and some are assumed only by individuals.

Content writer at Invyce.com

Related Post

Copyright © 2024 – Powered by uConnect

Meena Khan