11 Feb

Every business and company has its own principles that help business owners in reporting financial data. Accounting principles are rules and guidelines that companies must follow in reporting the company’s financial data. Moreover, the ultimate goal of accounting principles is to ensure a company’s financial statements are complete, consistent, and comparable. These principles makes it easier for investors to analyze and extract useful information from the company’s financial statements.

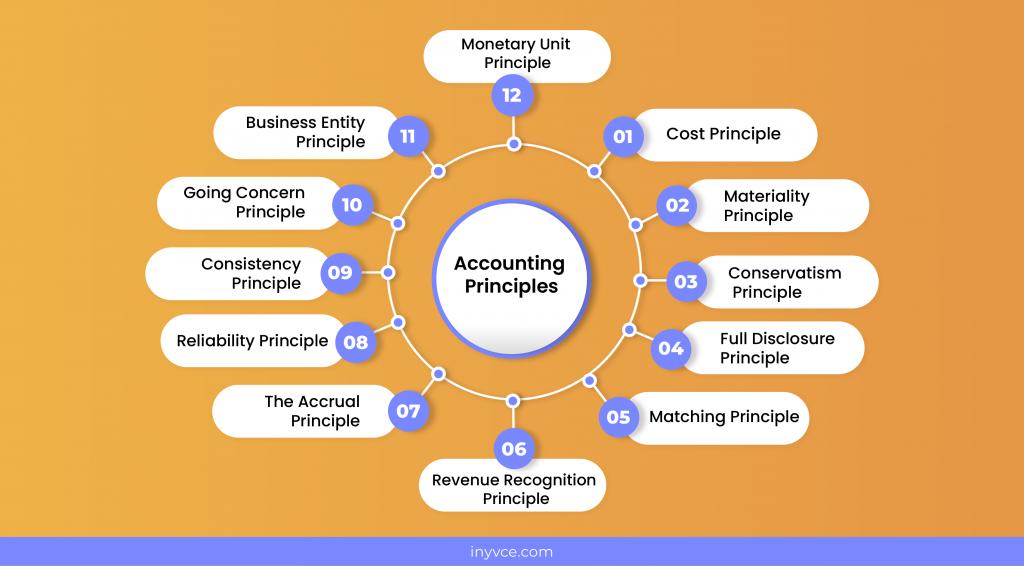

Basic accounting principles and guidelines govern the field of accounting on which accounting rules are based. Here you will find the most fundamental accounting principles in detail.

Table of Contents

What are Accounting Principles?

Accounting principles are the essential rules that an accountant makes sure and uses to prepare the financial statement of an entity. They are used by the standard-setting body to develop accounting standards and frames.

Accounting principles are standards that are defined by the Generally Accepted Accounting Principles (GAAP). Therefore, all of the concepts and standards can be traced back to the underlying accounting principles.

Here is the list and examples of accounting principles that will give you a better idea of how businesses use the accounting principles in action.

List of Accounting Principles.

Cost Principle

The cost principle states that any asset acquired by a company must be recorded in financial records at its original cash value rather than its market value. The assets recorded value will not fluctuate along with inflation or changes in market value.

Example:

A company purchased a land in 2018 worth PKR 200,000. After three years the value of land appreciates to RKR 600,000. but in the companies balance sheet,land is still recorded at PKR 200,000.

Materiality Principle

The materiality principle states that those accounting principles do not necessarily have to be followed if the impact of ignoring them is negligible. The impact of ignoring any accounting principle should not significantly affect the net income and other financial statements of a company. Materiality refers to the size of an amount and how it relates to the company’s size.

Example:

A business purchase a computer table For PKR 200 it was expensed in the year it was purchased instead of depreciating it over its useful life. According to the matching principle, every year a certain amount of depreciation should be charge to an asset but the materiality principle allows to expense entire amount in the year it was purchased, because the amount is not that much huge to mislead investors, creditors, or any other interested party.

Conservatism Principle

Conservatism principle is one of the main accounting principles which records future possible loses but not future gains or revenues. According to the conservatism principle businesses should record any future uncertain loses but not record future gains until they become certain.

Conservatism principle is concerned about the reliability of financial statements of an entity and benefits for the user, especially in the areas of overstating the revenue and assets and understating the loses and expenses. The conservatism principle says that company accounts should be prepared with caution and some moderation, especially in times of uncertainty. So in such times loses should be recognized immediately upon discovery, and revenues only when verified.

Example:

Company A files a sue against company B for a patent. If company A predicts that they will win a case and gain a large amount of settlement, then company A will not record this uncertain gain in financial statements until it becomes certain. While if company predicts to lose a case, then company A should record the amount which they have to pay if they lose a case.

Full Disclosure Principle

Full Disclosure obligates the entity to disclose all compulsory information in its financial statements. The main idea behind this principle is that the users of the financial statements of an entity might depend on the financial information disclosed in the financial statements to make their decision.

The entire disclosure principle is to report and share all necessary and relevant information transparently. Essentially, any information that could impact critical business decisions relating to the company and its activities must be reported openly in its financial statements.

Example:

A company fails to achieve a contract over their competitors, this results company a huge financial lose . Company may not wish to disclose this lose in their financial statements because this may badly impact their goodwill in the eyes of creditors and investors. But according to disclosure principle company is bound to disclose this loss in their financial statements.

Matching Principle

The matching principle states that any expenses and the revenues incured should be recognized in the same period. The guide acknowledges that an effect and cause relationship exists between revenues and expenditures. The purpose of matching expenses with revenues is to associate cost of assets and revenues to its benefits.

Example:

A company has a policy to pay 10% as a commission to sales agent on each sale. In August sales agent sold out goods worth PKR 50,000. Company paid PKR 5000 in September. According to matching principle a commission of 5000 should be recorded in August financial statements along with its sales.

Revenue Recognition Principle

Relate to the accrual principle; the revenue recognition principle says that a company should record revenue when a sale has been made, or when a service is given not when the related cash will received . If there is doubt whether the customer will pay for amount owe then allowance for doubtful debt should be maintained for the amount which company considers is not going to be realized.

Example:

Company X provided auditing services to a client in July worth PKR 100,000. The client didn’t pay for services received till august end. According to revenue recognition principle company should record PKR 100,000 revenue in july because revenue was earned in july.

The Accrual Principle

Accrual accounting requires the revenues and expenses to be recorded and recognized in the entity financial statement when induced, rather than when cash is received or paid.

The accrual principle states that transactions should be recorded when they happen and not when their resulting cash flow happens. This principle helps the users of financial statements get the financial information reflected in the current financial status of the economic situation of the entity.

Example:

A company purchase plant and machinery worth PKR 150,000 on 01.01.2022. The payment for transaction was made on 20.01.2022. According to accrual principle the record of transaction should made on 01.01.2022 not on 20.01.2022.

Reliability Principle

The reliability principle is also known as the objectivity principle. This principle is used as a guide for knowing what information is accurate, fair, relevant, and trustworthy. Only those transactions can easily be verified with evidence that should be recorded in accounts. Objectivity principle is concerned with financial information of a company that the information provided in financial statements and records should be accurate and reliable. Reliable and accurate data is maintained for decision making in the right time, trustworthy or accurate information required by outsiders or even insiders.

Consistency Principle

This consistency principle is the accounting principle that requires an entity to apply the same accounting policies, methods, and standards for reporting its financial statements.

The principle states that once a company has decided on an accounting principle. It can not be changed unless it leads to more accurate financial reporting.

Example:

A company uses the straight line method to charge depreciation on assets from several years but now company wants to use declining method of depriciation . For doing this company must have a logical reasoning . Now after few months of adopting declining method if company wants to switch back to straight line method then this is violation of consistency method.

Going Concern Principle

This principle assumes a company will stay in business in the future as long as there is no evidence to the contrary. This allows companies to accrue expenses to believe that they will still be in operation when it is time to meet financial obligations.

Example

A company runs four sub branches in a country, due to any reason company decides to shut down one of its branch . The company is still going concern because shutting down of one branch can’t provide lose to that extent that the whole company will liquidate . In case if company has only one unit and it becomes no more operational, then we can say that the company is no more going concern.

Business Entity Principle

Business entity concept or business entity principle considers the owner of an entity has different legal liabilities. Therefore, under this concept, the entity must record all transactions separately from its owner .This principle considers business and owner two different persons,therefore their accounts should be maintained separately.

This principle could help minimize conflict between owners if there are many owners of the entity. And it also prevents the owner from avoiding tax obligations to the government.

Example

One of business owner provided loan of PKR 500,000 to a company for two years. The amount of 500,000 is long term liablity for a company and is loan receivable for owner.

Monetary Unit Principle

The monetary unit principle concerns the valuation of events and transactions that entities record in their financial statements. In monetary unit assumptions, trades could be recorded in financial information only if they were measured in terms economics/ currency so anything that is not quantifiable is out of question to record in financial statements, It is also important that the unit of currency in which business records transactions should be consistent over a period of time.

Example:

Company purchase a building worth PKR 10,000 in 2019. Company records this transaction as increase in one asset( building) and decrease in another asset(cash/bank). Lets take an another example where a company has a very talented and skilled web developers now in this case company cant record the talent ad skill of employees as this cant be interpret interms of money

What is the Purpose of the Accounting Principles?

Accounting principles aim to provide the framework for how financial accounting is reported and recorded in financial statements.

When every company follows the same framework and rules, creditors, investors, and other financial statements. Users will have an easier time understanding the reports and making decisions based on them.

Wrap up

Accounting principles are important because they set the rules for reporting financial information. The aims to keep a systematic record to ascertain an entity’s financial position and financial performance.

These are the principle concepts, guidance, and rules that an accountant uses to prepare the financial statement of an entity. They are used by the standard-setting body to develop accounting standards and frames.

Marjina Muskaan has over 5+ years of experience writing about finance, accounting, and enterprise topics. She was previously a senior writer at Invyce.com, where she created engaging and informative content that made complex financial concepts easy to understand.

Related Post

Copyright © 2024 – Powered by uConnect

Marjina Muskaan