18 May

The (TVM) time value of money is the main concept in financial management. Moreover, the time value of money (TVM) includes the concepts of future value and discounted value. Therefore, a financial professional must know and operate the specific techniques of the time value of money.

The time value of money is an important financial concept, declaring that the current value of money is worths higher than its future value, given its potential to earn. Here, I will give you a detailed insight into the time value of money in a financial management.

What is the Time Value of Money?

The time value of money is the concept that the sum of the money is now worth more than the same sum will be at a future date due to its earning potential in the interval.

Time value of money is based on a simple principle that a rupee received today has a greater value than a rupee received in future.

The time value of money is a crucial concept because if an individual invests a sum of money it can grow over a period of time. Investing in a savings account is an even better idea to earn compound interest. On the other hand, if an individual didn’t invest money it will only lose value because of inflation and loss of earning potential over time. Just take an example of yourself and think, are you able to purchase the same things for $ 50 now, that you purchased 10 years ago? You surely answer no, because this is what is called the time value of money. Therefore, a financial professional must know and operate the specific techniques of TVM.

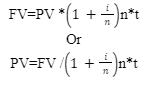

The Formula of the Time Value of Money:

Where:

PV = present value of money

FV= future value of money

I = Rate of interest or current yield on similar investment

T = No of years

N = No of compounding period of interest each year

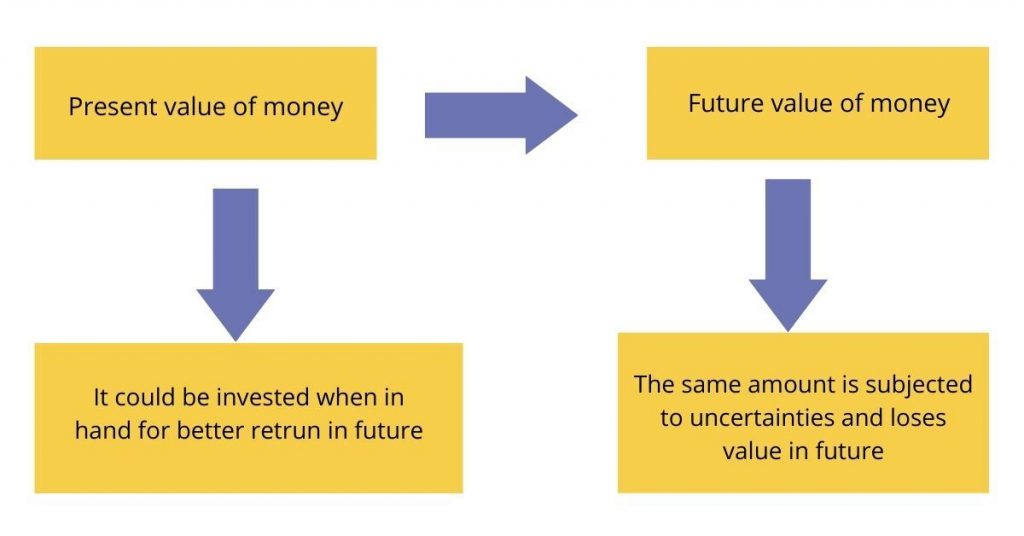

What is the Present Value?

Present value is the value of money you held today. It also presents the value of the sum of all future cash flow from an investment. The future cash flow is discounted at a discount rate. A lower discount rate suggests a higher present value of the future cash flow and vice versa.

What is Future Value?

Future value is the value of an investment at the end of the investment duration. Usually, it is expected that future value should be greater than that of present value because it grows over time and earns interest. So, for example, you can determine the future value for round-sum investments and recurring investments like SIPs.

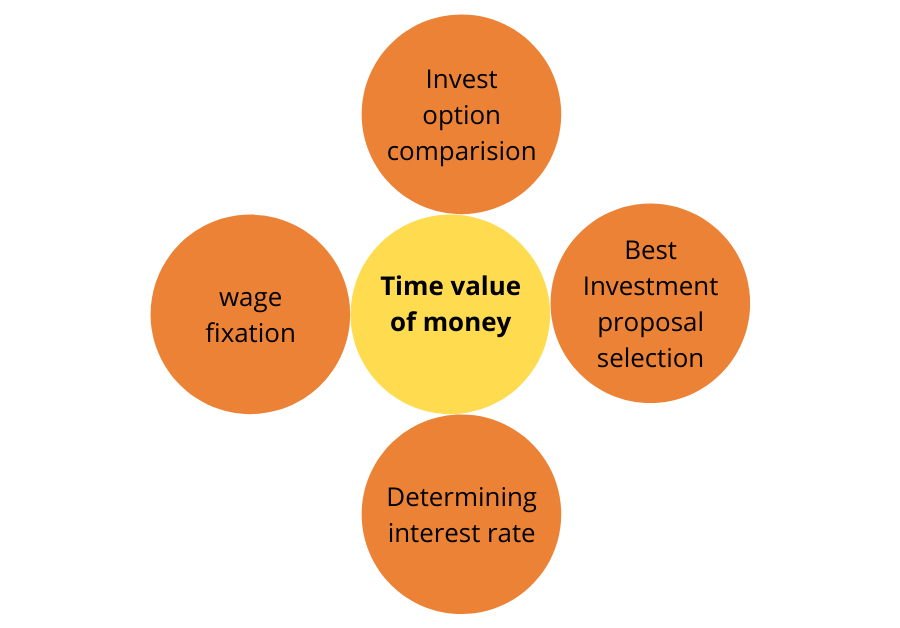

Importance of Time Value of Money(TVM)

- The time value of money is important because it helps investors and people to save more for retirement and determine how to get the most out of their dollars. This concept is fundamental to financial literacy and applies to your savings, purchasing power, and investment.

- The time value of money helps investors make the best investment decisions, knowing the future returns they should expect from what they invest.

- The money also loses its value over time, due to inflation affecting the buying power of the public.

- The future is always unclear. Therefore, the best financial decisions can be taken with the time value of money.

- TVM is an important area that one should know if you are associated with the field of finance especially when you are dealing with loans, capital budgeting, investment analysis, and other finance-related decisions. It is a fundamental building block on which the entire finance is built upon.

- In financial decisions, the time value of money holds great importance. It is the most crucial principle in finance and economics now because all investment decisions and other financial decisions are made solely on the basis of what and how much they will get in return from such decisions.

Time Value of Money Analysis

The time value of money concept detects the potential earning capacity of an amount in the future. It, therefore, help different financial sector to understand and compute the present value and compare the same with the future value of the particular amount. Then, based on the result obtained, they decide whether to invest in a specific asset, venture, or security.

Five Components of the Time Value of Money

Five components of the time value of money are.

- Rate of interest

- Time period(n)

- Present value PV

- Future value FV

- installments(PMT)

Interest Rate(i)

Interest rate is the rate of return received during the lifetime of an investment.

Time Period (n)

It refers to the number of time periods for which we want to calculate a sum’s present or future value. These time periods can be annual, semi-annually, weekly, monthly, quarterly, etc.

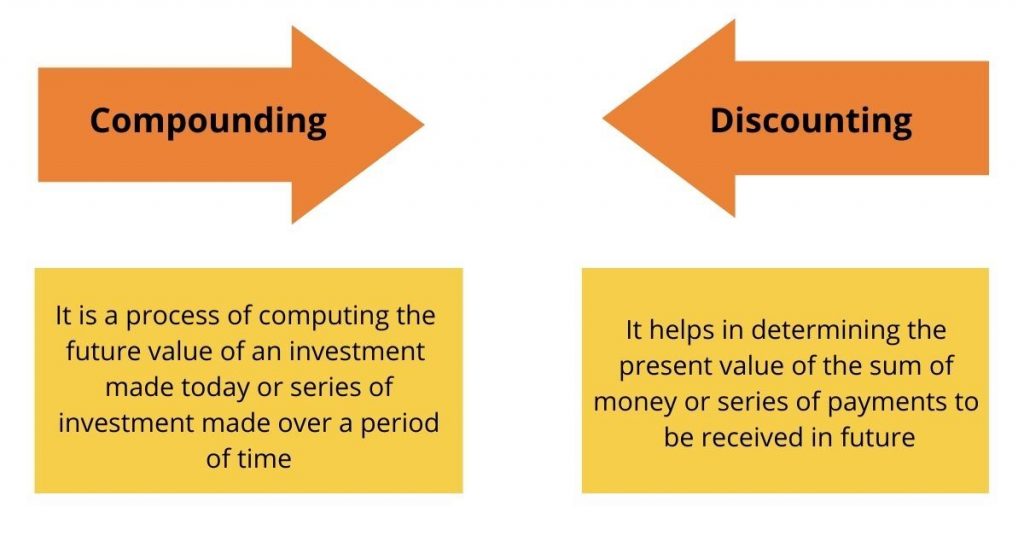

Present Value. (PV)

We obtain the amount by applying a discounting rate on the future value of any cash flow.

Future Value (FV)

We obtain the amount of money by applying a compounding rate on the present value of any cash flow.

Installments(PMT)

Installments represent the payments to be paid periodically or received during each period. Therefore, the value is positive when payments are received and becomes negative when payments are made.

Base for TVM

Key Takeaways

- The( TVM )time value of money is the main concept that one should understand if they are connecting with the fields of accounts and finance.

- The Present Value (PV) is known as the current value of a sum of money.

- Five major components of the time value of money are rates, time periods, present value, payments, and future value,

Marjina Muskaan has over 5+ years of experience writing about finance, accounting, and enterprise topics. She was previously a senior writer at Invyce.com, where she created engaging and informative content that made complex financial concepts easy to understand.

Related Post

Copyright © 2024 – Powered by uConnect

Marjina Muskaan