07 Jun

Contra accounts help determine a company’s historical cost; these accounts assist financial managers, and accountants in maintaining clean and easy-to-track financial records. It is necessary to keep a good record of historical costs for tax purposes. As a result, contra accounts are helpful in tax preparation and reduce the value of the associated accounts. In this article, you will learn about contra account, its types, and its benefits.

What is a Contra Account?

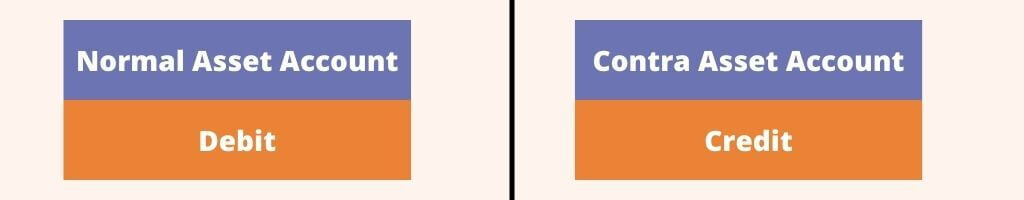

A contra account is an account of the same type used to reduce the value of a related account. It’s called a “contra” because it is recorded on the opposite side of a related account i.e., on the other side of the accounting equation.) For example, accumulated depreciation is a contra asset account that reduces the value of fixed assets on the balance sheet. It’s also possible for contra liability and contra equity accounts to exist.

Contra accounts allow for double-entry accounting to be simplified. They record reductions in related accounts; however, they can make financial statements more difficult to read and require investors to perform additional work.

The term “contra account” is used in accounting and finance to describe an account that’s a mirror image of another. In other words, contra accounts are accounts of the same type as the original account but with an opposite balance.

They are useful for reducing the value of related accounts on financial statements. They’re also helpful because they simplify double-entry accounting by transforming multiple entries into one entry each time you use them—a process known as eliminating duplicates or eliminating reversal. The name means “against” in Latin; however, it’s not just negatives. Contra accounts can be positive or negative, depending on their relationship with other accounts.

Types of Contra Accounts

There are three main types of contra account

Contra Assets

A Contra asset account has a credit balance rather than a debit balance, as seen in the normal assets.

Examples of contra assets

Accumulated depreciation

This account is used to record the cumulative amount of depreciation taken on an asset, which can be reviewed in the balance sheet. Accumulated depreciation reduces the value of a company’s real estates assets, such as buildings, equipment, and machinery.

Allowance for doubtful accounts

Allowance for doubtful accounts primarily refers to making an allowance for the estimated portion of accounts that may be uncollectible and thus become bad debt. It is shown as a contra asset account on the balance sheet, which reduces the gross receivables to represent the net amount that has to be paid.

Contra Liability

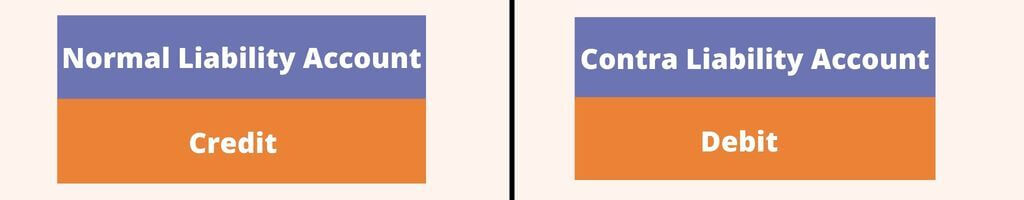

A contra liability account’s balance is a debit balance. A liability with a debit balance is used to reduce the balance of a liability. This account reduces the liability’s value. Contra asset accounts are more common than contra liability accounts.

Examples of contra liabilities

Discount on Bonds Payable

A discount on bonds payable occurs when a bond’s stated interest rate is less than the bond market’s interest rate.

Bond Issue Costs

Bond Issue Costs is a contra liability account reported alongside Bonds Payable. Bond issue costs include professional fees and registration fees associated with bond issuance.

Discount on Notes Payable

A discount on notes payable occurs when investors pay less than the face value of a note. The amount of the discount is the difference between the two values. This difference is gradually amortized over the remaining life of the note until it is gone by the maturity date.

Contra Equity

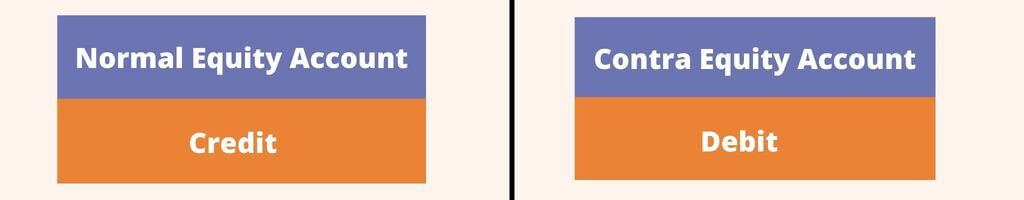

A contra equity account for owners or stockholders has a debit balance rather than a credit balance. The owner’s drawing account, a dividend account, and a treasury stock account are all examples of contra equity

Examples of contra equity

Treasury stock account

The stock of a corporation that has been repurchased from stockholders is reported in the treasury stock account. A stockholders’ equity account usually reports the cost of the repurchased stock.

Owner's drawing account

A drawing account is a ledger that tracks money withdrawn from a business by its owner, usually a sole proprietorship or partnership (s). A drawing account serves as a counter-account to the business owner’s equity; a credit offsets any debit to the drawing account to the cash account in the same amount.

Dividend account

When a company declares a cash dividend, the amount declared is deducted from the company’s retained earnings. Instead of debiting the Retained Earnings account when the dividend is declared, a corporation could instead debit the Dividends account (or Cash Dividends Declared).

Contra Revenue

Contra revenue accounts reflect lower gross income because certain asset expenses provide a company with a net revenue outlook. Examples of contra revenue accounts include sales returns, sales allowances, and discounts.

Examples of contra revenue

Return on sales

These accounts will reflect the monetary value of a returned product. This can be interpreted as a refund or a revenue loss for the returned goods. Sales returns accounts are used by businesses to track product issues and customer trends.

Sales allowance

Allowances are recorded when products sell for less than their normal price for any reason. Sales allowances can occur when there is a discount on excess inventory or when there is a discount due to product defects

Sales discounts

This includes the sales discount given to customers, which is typically a discount given in exchange for customers making early payments.

Benefits of Contra Account

Contra accounts are used to improve the accuracy of financial records. Because they’re designed to track changes in certain assets or liabilities, they can be used to document transactions more accurately. Suppose, you have a bank account that pays you interest every month, it would be helpful to have an income statement line item for “interest received. This is particularly relevant when making reports or presentations that require accurate data.

The use of contra accounts can also help prevent errors when recording transactions into general ledger systems such as double-counting items or missing out on revenue from services provided by one department but paid for by another. This is because all related transactions are grouped together under one heading instead of being separated by category.

Conclusion

In this lesson, we’ve covered contra accounts, which are accounts that reduce the value of related accounts when listed together on financial statements. Contra accounts are simple to implement and can simplify double-entry accounting; however, they do require some extra thought when it comes to their creation. Keep in mind that all contra accounts must be designated as such. Otherwise, they will be mistaken for standard accounts. In addition, they may need to be paid in future periods if you have a net operating loss or other items affecting your taxable income for a fiscal period (a year).

Content writer at Invyce.com

Related Post

Copyright © 2024 – Powered by uConnect

Meena Khan