10 Jun

Two methods of accounting and bookkeeping are the single entry system and the Double entry system used by businesses to record their financial transaction. Mostly, the double-entry system of accounting is the most important concepts in accounting and used for better accounting purposes. Moreover, it is a the fundamental processes in all accountancy systems, from the old accounting books to modern computers. This article gives you insight into the double-entry system, types, and advantages:

What is a Double-Entry system?

A double-entry system is used to summarize all business transactions. It deals with either two or more accounts for every business transaction. In this accounting system all transactions are record in terms of credit and debit. The debit in one account offsets a credit in another, in which the sum of all debits must be equal to the sum of all credits. Moreover, it use to satisfy accounting equation and also improve accuracy and detection of errors while making financial statements.

Equity

Equity( owners’ equity) refers to the amount of money invested in a business by its owners. It can also include a non-momentary value such as energy, time, and other resources.

Liabilities

These are everything that companies owe for the short and long term. Moreover, it include all payroll, taxes, loans, and credit cards.

Assets

These accounts provide economic value and future benefits—for example, cash, account receivables, and inventory.

Expenses

Expenses refer to “the cost of doing business” or any purchase you make or money you spend.

Revenue

Revenue is the total amount you earn on selling your products and services before expenses are taken out. In addition, it requires two book entries, such as debit and credit — for every transaction within a business.

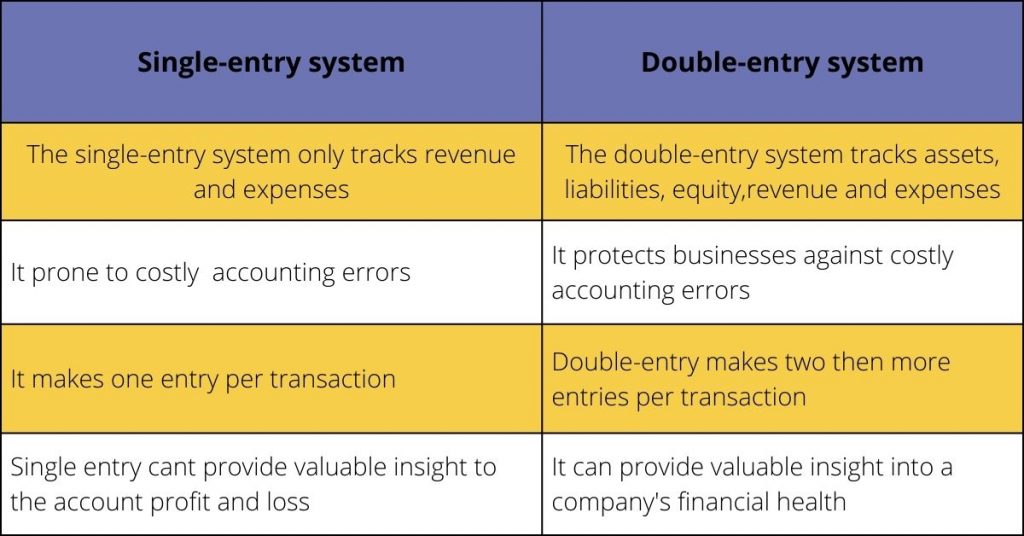

Single-entry vs double-entry system

Double-entry system examples

Example # 1

In double-entry accounting, if you are going to record a sale value of $300.You would need to make two entire, a credit entry and a debit entry. A debit entry of $300 to increase the balance sheet account called “Cash,” and a credit entry to increase the income statement account called “revenue.”

Example # 2

If you purchase a new computer for $800, you need to enter an $800 debit to increase your income statement “Technology” expense account and $800 credit to decrease your balance sheet “Cash” account.

Advantages of Double-entry system

The advantages are as under

- It tracks equity. Liabilities, assets, expenses, revenue.

- In this system, there is a minimum of two entries per transaction.

- It provide valuable insight into financial health.

- In addition, it protects businesses against costly accounting errors through trial balance.

- Moreover, Double-entry can keep the accounting records in detail, which eventually helps in controlling and help in financial decision-making.

- Detail records in the double-This entry can used for comparison purposes as well. The first-year record can be compared with the second year, and deviations found during the comparison can be worked on.

Final thoughts

The main reason that double-entry bookkeeping systems have been getting a lot of attention is that they have proved to be more efficient than the single-entry bookkeeping system. This is because focuses on balancing debits and credits, while single entries tend to ignore them when they are of no use towards the purpose of the accounting.

Shabana has been a committed content writer and strategist for over a 5 years. With a focus on SaaS products, she excels in crafting compelling and informative content.

Related Post

Copyright © 2024 – Powered by uConnect

Shabana