28 Sep

Most people around the world purchase homes as long-term investments. This is because the value of a home increases over time. Unfortunately, this is not always the case. The fluctuations in market prices happen all the time. Sometimes, the value of your home can decrease dramatically over time. When this happens, it means that you are in negative equity. If you’ve ever wondered what negative equity is, how it can happen to your property, and how to get out of it, then this post is for you.

What is Negative Equity?

If your real estate is worth less than the mortgage you took, you are in negative equity. It happens when real estate value falls below the outstanding value of your outstanding mortgage due to falling property prices in the market. It can be calculated by subtracting the amount remaining on the mortgage from the property’s current market value.

Sometimes, you might don’t know that you are in negative equity. To find out whether you are in negative equity or not;

- Check your mortgage statement or contact your lender.

- Then, ask the real estate agent to know your worth at the current time.

- If the property’s value is below your own, you are in negative equity.

Example

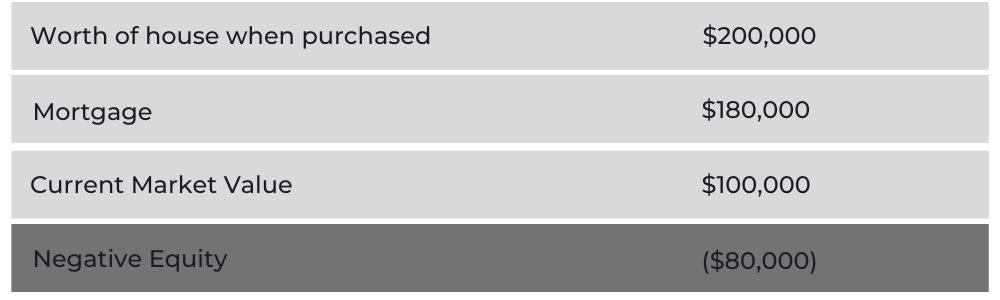

For example, a person purchases a house worth $200,000 with a mortgage of $180,000. After two years, he wanted to sell his house because he needed money immediately for some reason. After contact with a real estate agent, he finds that the current market value of his home is $100,000. In this case, the person is in negative worth. The mortgage on his house is $80,000, greater than his current property value.

How Negative Equity Happens?

Several situations can result in negative equity. The three possibilities we define below are as follows:

Negative equity for an asset: It usually happens in the housing and automobile industries. Typically, people use debt (such as bank loans or mortgages) to finance an automobile or a property. Real estate price fluctuations can cause a house’s price to drop, while more usage can cause a car’s price to drop (depreciation). It occurs when the asset’s value falls below the loan or mortgage balance.

Negative shareholders equity: It occurs when a firm has more liabilities than assets, or, to put it in more financial terms, when the company has sustained losses greater than the sum of its payments to shareholders and accumulated profits from prior periods. It appears under the equity-line item on the balance sheet.

Negative net worth: If the total debt exceeds total assets, negative net worth is the result. For instance, a person’s net worth will be negative if the total of their credit card, utility, outstanding mortgage, auto loan, and student loan expenses exceeds the whole amount of their cash and investments.

How to Get Out of Negative Equity?

Negative equity can cause problems If you want to sell your property immediately. If you don’t have enough savings or assets to pay the difference in mortgage and real estate worth, you can face issues in repaying. In this case, contact your lender as soon as possible. Your lender can find an alternative solution to this problem. Some lenders can also offer ”negative equity mortgage”,

Before buying real estate, do your research. If the prices are at their peak, don’t apply for a mortgage. Wait until the prices of real estate decrease. Once you own a property, don’t rush to sell it, especially when the market prices are low. Wait until the value of real estate rises again.

Key Takeaways

- Negative equity is when your mortgage exceeds the value of your home or other assets you owe. It can happen if a house price goes down and you still owe money on it.

- Real estate price fluctuations can cause a house’s price to drop, while more usage can cause a car’s price to drop.

- To avoid negative equity, wait for the prices to rise again in the market or contact your lender.

Related Post

Copyright © 2024 – Powered by uConnect