06 Apr

A cash book is a particular type of book that is only concerned with the recording of transactions of an organization. Cash account performs the binary role of both journal and a ledger for all the cash transactions taking place in a business organization.

A cash account records all cash receipts on the debit side and all the cash payments of organizations on the credit side.

This article has guide you about cash Book,types,format and advantages.

Table of Contents

What is a Cash Book?

The cash book is used to record payments and receipts of cash. Cash account works as a book of original entries as well as a ledger account. The entries related to receipts and cash payments are first recorded in the cash book and posted to the relevant ledger accounts. While it is a substitute for a cash account in the ledger. While a company that properly maintains a cash book does not need to open a cash account in its ledger.

Types and Format

There are three types of cash books.

Single Column

This type of cash book contains only the transactions done by the business. Single column cash book has only a single money column on both debit and credit sides. At the same time, it does not record the transaction which involves discounts or banks. The transactions done on credit are not recorded while preparing the single-column cash book.

Double Column

The double-column contains two columns i.e. cash and bank, both on the credit side as well as on the debit side. One column is for the transactions related to cash, and another column is for the transactions related to business bank accounts. So, under the double column cash book, the business’s cash transactions and transactions through the bank are recorded. However, the transaction which is done on credit is not recorded while preparing the double column.

Triple Column

This column is also referred to as a three-column cash book format, and it is a most comprehensive form which has three columns on both receipt and payment sides and records transactions about the cash, bank, and discounts. While this is generally maintained by the large firms that do transactions in cash mode and through the bank and frequently allow and receive cash discounts.

Example

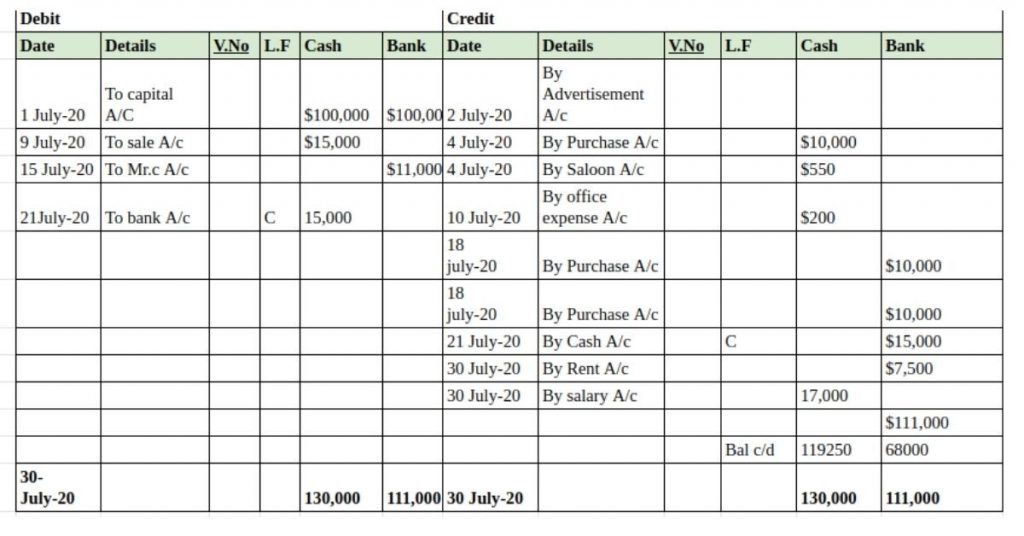

Mr.Y started the business in the month of July -2020. He invested the capital of $200,000, in which the cash contribution is $100,000, and the rest of $100,000 he deposited in the business bank account of a business.

On June 19, the following transaction took place in the business. Prepare the necessary double-column using the data as given below.

| Date | transaction |

| July 1 | Initial capital contribution.Cash:$ 100,000 and bank $ 100,000 |

| July 2 | Paid for advertisement $500 by check |

| July 4 | Raw material purchase from Mr.A worth $10,000 by paying cash |

| July 4 | Purchased cosmetics for cash worth $550 |

| July 7 | Raw material purchased from Mr.B for $20,000 on credit |

| July 9 | Goods sold to the customer for $15,000 in cash |

| July 10 | Mr. Y paid $ 200 for the office expenses in cash |

| July 13 | Gold sold on credit worth $ 11,000 to Mr.c |

| July 15 | Mr.Y received a check worth 11,000 for the goods sold on credit on 13- July 2019 from Mr.C. |

| August 18 | Raw material purchased for $10,000 by paying through check |

| July 21 | Withdrew from the bank $15,000 for business use. |

| July 25 | Goods sold on credit worth $5,000 |

| July 30 | Paid rent by check of $7,500 |

| July 30 | Paid salaries to the staff of $17,000 in cash |

Example of Double Column Cash Book Format

Solution:

Features

The following features are.

- This should always have a debit balance.

- It acts as both ledger and a journal

- A debit side should be identical to the credit side

- It can be used as an alternative to a cash account for recording transactions

- Moreover, it follows the dual entry system of accounting(i.e., debit and credit side)

Advantages

The following advantages are.

- It helps to detect any cash frauds in the organization

- It maintains a regular record of cash transactions date-wise for the convenience of accounting personnel.

- Save time and labor by reducing the workload.

- This offers easy verification of cash by matching the balance in the cash book with the actual cash in hand and is therefore helpful in identifying mistakes in the entry.

Key Takeaways

- It is recorded in historical order, and the balance is updated and verified continuously.

- A cash b is supplementary to the general ledger in which all cash transactions during a period are recorded.

- It differs from a cash account in that it is a separate ledger in which cash transactions are recorded, whereas a cash account is an account within a general ledger.

- Larger organizations divide the cash book into two parts as disbursement journal and the cash receipts journal.

- Three types of cash books are single column, double column, and triple column.

Marjina Muskaan has over 5+ years of experience writing about finance, accounting, and enterprise topics. She was previously a senior writer at Invyce.com, where she created engaging and informative content that made complex financial concepts easy to understand.

Related Post

Copyright © 2024 – Powered by uConnect

Marjina Muskaan