21 Dec

Imagine you are the CEO of a large corporation, and you have just received a surprise visit from a group of concerned shareholders. They present you with a resolution that calls on the company to divest from a certain industry or to adopt a new environmental policy. As the CEO, you know that this resolution of shareholder could have significant implications for the company’s business and reputation.

This scenario illustrates the shareholder resolutions, which are proposals made by shareholders to be voted on by the other shareholders of a company. These resolutions can address a wide range of issues, from corporate governance and executive compensation to environmental and social concerns. Read this article to explore more about shareholder resolution.

What is Shareholder Resolution?

A ‘resolution’ is a formal decision made by a vote at a meeting. A shareholder resolution is a proposal made by a shareholder or group of shareholders to be voted on by the other shareholders of a company on certain concerns. These resolutions are typically made in order to address a specific issue or concern that the shareholders believe is important to the company or its stakeholders.

Shareholder resolutions allow shareholders to have a say in how to run a company and to express their concerns about certain issues. These resolutions ensure that the company is accountable to its shareholders and that its policies and practices align with the values and interests of its stakeholders.

Issues Included in Shareholder Resolutions

Corporate governance issues: Shareholder resolutions related to corporate governance might address issues such as board composition, director independence, or executive compensation. These resolutions may be used to propose changes to the company’s governance structures or practices or to express concerns about certain aspects of the company’s governance.

Environmental and social issues: Shareholders may also introduce resolutions related to environmental or social issues that they believe are important to the company or its stakeholders. These could include issues such as climate change, sustainability, human rights, or diversity and inclusion.

Executive compensation: Issues related to executive compensation, including proposals to change the way executives are paid or to express concerns about the level of executive pay may also include in resolutions.

Other matters of corporate policy: Shareholder resolutions may also address a wide range of other issues related to corporate policy, such as mergers and acquisitions, dividend payments, or strategic planning.

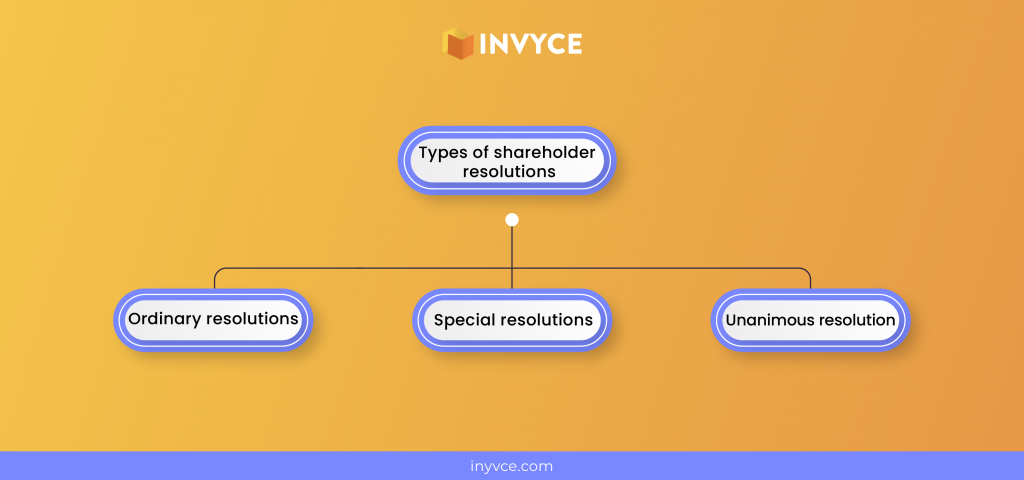

Types of Shareholder Resolutions

There are three main types of shareholder resolutions: ordinary resolutions, special resolutions, and unanimous resolutions.

Ordinary Resolutions

An ordinary resolution is a resolution that is passed by a simple majority of the shareholders who vote on it. In other words, if more than half of the shareholders who vote on the resolution support it, it will pass. Ordinary resolutions are used for routine matters that do not require a higher threshold of support for example Buyback of Shares, Issuing shares under the employee stock options, change of directors increasing authorized capital, or deciding on high-level executives’ pay.

Special Resolutions

A special resolution is a resolution that requires a higher level of support to pass, typically a two-thirds majority of the shareholders who vote on it. Special resolutions are used for more significant matters, such as changing the company’s articles of incorporation or bylaws, any reduction in share capital, voluntary winding up of the company, ratification of decisions taken by the directors, etc.

Unanimous Resolution

A unanimous resolution is a resolution that requires the support of all of the shareholders who are eligible to vote on it. These resolutions are used for very rare or important matters that require the unanimous agreement of all shareholders.

Eligibility Criteria

There are several eligibility criteria that a shareholder may need to meet in order to introduce a shareholder resolution. These criteria can vary depending on the laws and regulations of the jurisdiction in which the company is incorporated, as well as the company’s own rules and policies.

Here are some examples of eligibility criteria that a shareholder may need to meet in order to introduce a resolution:

Ownership: The shareholder must typically be a shareholder of record at the time of the resolution submission and must meet any minimum ownership requirements that may be in place.

Length of ownership: The shareholder may need to have owned the shares for a certain length of time in order to be eligible to submit a resolution.

Support: The shareholder may need to obtain the support of a certain number or percentage of other shareholders in order to have the resolution considered.

Timing: The shareholder may need to submit the resolution by a certain deadline in order to have it considered at the annual meeting or other specified meetings.

Form and content: The shareholder may need to follow certain rules and guidelines for the form and content of the resolution, such as formatting requirements and word limits.

It is important for shareholders to carefully review the rules and requirements for introducing a resolution in order to ensure that their resolution will be considered by the company and voted on by the other shareholders.

Conclusion

In conclusion, shareholder resolutions are an important tool for shareholders to have a say in how their company is run and to express their concerns about certain issues. These resolutions can address a wide range of matters, including corporate governance, environmental and social concerns, executive compensation, and other matters of corporate policy. To be effective, shareholder resolutions must be carefully crafted and must follow the necessary procedures and requirements for submission and voting. By participating in the resolution process, shareholders can help ensure that their company is accountable to its stakeholders and that its policies and practices align with their values and interests.

Content writer at Invyce.com

Related Post

Copyright © 2024 – Powered by uConnect

Meena Khan