02 Mar

Identification and analysis of transactions in accounting is an essential part of the accounting process. Whenever a business starts to keep chronological records of its business transactions, it aims to maintain books of accounts that are free of errors and quickly help access its business performance. In this article, you will find what a transaction is and how the identification and analysis Of transactions In Accounting is processed – let’s go into details.

Table of Contents

What is the Identification of Transactions?

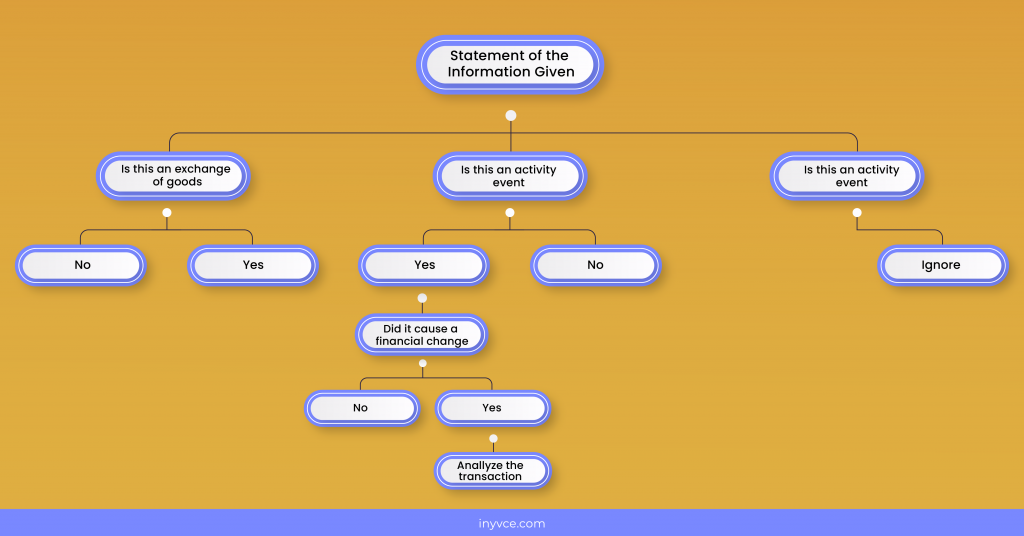

Identifying Transactions is the initial step of the accounting cycle. Identifying a transaction means determining if it exists and whether It is a monetary transaction related to business. However, in books of accounts, only transactions related to business will be recorded that are separate from owners’ transactions. After a transaction has been identified, then it is analyzed. The analysis is deciding which accounts will be affected by that Transaction and what changes it will have on the books of accounts.

Example of Identify Transaction

Example .1

Michal owns a restaurant. He buys two stoves so that staff can prepare more meals in less time.

According to the above chart, we would identify this statement as a transaction; we would recognize this as a transaction because it is an exchange, i.e., Michal is buying two stoves in exchange of money for goods(stoves).

Example.2

Several months later, one of the stoves stops working, and Michael throws it out.

The above chart will identify this statement as a transaction because it is an event, even though it is not an exchange. This event will directly cause the financial position of the business to change. Michal is throwing out the stove means that the company will have fewer assets than before.

Example.3

statement

Michal is considering hiring some more employees. By following the charts, we would not identify this as a transaction because it does not directly affect the financial position. However, it can affect the financial position if Michal hires employees.

Accounting Transaction

A transaction is an economic event that changes a business’s financial position against the exchange of goods or services. In other words, a business activity or event that impacts a company’s financial statements is considered a transaction. An example is Apple representing nearly $200 billion in cash and cash equivalents in its balance sheet, which is an accounting transaction.

Recording of such transactions is based on the fundamental accounting equation:

Assets = Liabilities +Equity

Accounting Transaction Example

Example:

Nilo owns a cosmetics shop and expanded her delivery business; she bought a second-hand delivery carrier worth $35,000. She also made the cash payment to the seller and noted the entries in the book of accounts.

Analysis of Accounting Transaction

The accounting transaction analysis translates the business events and activities that have a computable effect on the accounting equations into the accounting language and writes it into the book of accounts.

An analysis of accounting transactions is the first step of the recording process of the accounting cycle, which is the foundation of accounting types.

This is the process of analyzing business transactions to determine their effects on the book. Therefore, business analysis ensures that the accounting equation stays balanced after completing each transaction.

How to Identify and Analyze Transaction?

To identify and analyze transactions, accountants need to do some assessments. Identifying transactions means determining if a transaction exists and whether or not it is relevant to the business. After the transaction has been identified, it is then analyzed.

The analysis decides which business accounts will be affected and how they will be affected. But to analyze a transaction, one must know which events are considered transactions.

In accounting, transactions must involve at least one of the below-mentioned two categories.

- An event /activity/ process that immediately or directly changes the business’s financial position.

- Goods or services can be exchanged for money or other goods or services carried out by or on behalf of the business.

Six-Step of Accounting Transaction Analysis

Identify If the Event is an Accounting Transaction

First, you need to determine whether this transaction is a business-nature transaction. An accounting transaction has to involve cash because only signing a contract can not be considered a transaction, and it must require making a payment to consider it an economic event or transaction. Examples include the sale of products, the purchase of equipment, and salary payments.

Identify what Accounts it Affects.

The second step is to identify which accounts the Transaction will affect. For example, John invested $100,000 in a business and purchased a truck with a market value of $ 50,000.

The cash invested will be capital. The truck purchase will be an asset for that business. The accounts impacted by transactions are capital, truck, and cash accounts.

Identify what Accounts it Affects.

Every Transaction results in a measurable change in the accounting equation. Knowing whether the account belongs to asset, liability, or equity will let you know to identify whether the account will have debit or credit balances. In the above example, we determined that the accounts involved are Asset accounts, i.e., truck and cash, and the capital account is the Owner’s Equity account.

Identify which Accounts are Going up or Down

A business uses debit and credit effects to record any transaction. These double-entry procedures keep the accounting equation in balance. So when John invests cash, the capital and cash account increase because, at this stage, money, and capital are coming into the business. On the other hand, when a truck has been purchased, truck(asset) accounts will increase, and cash(asset) account will decrease.

Apply the rules of Debits and Credits to the Accounts

Every business must record transactions in two or more related but opposite accounts. Therefore, we debit one account and credit the other in the same transaction amount.

We apply golden rules of accounting to record these transactions, accounts on the left side increase with a debit entry and decrease with a credit entry, while accounts on the right side increase with a credit entry and decrease with a debit. So, if the plant and machinery account increases, which is an asset account, it will be debited to show an increase in assets. While to show the increasing effect of equity, we record on the credit side of an entry.

Find the Transaction Amounts to be Entered

The last step of analyzing transactions is to identify the amounts to be recorded on the debit and credit sides of an entry. For example, in the above example, if capital was invested Rs.10,00,000, then debit will be given to the cash account with Rs.10,00,000, and credit is given to the capital account with the same amount.

Bottom Line

Whenever a business starts to keep chronological records of its business transactions it aims to maintain books of accounts that are free of errors and quickly help access its business performance.

So to achieve this purpose every business first needs to identify transactions that must be considered in books of accounts. Hence the proper accounting cycle begins with the identification of transactions.

Marjina Muskaan has over 5+ years of experience writing about finance, accounting, and enterprise topics. She was previously a senior writer at Invyce.com, where she created engaging and informative content that made complex financial concepts easy to understand.

Related Post

Copyright © 2024 – Powered by uConnect

Marjina Muskaan