19 Sep

When you need money, you don’t always have time to apply for a loan or look into your financial standing. Many different loan options are available to people, whether they are in a financial crisis or just want to make improvements to their homes. However, a line of credit (LOC) could be the best option for you in this case. LOC is an open-ended revolving loan that can be accessed on demand Read an article to learn more about a line of credit in detail.

Table of Contents

What is a Line of Credit?

A line of credit (LOC) is a flexible loan from a bank or financial institution. It can be used to cover an overdraft on a checking account, a cash shortage when you borrow money, or short-term needs. It helps you pay for education costs and day-to-day expenses or start a business. It can also help you to manage your cash flow.

The maximum amount of money you can borrow is called the credit limit. You’ll only be required to make payments of the principal amount plus interest for the amount you’ve used. Which means that you can have a zero balance on your line of credit if you pay off all your bills in full each month. Your payments will vary depending on how much you’ve borrowed and the lender’s interest rate. Interest is calculated based on the amount you owe and your credit limit.

Example Of The Line Of Credit

Let’s say that John’s line of credit is $100,000. In Aug 2022, he had a car accident. His doctor’s bill was $70,000. As he didn’t have any cash or savings, he decided to withdraw money from the line of credit. At the end of the month, he received the bank statement in which the interest rate was mentioned only on the amount he used. Therefore, he will repay the principal amount of $70,000 with interest charges on this amount. Before this, he never withdrew any money; therefore, he didn’t need to repay any interest charges for previous months.

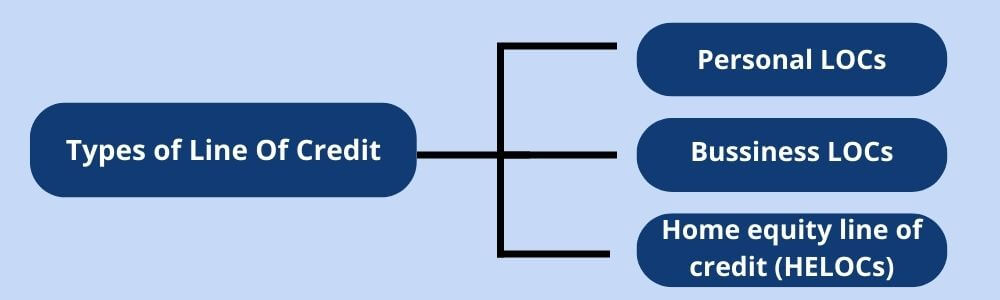

Types of the line of credit

When most borrowers take out a line of credit, it’s usually a personal LOC, a business LOC, and a home equity LOC.

A Personal Line of Credit (PLOC)

A PLOC is a loan you would use for personal purposes. The personal line of credit is a low-interest borrowing product that allows individuals to finance expenses that are not normally covered by tax-deductible benefits. This includes paying for home improvements, moving expenses, weddings, entertainment or giving financial assistance to someone in need. Personal lines of credit are good choices for unexpected expenses and large purchases over time.

Before taking a personal LOC:

- Discuss the product with your lender.

- Decide what amount you can afford to pay monthly and how much money you’ll need on your purchase.

- Be aware that interest will be charged in different ways depending on your use of the credit.

A Business Line of Credit (BLOC)

A business line of credit is a commercial loan granted by financial institutions that enable businesses to borrow against their assets or earnings. The loans are used for various purposes, such as expanding the business, purchasing fixed assets, finishing construction work, purchasing inventory, etc. The money lent to a business LOC is also known as an overdraft or check advance and can be taken on demand with an approval process taking place before finance is granted. Lenders frequently use your personal and business financial data when determining whether you are creditworthy for a business line of credit.

Home Equity Line of Credit (HELOC)

A HELOC, commonly referred to as a second mortgage is a type of revolving credit that enables homeowners to borrow money against the equity in their home. It is calculated as the home’s appraised value, less the mortgage balance.

A draw period, typically ten years long, is a feature of HELOCs that allows borrowers to access available funds, pay them back, and then borrow again. The remaining debt is due following the draw period, or a loan is extended to cover the remaining sum over time.

Advantages of the LOCs

- A line of credit provides a temporary cash flow solution that stabilizes your budget.

- LOC can be a cheaper option as it typically offers lower interest rates and offers more-flexible repayment schedules.

- It allows you to borrow funds and spend them as you wish.

- A line of credit can be very useful for emergencies or short-term financial needs.

- They are available to anyone and can be used as needed.

Disadvantages of the LOCs

As with all financial products, lines of credit come with some drawbacks.

- Overborrowing against your line of credit can put you in financial trouble. Although they are generally a great tool for dealing with the monthly whims of your budget, carefully follow the terms and conditions carefully.

- It often requires extra steps to access your balance. Sometimes, you must meet with a customer service representative or a decision-maker. In either case, you will want to make regular personal contact with a bank representative to ensure you receive the best possible terms.

- Although they offer the benefits of extra flexibility, but can still carry a higher interest rate than other lending products.

- There is a credit evaluation process to approve LOCs. Therefore, borrowers with poor credit will have a more challenging time being approved.

- LOCs are usually cheaper than credit cards. However, they’re more expensive than traditional secured loans, such as mortgages or auto loans.

Conclusion

To summarize, a line of credit can cover short-term needs or emergencies. You can borrow up to your credit limit and make only interest and principal payments. An unsecured loan allows you to borrow and spend funds as you wish. LOC is a good way to build your credit, but it can also lead to financial trouble if you don’t keep up with repayments.

Content writer at Invyce.com

Related Post

Copyright © 2024 – Powered by uConnect

Meena Khan