15 Sep

Revolving credit can be an adaptable and convenient option for borrowing money. If you are using a credit card, you’re already familiar with revolving credit. Revolving credit is a form of consumer credit that allows consumers to borrow funds legally for particular purposes. It enables borrowers to exceed their charge limits only when they need money for a specific purpose or when it is impossible to borrow from other sources.

Read further to know more about revolving credit.

Table of Contents

What is Revolving Credit?

Revolving credit is a credit account where you can borrow money repeatedly until you’ve repaid the entire balance. It is a type of credit that is automatically renewed as the credit amount is paid. You can borrow money from a credit line with revolving credit and repay it repeatedly. You can borrow credit on an ongoing basis through revolving credit. Like other borrowings, it has an interest rate, a spending limit, and a monthly payment.

One way to think of revolving credit is as easy to access credit. With revolving credit, you can regularly borrow money up to your credit limit while paying off your debt gradually over time. Your assigned credit limit determines how much you can charge to the account. The more you pay monthly, the more credit becomes available for use.

Revolving Balance

Considering that you’ll always pay your bill in full each month, you might request credit. But obstacles can arise from daily living, such as car malfunction, doctor’s appointments, etc. Due to this, you might be unable to pay the bill on time. The unpaid amount rolls into the next month when you don’t pay your revolving credit monthly. This balance is known as a revolving balance.

How Does Revolving Credit Work?

The lender will set a credit limit when you’re approved for a revolving credit account, like a credit card. The amount of credit you’re allowed to use each month is your credit line or credit limit. You can use that credit line as much or as little as you wish on any purchase. You have three options for handling outstanding balances:

- Paying them off entirely at the end of each billing cycle

- Carrying them over to the following month

- “Revolving” them

At the end of each statement period, you receive a bill for the balance. If you don’t pay it off in full, you carry the balance to the next month and pay interest on that amount. More of your credit line becomes accessible as you reduce the balance. Make sure you pay your balance off monthly when using a credit card. If you don’t pay your credit on time, you will have to pay unexpected interest and the associated fee with the borrowed money.

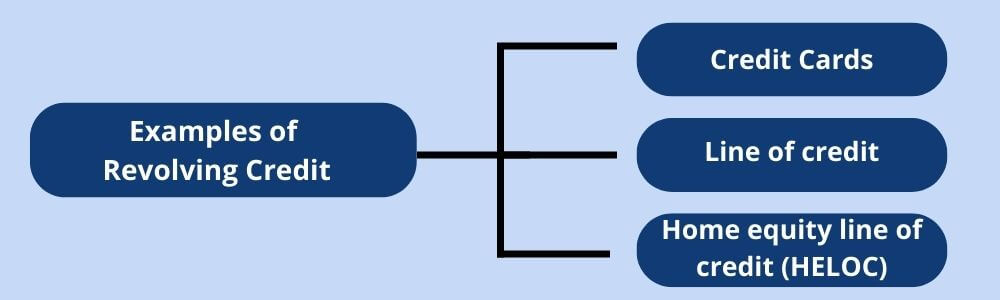

Examples of Revolving Credit

Common examples of RC include; credit cards, lines of credit, and home equity lines of credit (HELOCs).

Credit Card

A credit card is a piece of plastic or metal issued by a bank or financial services company that allows cardholders to borrow funds to pay for goods and services with merchants that accept cards for payment. People use these cards to make everyday purchases or pay for unexpected expenses. Some credit cards have rewards and benefits you can use to your advantage.

Line Of Credit

The customer is not required to purchase in order to use a line of credit. Instead, it allows money to be transferred into a customer’s bank account for any reason without requiring an actual transaction using that money. In addition, no physical card is involved in using a line of credit, unlike a credit card; they are typically accessed via checks issued by the lender.

Home Equity Line Of Credit (HELOC)

An open-ended credit account called a home equity line of credit (HELOC) enables you to borrow money against the value of your house. You can borrow and refund the money several times if you don’t exceed your credit limit. It’s crucial to understand how a HELOC varies from a home equity loan, which is often a one-time, fixed-interest loan for a large quantity of money. HELOCs function similarly to credit cards, except that your home’s equity backs the line of credit.

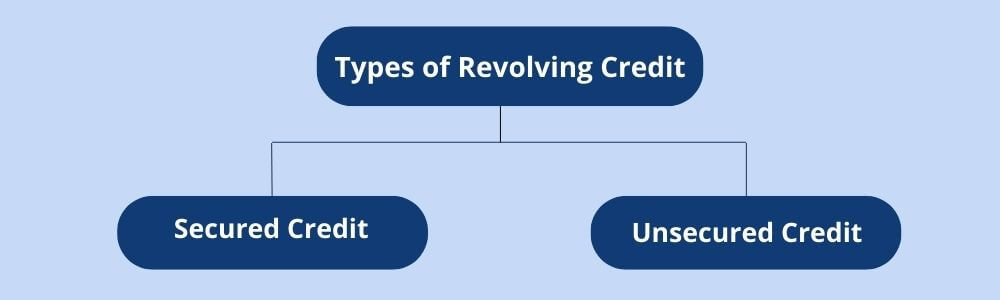

Types of Revolving Credit

There are two main categories of revolving credit; secured and unsecured.

Secured Credit

Secured revolving credit is a credit backed by collateral. It is guaranteed by collateral, such as a home in the case of a HELOC.

Unsecured credit

Unsecured revolving credit is a type of credit that is not secured by collateral, such as a deposit. Instead, the credit limit is determined mainly by the card member’s credit profile. Unsecured revolving credit is not guaranteed by collateral or an asset, for example, a credit card.

Difference Between Revolving Credit And Installment Loan

- Revolving credit differs from an installment loan, which requires a fixed number of payments, including interest, over a set period of time. Revolving credit requires only a minimum amount plus any fees and interest charges, with the minimum payment based on the current balance.

- Revolving credit is more flexible than installment loans. In the case of installment loans, You must make the full payment on your home or auto loan if money is tight for a given month; you cannot make the minimal payment. However, you can only make the minimum payment on your revolving credit accounts.

- Revolving credit allows you to borrow money continuously, while installment credit is meant for one-time borrowing. You cannot reborrow the same amount from an installment loan once you have paid it off. When you use revolving credit, you can immediately draw more money or make new purchases up to your credit limit.

- For an installment loan, once the account is closed, you can’t go back and borrow the same amount again. With revolving credit, you can draw or spend again within your credit limit as soon as you pay down your balance.

- Revolving credit often has a significantly higher interest rate than installment credit; it may even be six to seven times higher.

- Revolving credit is intended for shorter-term and smaller loans.

- Because you can withdraw over time with revolving credit, there usually isn’t one set purpose for what you’re spending it on. On the other hand, installment credit is typically borrowed for one specific reason, like buying a car or taking out a student loan for the semester.

Conclusion

If you are looking for opportunities in credit and finance, then revolving credit is the best thing for you. It is one of the most useful financial products you can ever have. You can use it for funding your business, or you can also use it for getting loans for personal use or for repairing and upgrading your current home appliances. Revolving credit is one of the most popular methods used by people nowadays to get easy cash investments and other financial facilities. However, before applying for such loans and other facilities, there are certain essential aspects that you need to consider as well.

Content writer at Invyce.com

Related Post

Copyright © 2024 – Powered by uConnect

Meena Khan