20 Jun

There are two types of techniques for accounting for financial transactions. The Traditional Approach and the Modern Approach are two different approaches. Let’s learn more about the modern accounting approach, also known as the accounting equation approach.

Table of Contents

Modern Approach of Accounting

The modern approach of accounting believes that financial accounting provides valuable information in investment and credit decisions. It uses accounting equation to debit or credit any transaction or account. This method is considered more accurate and in line with Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS) and is widely used by businesses today.

It also provides a way of thinking about how financial accounting works and clarifies what statements should look like when they are prepared correctly. For example, any company’s balance sheet will tell you the value of its assets, liabilities, or capital structure at a given time. At the same time, its income statement will report on revenues earned during some period (e.g., month) and expenses incurred during that period

Accounting Equation

Under the modern approach to accounting, the accounting equation is used to record transactions or debit or credit accounts. This approach is also referred to as the accounting equation approach, as it utilizes the accounting equation to ensure that the balance sheet remains in balance.

The key to understanding this formula is that assets are, by definition, anything that can be use to earn revenue and use to help in daily business operations.. The liabilities component of the equation represents those obligations that a business can pay off with assets in a short period (usually within one year). And capital represents the cash or resources invested by owners or shareholders in business.

The modern equation approach believes that financial accounting provides helpful information in investment and credit decisions. However, many accountants, who feel it creates a conflict between their profession’s ethical responsibilities and those of investors and creditors, usually criticize this approach.

Modern Classification of Accounts

As per the modern approach, transactions are divided into numerous groups listed below.

Assets Accounts

Assets are resources owned by a person or company. They can be current or non-current assets, and intangible assets such as patents and copyrights. An asset account is a type of account used to record financial resources that a company owns or controls, such as cash, investments, inventory, and property. For example Cash, bonds, mutual funds, account receivables, buildings, and furniture is included in assets account.

Liabilities Accounts

Liabilities are any debts owed by a person or company. Again, they can be current liabilities or non-current liabilities. Examples of liabilities include wages payable, interest payable, long-term borrowings, bonds payable, income tax payable, and many more.

Capital's Accounts

The money that the owner puts into the business is referred to as capital or owner’s equity. The owner might bring in the capital in cash or assets. It is the difference between total assets and liabilities and represents a company’s total ownership. It’s also known as net assets or net worth.

Revenue Accounts

Revenue Accounts reflect the business’s income and, as a result, have credit balances. For example, according to modern classification of accounts the sale account is considered as a revenue account.

Expenses Accounts

In accounting, expenses are the funds or charges incurred by a company to earn revenue. When a corporation sells commodities, for example, the associated cost is what it pays to and sell those things are considered as expense. For example, transportation expense, advertisement expense, route expenses.

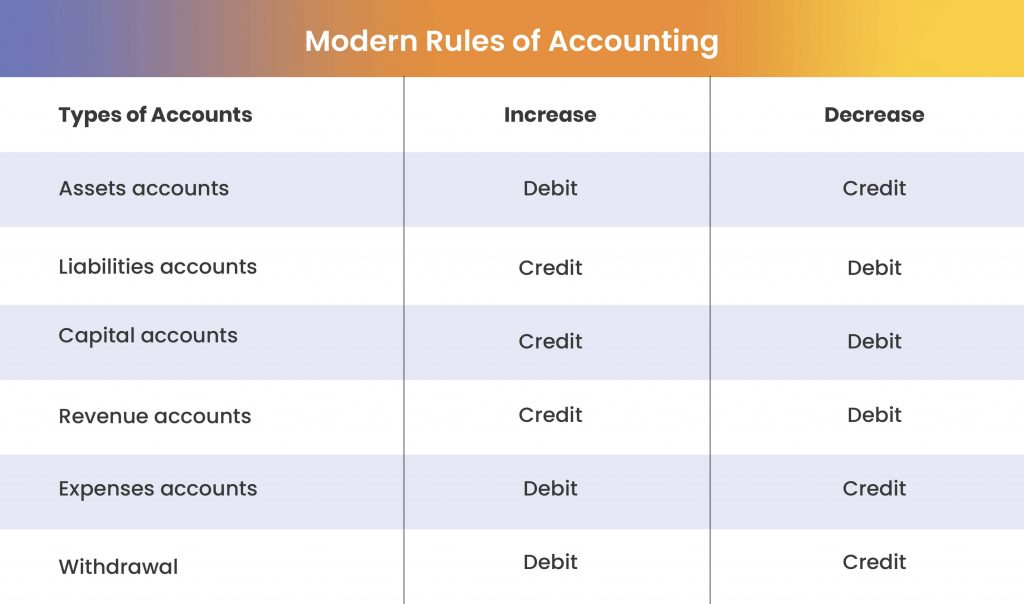

Modern Rules of Accounting

The traditional approach of accounting categorizes accounts into three types: real, personal, and nominal. However, the modern system classifies accounts into six types: asset, liability, revenue, expense, capital, and withdrawal. These categories are used to classify transactions and affect the debit and credit sides of a ledger.

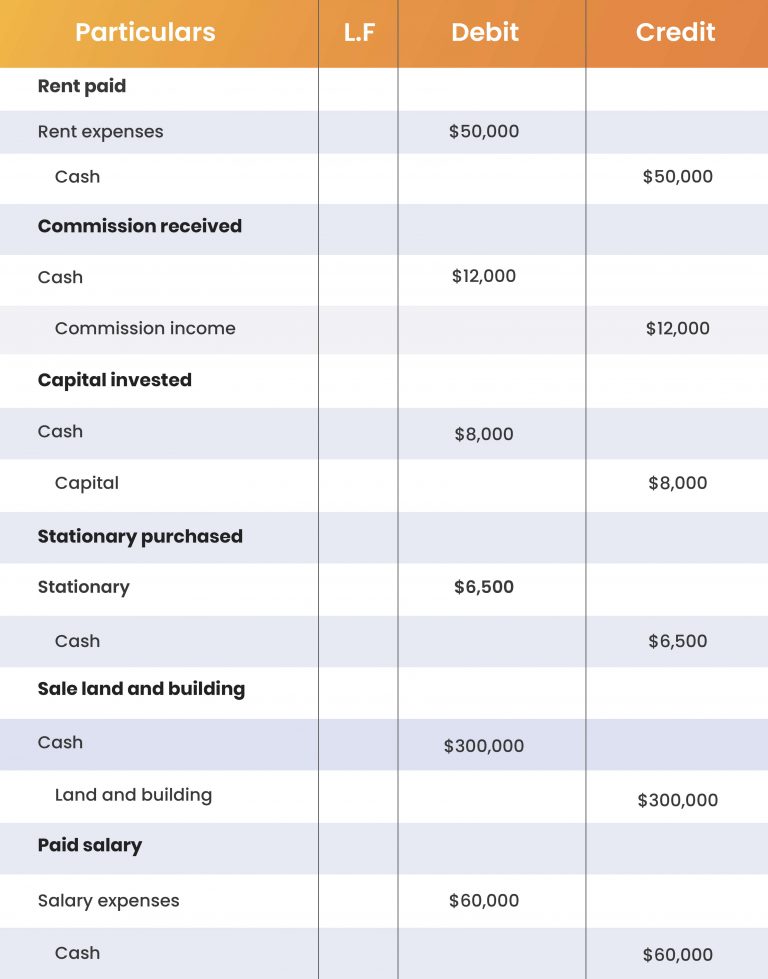

Modern Approach Journal Entries Example

Analyze the following transactions using rules of debit and credit under the modern accounting approach.

Following journal entries will passed;

Conclusion

The modern equation approach states that financial accounting provides valuable investment and credit decision information. Therefore, it is essential to understand the basic accounting equation of assets = liabilities + shareholders’ equity. Without knowing this equation, making well-informed decisions about investments or credits will be difficult.

Marjina Muskaan has over 5+ years of experience writing about finance, accounting, and enterprise topics. She was previously a senior writer at Invyce.com, where she created engaging and informative content that made complex financial concepts easy to understand.

Related Post

Copyright © 2024 – Powered by uConnect

Marjina Muskaan