18 Jun

Various approaches have been applied to financial accounts over time. Some of these approaches are traditional and modern approaches. The traditional approach is a method to make entries in accounting, and the rules of debit and credit under this approach are golden rules.

In this article, we will discuss the traditional approach, classification of accounts, and differentiate between the traditional and modern approaches.

Table of Contents

A traditional approach to accounting

The traditional (British approach) is used to record transactions. The approach classifies the accounts, and all these ledger accounts are classified as “personal” and “impersonal” accounts.

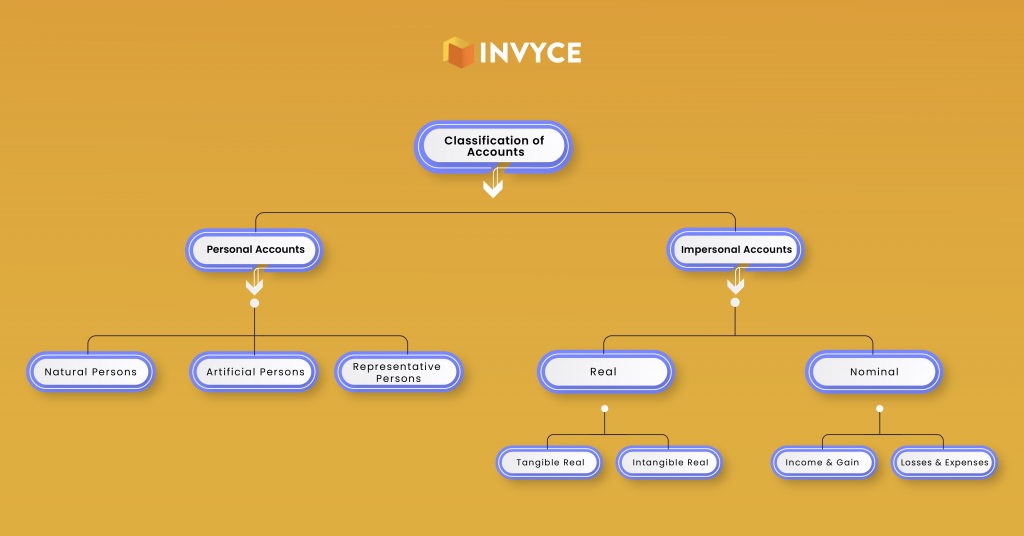

Classification of accounts under the traditional approach

According to traditional accounts, the accounts are classified into two:

- Personal

- Impersonal

Personal Account

These accounts are used to record the transactions related to persons/natural persons and artificial persons. These personal accounts are further classified into:

- Natural person

- Artificial person

- Representative person

Natural person

In the natural person, we include accounts belonging to humans. It consists of debtor A/c, Creditor A/c, proprietor A/c, proprietor’s capital A/c, and proprietors’ drawing.

Artificial person

The artificial person is not a human but legally works like a human. It possesses a separate entity in the eyes of the law. Families, partnership firms, cooperative societies, associations of persons, companies, municipal corporations, hospitals, and government bodies are all artificial persons under the eyes of the law.

Representative person

These accounts represent the account of a person. This person may be natural or artificial. Thus the outstanding, pre-paid, accrued, Wages Outstanding A/c, Prepaid Rent A/c, Accrued Interest A/c, and Unearned Commission A/c come under this category.

Impersonal

Those accounts are not included in a personal account. The accounts are other than the personal account. It consists of two categories:

- Real account

- Nominal account

Real account

Real accounts are the accounts of all liabilities and assets of businesses. These accounts(real) are not closed at the end of the accounting year. In addition, these are permanent accounts. The balances of these accounts are forwarded to the next accounting period. These have the following categories:

Tangible real account

These are the type of accounts that can be touched, measured, and seen. for example, Building A/c, Furniture A/c, Cash A/c, etc.

Intangible real account

These accounts can’t be touched, measured, or seen thus they can be bought and sold—for example, Copyright, Trademark, Goodwill, Patient, etc.

Nominal account

These are temporary accounts. These accounts are related to expenses, gains, incomes, and losses.

These balances are transferred to Trading and Profit and Loss A/c at the end of the accounting year, but these accounts have no balance to carry forward next year. Therefore, these accounts start with zero balance for the next year.

Rules of debit and credit

Rules for the debit and credit for the above accounts are as under:

Personal account “Debit the receiver and credit the giver”

This account is related to the person. According to this rule, “debit the person who benefits and credit the person who gives the benefit.”

For Example- A check of $3000 was paid to John. In this case, both the bank and John’s accounts are affected. Here if you apply the rule, John is the receiver and the bank is the giver, the John account will be debited and credited to the bank account.

Real account “Debit what comes in and Credit what goes out”

In the case of a real account, the rule is “debit what comes in credit what goes out ”

For Example- John purchased $3000 of furniture in cash. In this case, both furniture and cash accounts are affected. If we apply the rule, the furniture account is debit and the cash account credit.

Nominal account “Debit all losses and expenses and credit all incomes and gains

In the case of nominal accounts, the rule is “debit all losses and expenses & credit all income and gains”

For Example- if a company paid a salary of $3000 to John, In the case both salary and cash account affected. If we apply the rule, salary expenses go up and the cash element goes out.

Traditional approach vs modern approach

| Traditional Approach | Modern Approach |

|---|---|

| The traditional approach is also known as British approach | The modern approach is also known as American approach |

| The traditional approach based on "Golden rules of Accounting" | The modern approach based on "Accounting Equation" |

| Traditional account classify into three categories personal ,nominal and real. | The modern approach classify into five categories asset . liability , capital ,income, expense accounts. |

| Traditional approach is not mush useful. | The modern approach is much useful then the traditional approach in the present time. |

Final thoughts

In conclusion, the traditional approach is used most often by public companies with complex financial arrangements and many transactions to be accounted for. Budgeting your expenses would be more than sufficient in personal or automobile businesses. This cash accounting becomes increasingly essential as your business grows; otherwise, managing large amounts of accounting could be difficult.

Shabana has been a committed content writer and strategist for over a 5 years. With a focus on SaaS products, she excels in crafting compelling and informative content.

Related Post

Copyright © 2024 – Powered by uConnect

Shabana